SUI gains over 4% amid upcoming $119 million unlock

- SUI network is set to add $119 million worth of its token into circulation next week.

- Optimism, FET, and Kamino Finance will also unlock $16 million, $2 million, and $12 million worth of tokens, respectively.

- SUI is up over 4% in the past 24 hours as it eyes a move above a key descending channel.

SUI is up 4% on Friday as the Layer-1 blockchain prepares to add $119 million worth of its token into circulation, contributing a major share of the unlocks for next week. Other tokens set to increase their supply include Optimism (OP), Kamino Finance (KMNO), and Artificial Superintelligence (FET), with allocations of $16 million, $12 million, and $2 million, respectively.

SUI, Optimism, Kamino Finance set for token unlocks next week

The cryptocurrency market is poised for another week of token unlocks worth $212 million as several projects prepare to increase their current circulating supply by distributing new tokens.

The tokens involved include SUI, Optimism (OP), Kamino Finance (KMNO), Ethena (ENA), Zetachain (ZETA), SingularityNet (AGIX), FET and DYDX, according to Tokenomist data.

SUI leads next week's supply hike with a $119 million unlock volume set for Monday. Sui's supply injection represents 56% of the total unlocks for next week. However, the unlock volume represents 1.16% of its circulating supply, indicating it may have a minimal impact on its price.

Cliff unlocks are events where crypto projects release previously locked tokens into circulation in a lump sum. Large supply hikes often negatively impact the price of a token due to the imbalance between supply and demand.

SUI is currently up 4% over the past 24 hours despite a general decline in the cryptocurrency market.

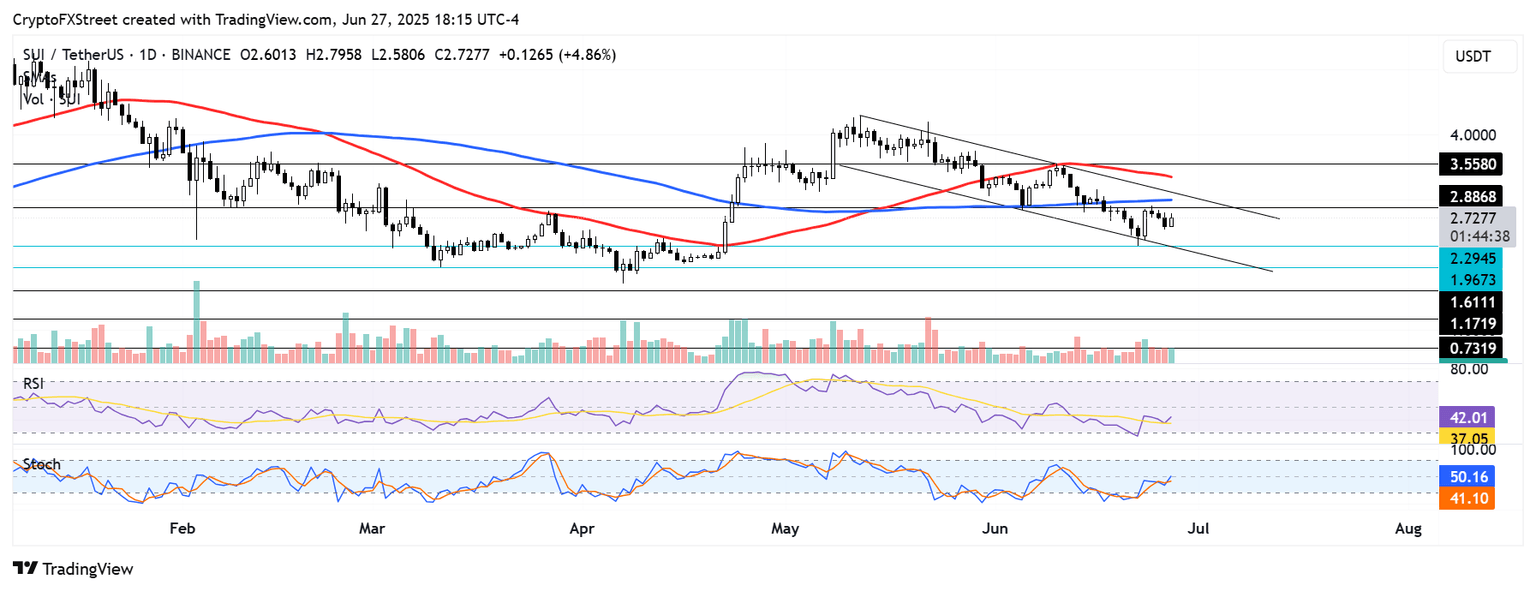

SUI faces pressure around the 100-day Simple Moving Average (SMA) near the $2.88 resistance. The altcoin is also trading in a descending channel. A firm close above $2.88 and the descending channel's resistance could see SUI rise to $3.55.

SUI/USDT daily chart

However, a fall from current levels could see SUI decline toward the $2.29 support level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are currently below their neutral levels but trending upward, indicating a weakening of bearish momentum.

Meanwhile, other tokens with cliff unlocks include Optimism, Kamino Finance, Ethena, and Zetachain, with supply hikes of $16 million, $12 million, $10 million, and $7 million, respectively.

Kamino Finance will add 10% of its current supply into circulation, which could weigh on its price.

Smaller unlocks for next week include AGIX, DYDX and FET, which will each add $2 million worth of their tokens to their current supply.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi