Theta price has a clear upside target of $9 with no opposition ahead

- Theta price had a breakout from a symmetrical triangle pattern with a target of $9.

- Theta has a clear price target of $9 and faces weak resistance ahead.

- The digital asset aims for new all-time highs amid overall market recovery.

The entire cryptocurrency market had a significant pump in the past 24 hours thanks to a FOMC statement by the Federal Reserve, driving the dollar's weakness. Theta also had a significant breakout driven by this price action.

Theta price aims for $9 as bulls take the lead

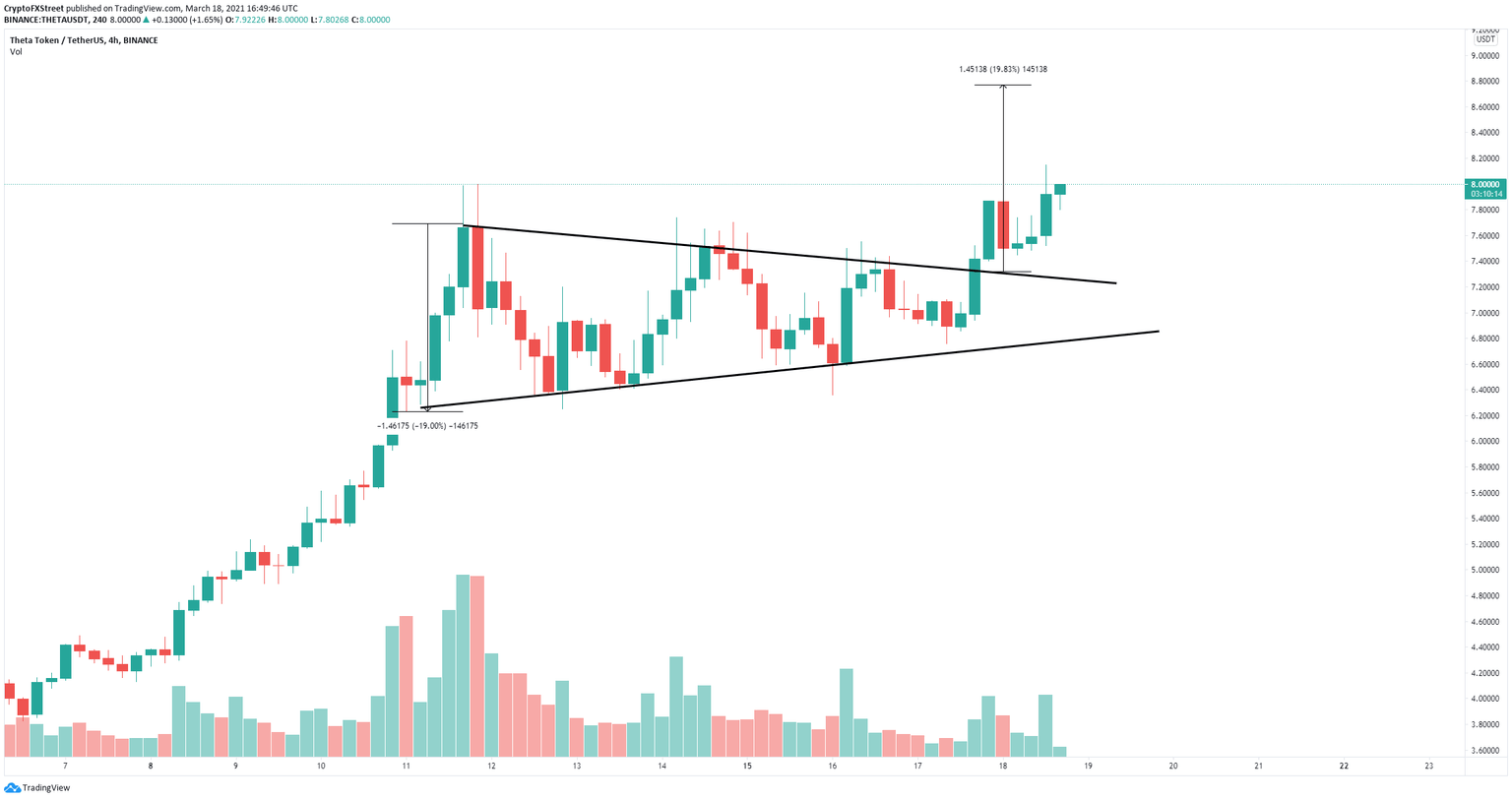

Theta had a major breakout from a symmetrical triangle pattern on the 4-hour chart with a price target of about $9, not reached yet. Since Theta has just established a new all-time high at $8.15, there is practically no resistance ahead.

THETA/USD 4-hour chart

The next level to beat for the bulls is the previous high of $8.15, followed by the price target at $9, calculated using the height of the triangle pattern as a reference point.

THETA/USD 4-hour chart

To invalidate the bullish outlook, bears will need to drive Theta price below $7, which was the previous resistance trendline. A breakdown below this point would push the digital asset down to $6.71 at the 78.6% Fibonacci level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.