These on-chain metrics suggest whales are planning to dump the Enjin Coin price

- Enjin Coin price has lost 40% of its market value since last week.

- ENJ has witnessed the largest influx of daily transactions this year.

- Invalidation of the downtrend scenario is a breach above $0.36.

Enjin Coin price could be on its way to new lows. On-chain metrics suggest whales might be offloading, while the technicals show little hope for a bullish retaliation. Key levels have been identified to determine Enjin Coin’s next move.

Enjin Coin price is in trouble

Enjin Coin (ENJ) price has been underwater most of the fall. On November 9, the bears added more pressure to the Ethereum-based gaming token as a 40% decline ensued in free-fall fashion. The declining rally has produced a steep-angled trend, which has given the trapped bull no chance to recover losses. Now on-chain metrics suggest bulls in the market may endure more pain in the days to come.

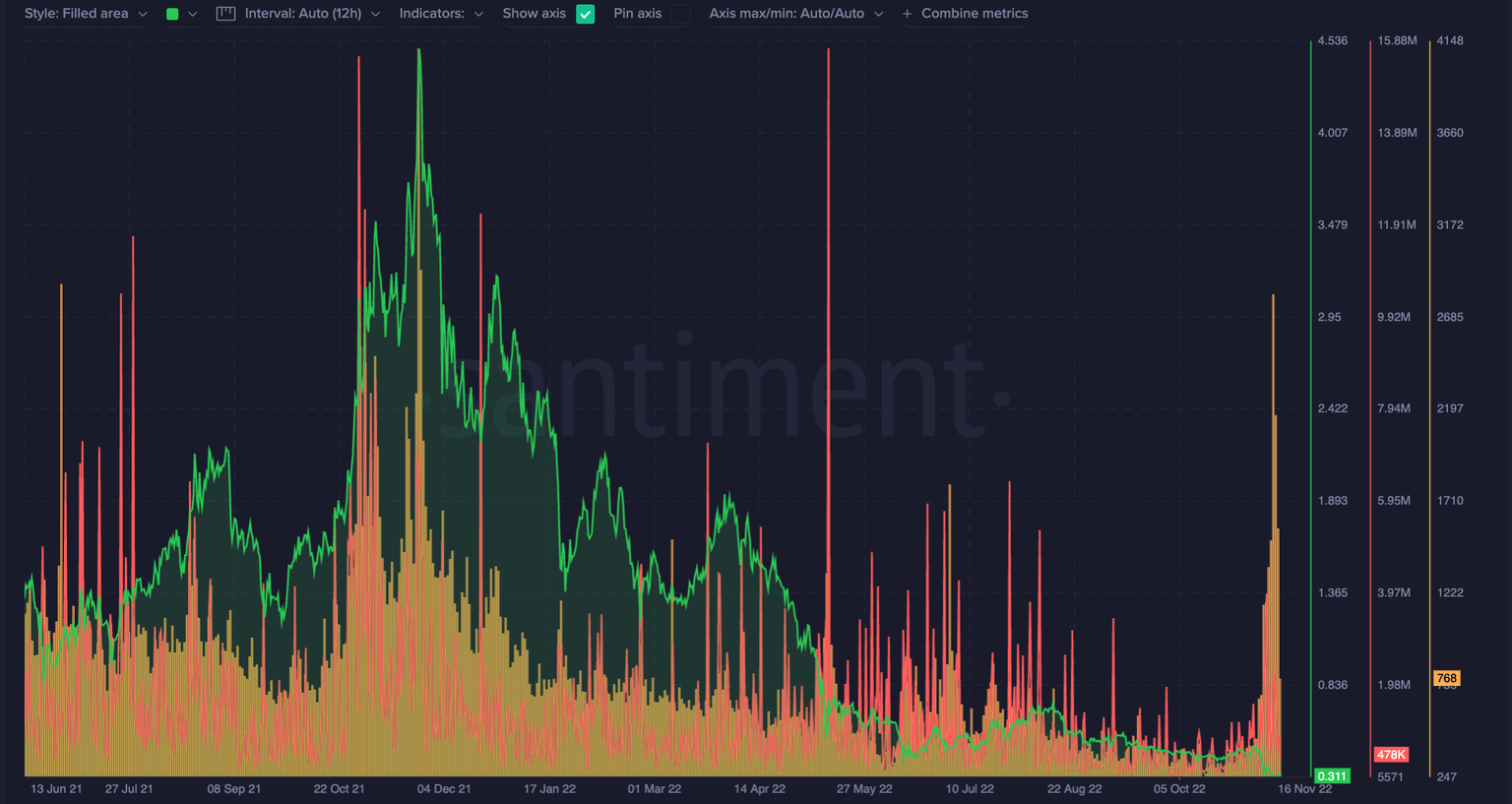

Enjin Coin price currently auctions at $0.31. Santiment’s Exchange Inflow and Daily Active Addresses Indicators compound the notion that the downtrend is far from over. On November 12, the Exchange Inflow indicator witnessed the largest influx since July, resulting in a sharp sell-off. The Daily Active Addresses exhibited the largest influx of transactions since the 2021 peaks when ENJ traded in at all-time highs for one day in the $4 zone. The ENJ price subsequently fell penny-from-Eiffel style by 90% and never retested the $4 barrier.

Santiment’s Exchange Inflow and Daily Active Addresses Indicators

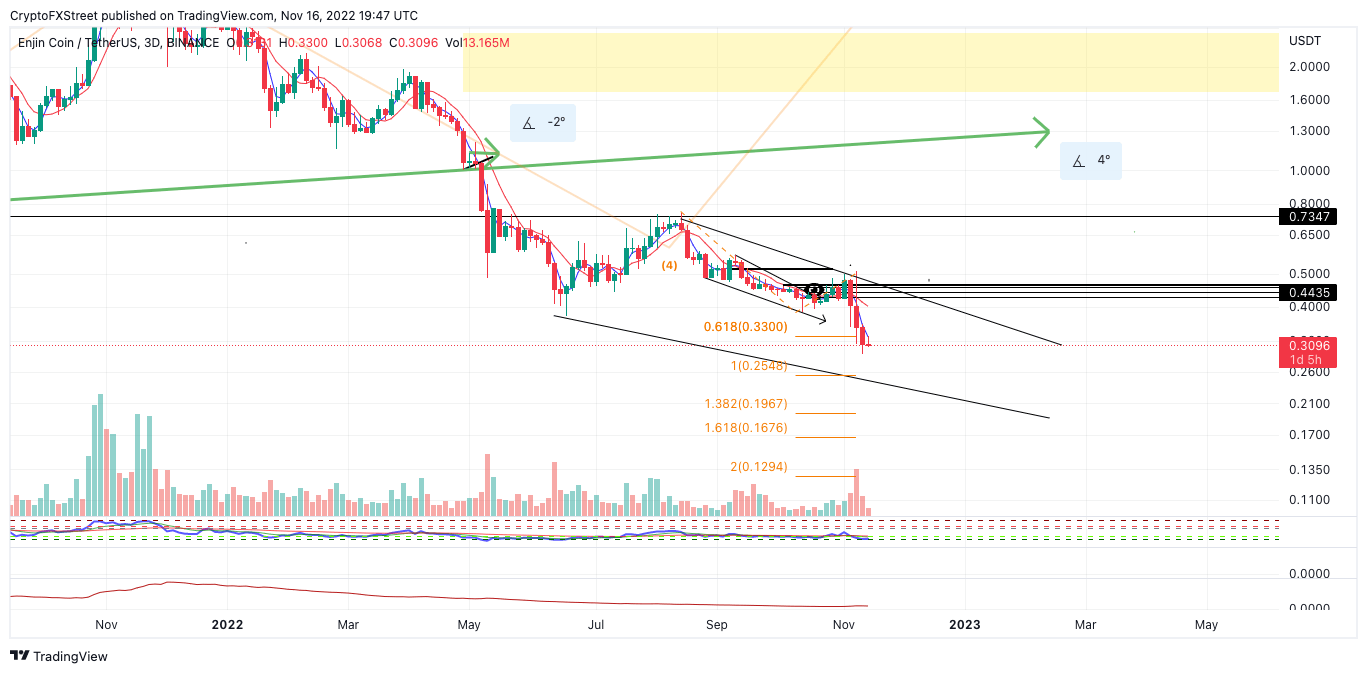

A Fibonacci projection tool surrounding the previous downtrend rally and retracement shows the current declining price at the 61.8% FIb level. Based on the confounding evidence above, it is likely that ENJ will fall into the 100% level at $0.25 in the coming days.

Invalidation of the bearish thesis will be a breach above the recent thrust candle that pierced the 8-day exponential moving average at $0.36. A breach of the invalidation level could induce a further uptrend targeting the recently broken support levels at $0.43, resulting in a 40% advance.

ENJUSDT 3-day chart

In the following video, our analysts dive deep into the price action of Enjin Coin, analyzing key market interest levels. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.