Strong Cryptocurrencies Sunday Surge

Cryptocurrencies are quite bullish this morning, in a surge that started this weekend, Bitcoin Cash being the star of this bullish move, with over 15 percent rise.

One of the reasons for the rise of the cryptocurrencies is said to be the fall of yuan, possibly prompted by travel restrictions in China, in an effort of the Chinese authorities to control the coronavirus outbreak.

The last 24 hours Bitcoin (+3.49%) was quite strong, but its sibling Bitcoin Cash(+15.66%) is rocketing on a surge of $52 in the last 24 hours. Also Bitcoin SV(+8.34%), DASH(+11.93%), Zcash(+7.66%), EOS( +6-6%) and LTC(+5.08%) are moving quite bullish. On the Ethereum token category, LINK (+5.6%), SNZ(+8.03%), OMG(+8.82%) CENNZ(+11.03%) and QNT(+15.9%) are among the best performers.

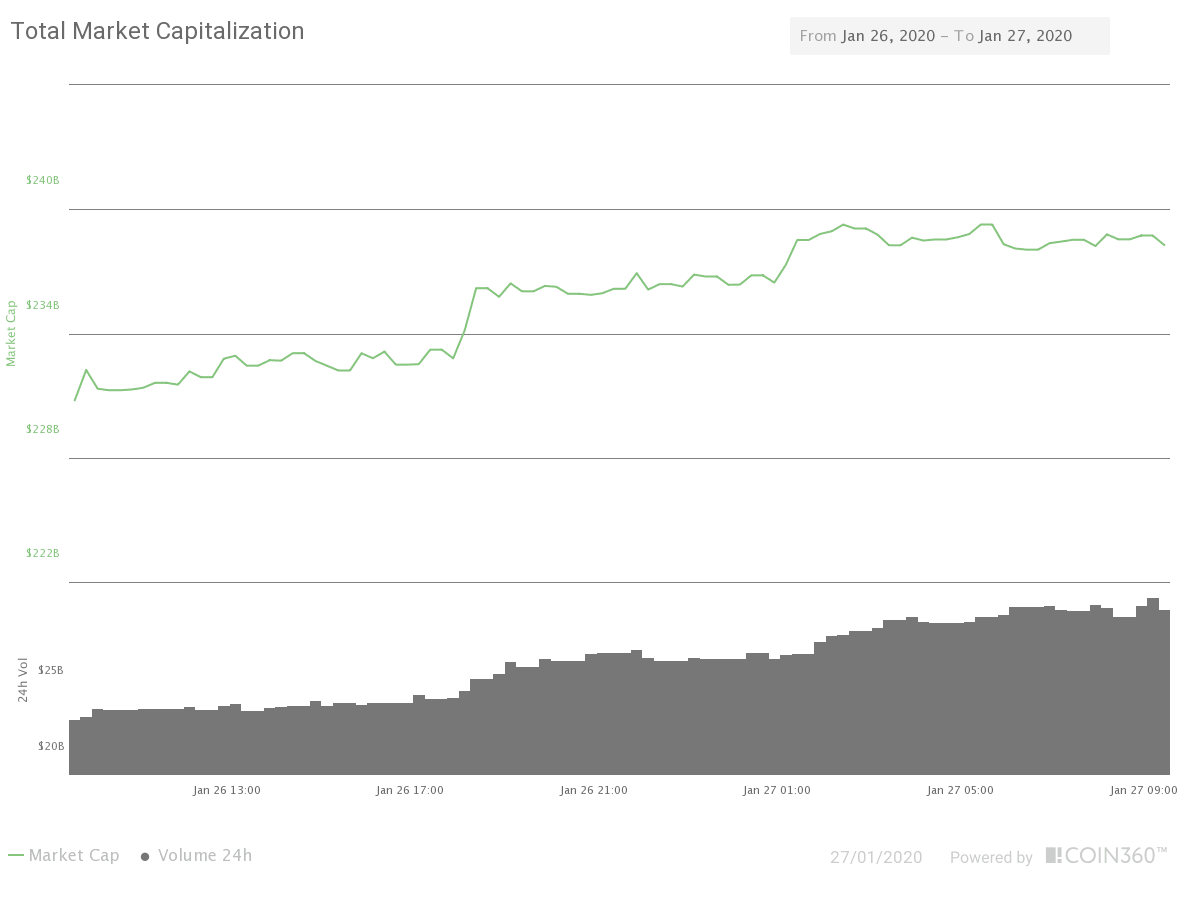

The market capitalization moved up almost four percent in the last 24 hours and is now $238.786 billion. The traded volume in the past 24 hours also moved up by 25 percent, to $31 billion. Bitcoin dominance is staying below 66percent, as currently is lagging the advances of the top capitalized altcoins.

Hot News

Bitcoin Gold (BTG) has suffered a set of 51% attacks on Jan 23-24, according to news-bitcoin.com. Reports show that more than 7,000 BTG was double-spent, so the BTG chain lost $70,000 in two days.

"It is obvious that the first 51% attack was done by ASICs — Why can't BTG be novel and create a truly new [algorithm]? This coin is a bad investment for anyone looking to buy — None of the devs are qualified."

Technical Analysis: Bitcoin

Bitcoin has surged on Sunday, confirming our forecast that the descending wedge would be resolved to the upside. After crossing to the upper side of the Bollinger bands and pierce through the $8,450 resistance level, BTC's price is also moving above the +1SD line and its 50-period SMA. The next resistance area is around $8,760.

|

Support |

Pivot Point |

Resistance |

|

8,450 |

8,520

|

8,760 |

|

8,200 |

8,900 | |

|

8,000 |

8,100 |

Ripple

After being rejected by the $0.126 level, XRP has moved up and crossed the upper side of its descending wedge. The asset is now struggling with the $0.23 key level. The price is now evolving above the +1SD line, and its MACD is in a bullish phase, although still on the negative side. Thus, we expect more advances to its $24 and $25 levels.

|

Support |

Pivot Point |

Resistance |

|

0.2250 |

0.2300

|

0.2300 |

|

0.2160 |

0.2500 | |

|

0.2090 |

0.2600 |

Ethereum

Ethereum'sm price bounced off of the $158 level and crossed the pennant-like formation to the upside. Then, the action moved above the +1SD line until the $170. At that level, the price made a shooting star figure (a rejection from resistance) and is currently developing a short retracement, possibly a product of profit-taking activity. All the indicators show a bullish bias on this asset, so we think it has room to break the $170 barrier and head towards $177.

|

Support |

Pivot Point |

Resistance |

|

162.00 |

165.00

|

170.00 |

|

158.00 |

177.00 | |

|

154.00 |

182.00 |

Litecoin

Litecoin's price was rejected from the $51,5 level on Jan 24 and, then, it found support in the $53 level from where it started to move up, as we had devised in our last report. LTC's price also crossed the $55.9 level and is currently above the upper side of the descending channel, moving above its +1SD line. Also, its MACD is moving in a bullish phase. In consequence, the bias on Litecoin is bullish, with $58.4 as the nearest target, followed by $60 and $62.5.

|

Support |

Pivot Point |

Resistance |

|

53 |

55.9

|

58.4 |

|

51.5 |

60 | |

|

46 |

62.5 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and