Theta Price Prediction: THETA bears need to break $6.55 for conviction

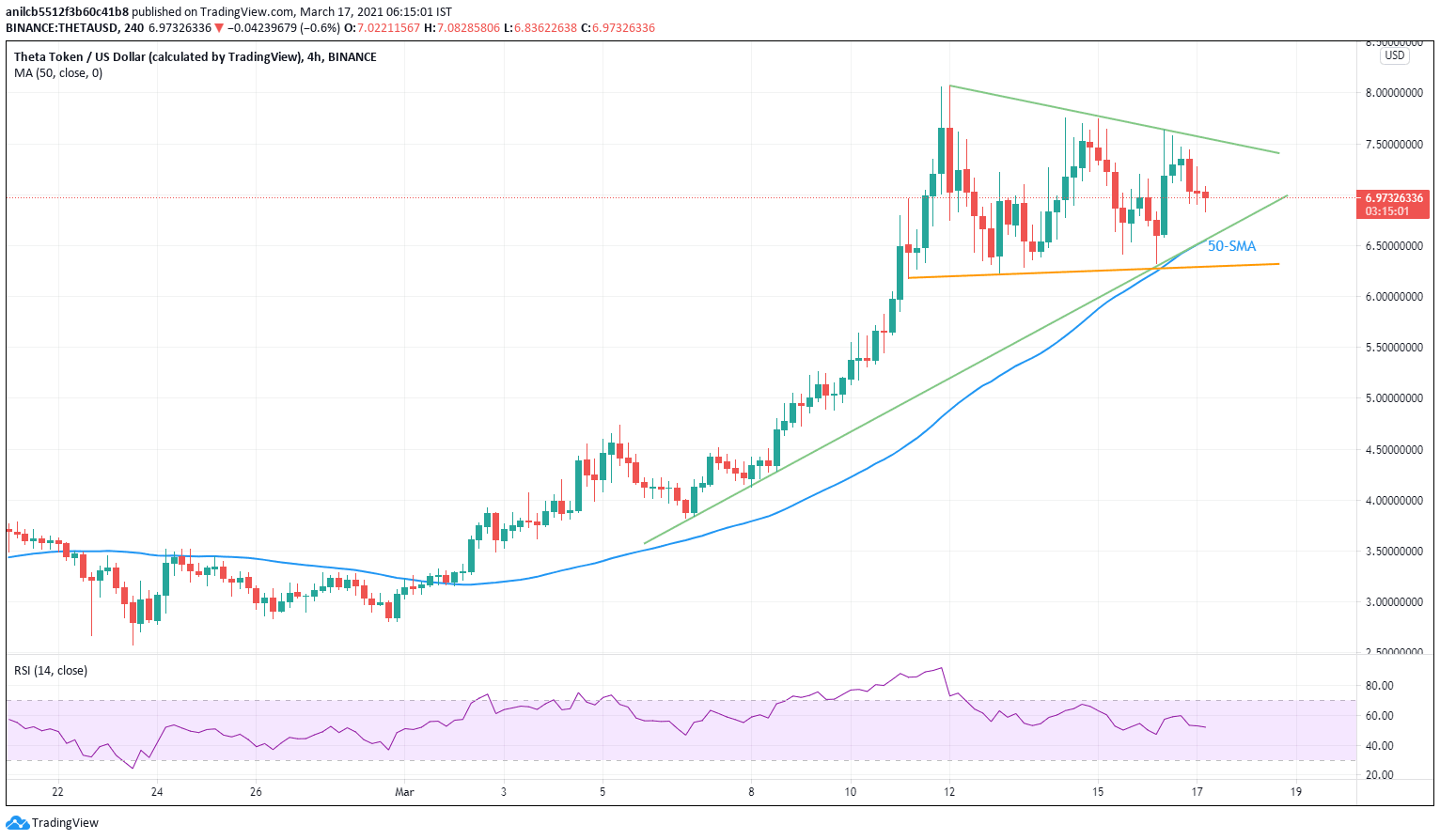

- THETA/USD extends Tuesday’s pullback towards convergence of 50-day SMA, 11-day-old support line.

- Normal RSI conditions, recent lower highs suggests further weakness.

- One-week-old rising trend line adds to the downside filters.

Theta sellers stretch recent pullback towards the sub-$7.00 area, currently down 1.0% around $6.95, during early Wednesday. In doing so, the cryptocurrency pair justifies the latest lower high pattern on the four-hour chart while staying below a downward sloping resistance line stretched from this Friday.

Given the normal RSI conditions favoring the extension of the quote’s latest weakness, THETA/USD is well on the road to battle a key support confluence around $6.55, comprising 50-SMA and an ascending support line from March 06.

Not only the $6.55 but a short-term rising support line, currently around $6.25, also challenges the Theta bears.

During the quote’s fresh recovery, clear trading above the $7.000 threshold becomes necessary to confront the weekly resistance line near $7.53.

However, any clear run-up beyond the same hurdle will not only challenge the latest record top around $8.05 but will also push the THETA/USD bulls toward the $10.00 threshold.

THETA/USD four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.