Sweden demands $90M in outstanding tax from crypto miners

Swedish crypto miners owe over $90 million in taxes after government investigations revealed four years of misappropriations.

The Swedish Tax Agency —Skatteverket — investigated the operations of 21 crypto-mining firms between 2020 and 2023. The investigation revealed that 18 crypto-mining firms filed “misleading or incomplete” information to benefit from tax incentives.

According to the agency, some crypto firms provided misleading business descriptions to avoid paying value-added tax (VAT) on taxable operations. Others found ways to avoid paying import taxes on mining equipment or income tax on mining revenue.

A rough translation of the Swedish Tax Agency’s statement read:

The described approach leads to tax disappearing from the country in the form of incorrect payments of input VAT, unpaid output VAT and unreported crypto assets.

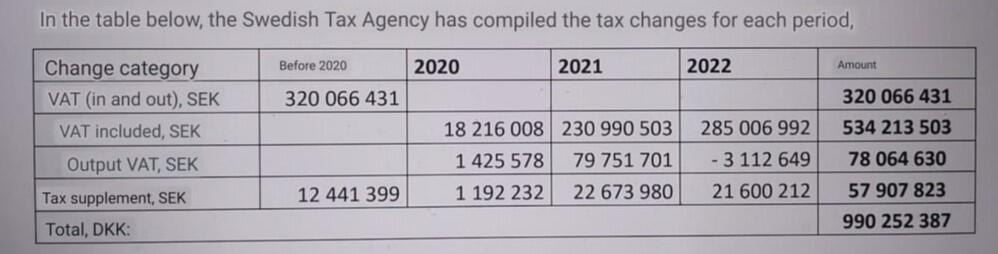

The crypto mining firms are required to pay the tax authorities over 990 million Swedish krona ($90 million) in total. This includes unpaid total VAT of 932 million krona ($85.4 million) and tax surcharges of approximately 57.9 million krona ($5.3 million).

A breakdown of tax obligations for crypto mining firms between 2020 and 2023. Source: Swedish Tax Agency

While the crypto mining firms appealed against the $90 million demand from the Swedish Tax Agency, the administrative court upheld the appeals of two mining firms and rejected the rest. “The amounts above have been adjusted with regard to the verdicts.”

In November 2023, crypto mining firm Hive Digital Technologies acquired a commercial property and a data center in Boden, Sweden. At the time, Johanna Thornblad, Hive’s country president for Sweden, said:

The new data center will enable HIVE to grow its regional footprint while further demonstrating its commitment to its ESG focus, sustainable practices, environmental responsibility, and energy efficiency with its newest “green” energy powered data center.

The company confirmed that the property will also house its incoming generation of ASIC servers and increase its Bitcoin (BTC $61,659) production.

Hive owns and operates data center facilities in Canada, Sweden, and Iceland, and it promotes the use of green energy to mine digital assets such as Bitcoin on the cloud.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.