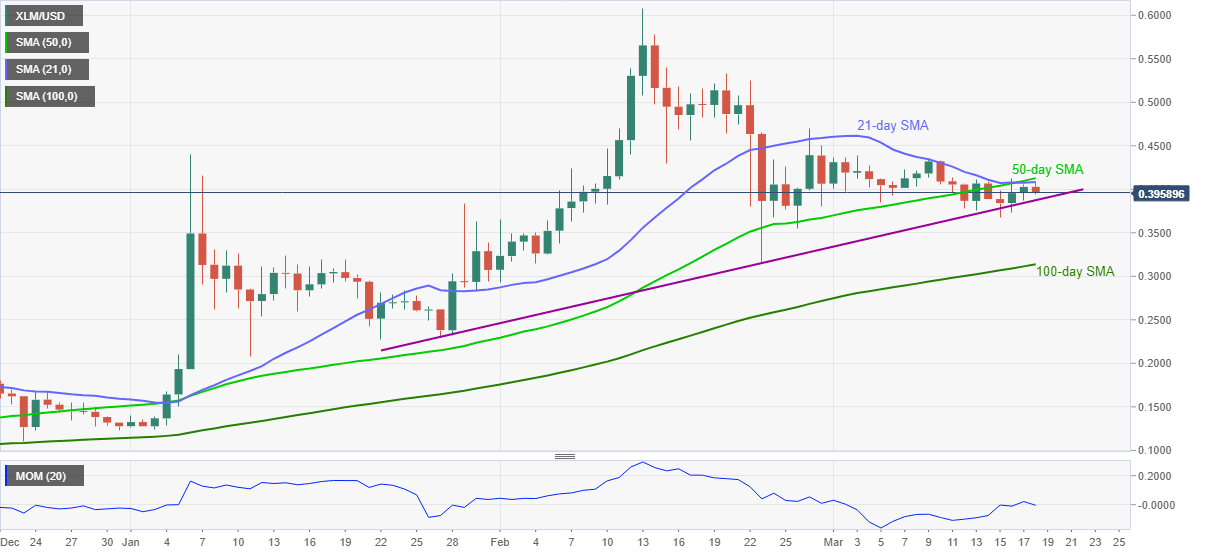

Stellar Price Prediction: XLM looks set to retest key support around $0.3875

- XLM/USD extends Thursday’s losses below crucial SMA confluence.

- Downward sloping momentum also favors bears, monthly top adds to the upside barriers.

Stellar Lumens (XLM/USD) extends Thursday’s pullback from a convergence of 21-day and 50-day SMA while declining to $0.3960 during early Friday.

Not only the multiple failures to cross important hurdle off-late but the receding strength of the upward sloping momentum indicator line also suggests the cryptocurrency pair’s further downside.

However, an ascending trend line from January 27, currently around $0.3875, restricts the quote’s immediate downside, a break of which will quickly refresh the monthly low of $0.3675.

In doing so, the XLM/USD bears can target the area comprising the late February lows and 100-day SMA, around $0.3160-40.

Meanwhile, a daily closing beyond $0.4130 becomes necessary for the XLM/USD recovery.

Following that, the monthly top near $0.4340 and the late February peak surrounding $0.4700 can offer intermediate halts during the quote’s run-up targeting the $0.5000 threshold.

Overall, XLM/USD is up for fresh downside but the key support line probes bears.

XLM/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.