Terra’s LUNA price back on the drawing board after snapping out of a 13% bullish breakout

- LUNA price seeks support at a confluence level created by the 50-day EMA and the 100-day EMA.

- Terra’s LUNA price is in grave danger of dropping to retest $2.30.

- Bulls could resume the 13% double-bottom breakout to $2.88 if LUNA reclaims the neckline support at $2.55.

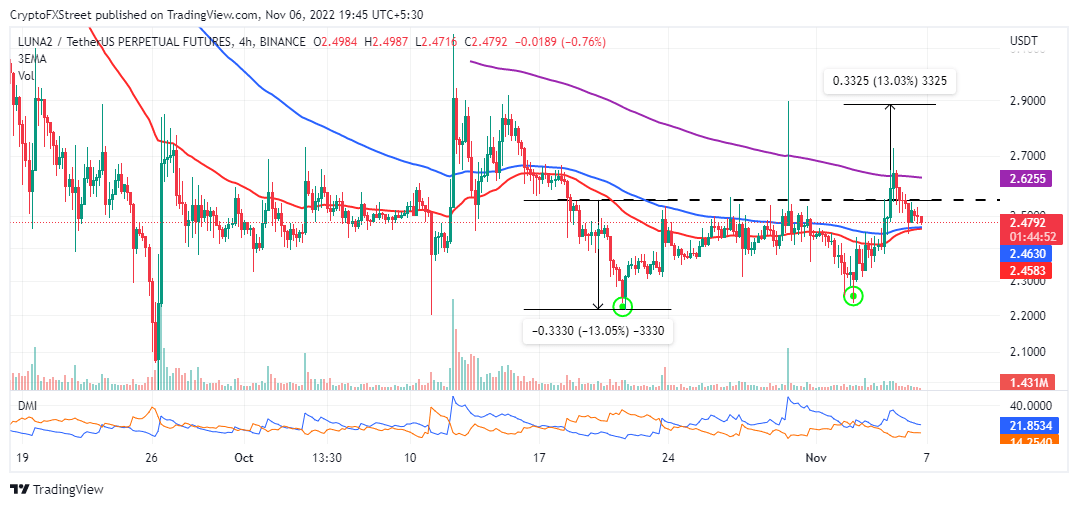

Terra’s LUNA price risks stretching its leg to $2.30 if support at $2.46 cracks. Before this retracement, LUNA had broken above a double-bottom pattern with a 13% breakout target of $2.88.

LUNA price back to trimming gains

Terra’s LUNA snapped out of its bullish move that could have tagged $2.88 just several days after releasing the community update for October. The key milestones the report focused on encompass protocol and feature launches as well as bounty releases – some of which were covered by FXStreet’s crypto team during the month.

LUNA price nurtured its bullish outlook after rebounding from a key demand area between $2.2 and $2.30. A double-bottom pattern was later confirmed, with the price cracking its way through the neckline (dotted line) resistance.

However, investors backing LUNA’s 13% move to $2.88 saw their hope vanish as resistance highlighted by the 200-day Exponential Moving Average (EMA) came into play at $2.62.

LUNAUSDT four-hour chart

Now LUNA price teeters at $2.48 in the wake of declines from the 200-day EMA and below the pattern’s neckline. The Directional Movement Index (DMI) could send a negative signal to validate Terra’s bearish outlook in the price of LUNA anytime.

Traders who may wish to short LUNA must way for the -DI to cross above the +DI before firing up their positions.

The confluence support at $2.46 formed by the 50-day EMA (in red) and the 100-day EMA (blue) could invalidate the expected move to $2.30. A four-hour to a daily candlestick close above this level will encourage buyers to retain their support ahead of another bullish attempt to $2.88.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren