The Graph aims to enable secure cross-chain GRT transfers with Chainlink’s CCIP

- The Graph announced the integration of Chainlink’s Cross-Chain Interoperability protocol for cross-chain operations on Wednesday.

- With plans to deploy cross-chain GRT transfers across Arbitrum, Base, and Solana, Graph plans to build secure bridges.

- The GRT token reflects mild gains and aims to surpass a critical supply zone.

The Graph (GRT) plans to adopt the Chainlink (LINK) interoperability standard (CCIP) to enable GRT transfers across three ecosystems. A successful deployment of GRT bridges across Arbitrum (ARB), Base (BASE), and Solana (SOL) will significantly expand its cross-chain functionality.

With the announcement of upcoming cross-chain functionalities and the adoption of CCIP, the GRT token records mild gains, projecting a potential breakout rally ahead.

The Graph plots to make GRT a cross-chain token

The Graph announced on Wednesday that it would adopt the Chainlink Cross-Chain Interoperability Protocol (CCIP) to deploy GRT bridges across Arbitrum, Base, and Solana. With this move, the Graph plans to expand the GRT token’s functionality in cross-chain staking, delegation, and query fee payments over the layer-2 projects.

Cautiously, the Graph indicates that the potential functionalities will depend on successful GRT bridge infrastructure.

The Graph (@graphprotocol), a blockchain data platform that has served over 1.2 trillion requests, is adopting Chainlink CCIP and making its native token GRT a Cross-Chain Token (CCT).

— Chainlink (@chainlink) May 21, 2025

Users will be able to transfer the $1B+ market cap token across @arbitrum, @base, and @solana.… pic.twitter.com/at9m0HwRZy

At the time of writing, the Graph holds a market capitalization of $1.14 billion.

GRT rally holds firm, targets $0.13 breakout

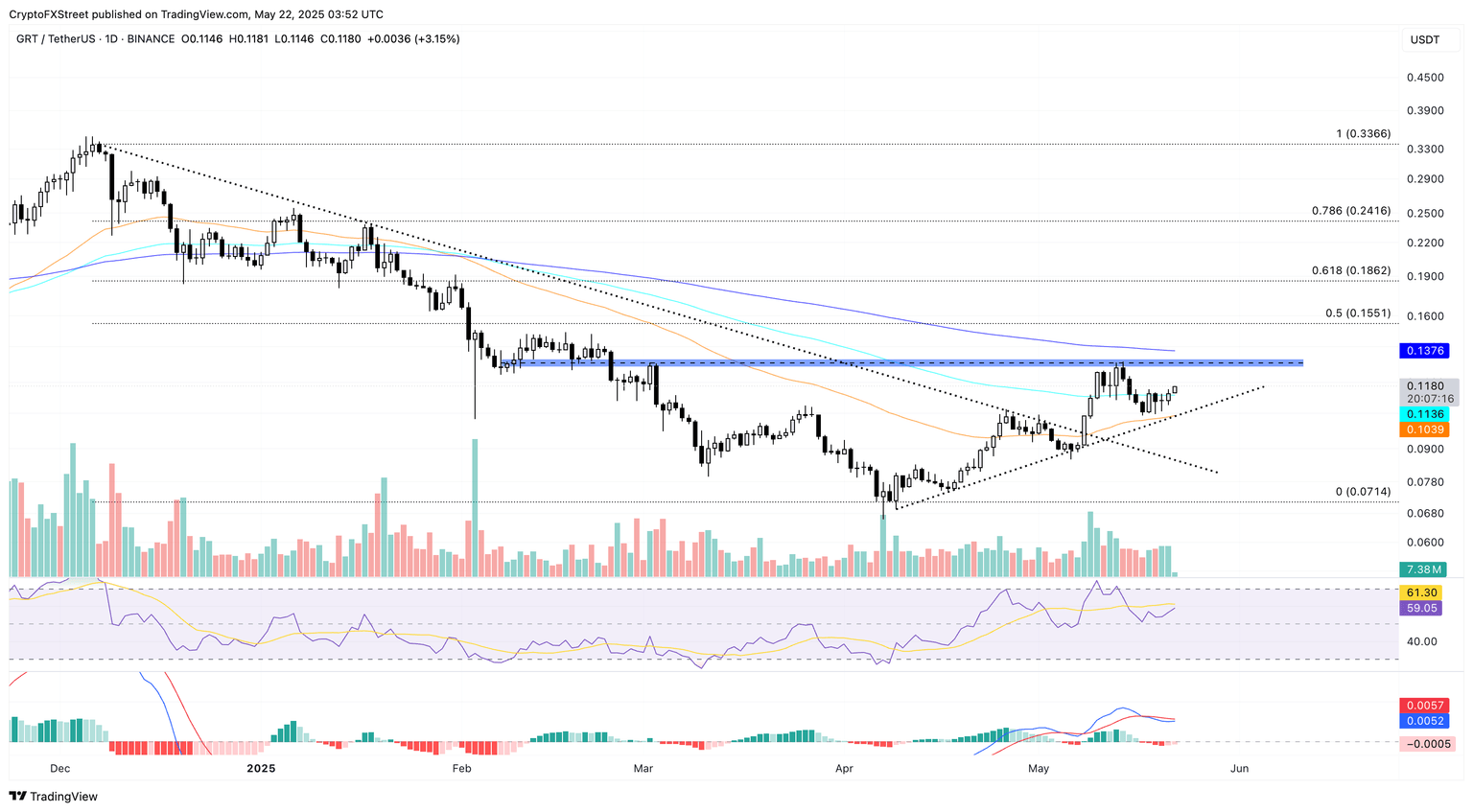

GRT token trades at $0.1180 with an intraday gain of 3.15% on Thursday, at the time of writing. Stacking over the 3.25% surge on Wednesday, the recovery rally in the altcoin surpasses the 100-day Exponential Moving Average (EMA) at $0.1136.

The altcoin is up 77% from the year-to-date low at $0.0663, creating a support trendline with higher lows. As the uptrend gains momentum, the price action nears the critical resistance zone encapsulating the $0.13 mark.

The Relative Strength Index (RSI) at 59, with a bounce back from the midline, shows a resurgence of underlying bullishness. Further up, the Moving Average Convergence/Divergence (MACD) line is close to surpassing its signal lines to trigger a bullish crossover. This will offset the recent negative fallout, suggesting the re-entry of bulls.

A potential breakout of the $0.13 supply zone could propel the GRT spot price to $0.1551, aligning with the 50% Fibonacci level. The Fibonacci retracement extends over the 79% crash from the $0.3366 trough peak to $0.714 between December 6 and April 8. Notably, the 200-day EMA at $0.1376 could be a minor hurdle for the breakout rally.

GRT/USDT price chart. Source: Tradingview

Conversely, a reversal from $0.13 might retest the 100-day EMA at $0.1136, followed by the next 50-day EMA support at $0.1039.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.