Tether launches recovery tool to migrate USDT between blockchains

Major stablecoin issuer Tether has launched a recovery tool to migrate its Tether (USDT $1.00) stablecoin between different blockchains amid USDT hitting a $100-billion market capitalization.

Tether announced the launch of a blockchain recovery plan on March 4 to ensure stable access to USDT in case of disruptions faced by one of multiple blockchain networks used for USDT transactions.

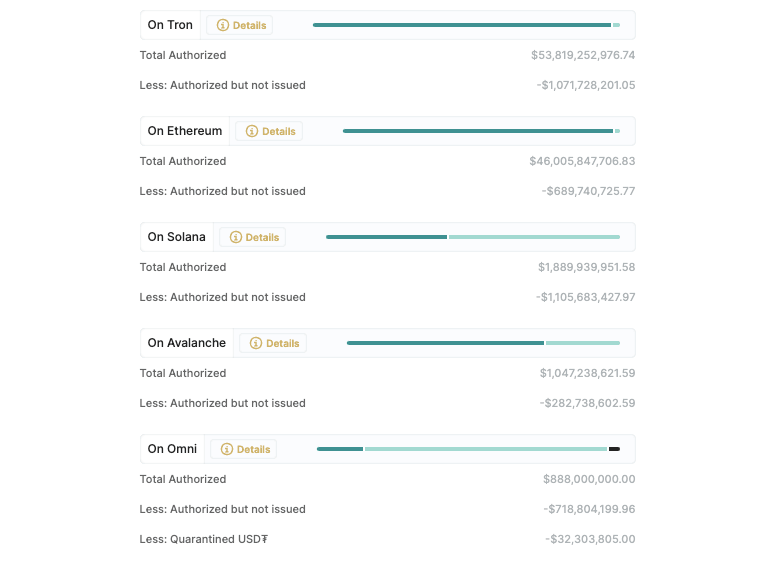

According to data from Tether, USDT resides on 14 blockchains as of March 4, including Tron, Ethereum, Solana, Avalanche and Omni. Tron and Ethereum are the two largest blockchains for USDT, accounting for 51% and 43% of all issued USDT, respectively.

Top five blockchain networks used by Tether (USDT) as of March 4, 2024. Source: Tether

Despite relying significantly on blockchains like Tron and Ethereum, USDT exists “independent of blockchains,” Tether’s latest announcement stated, stressing that the blockchains are used “only as a transport layer.”

To address the risk that a blockchain could become unresponsive, unreliable or unusable, Tether has established its official recovery tool, which would allow users to migrate USDT between blockchains. The firm noted:

Users would be able to verify ownership of their addresses on an unresponsive blockchain and a recipient address on another supported blockchain, and Tether will transfer the USDT between them.

According to the announcement, affected USDT users will be able to initiate the migration process using the web interface or command-line tools. The process involves cryptographically signing a request for migration to verify ownership of Tether tokens, which are available with browser extension wallets like MetaMask and hardware wallets such as Ledger or Trezor.

Additionally, a command-line interface allows users to input their private key directly, enabling them to sign the necessary message using an open-source script on their local machine, the announcement notes.

Cointelegraph approached Tether for a comment but at the time of publication had yet to receive a response.

Tether’s recovery tool launch came amid USDT breaking a major milestone in terms of its market value, with the USDT market cap reaching $100 billion on March 4 for the first time in history.

At the time of writing, USDT is the third-largest cryptocurrency by market cap, following Bitcoin (BTC $66,866) and Ether (ETH $3,701), which are worth $1.4 trillion and $442 billion, respectively, according to data from CoinGecko.

Top three cryptocurrencies by daily trading volume. Source: CoinGecko

On the other hand, USDT is the largest cryptocurrency by daily trading volume, as $132 billion in crypto trades and transactions are handled using USDT daily as of March 5. BTC and ETH follow USDT trading volumes with $82 billion and $33 billion in daily transactions, respectively.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.