Stellar Lumens Price Prediction: XLM at make-or-break point as bulls aim for 30% upswing to $1.2

- Stellar remains mainly in the bulls' hand as technical indexes align for a potential rally to $1.2.

- XLM/USD must also hold above the Bollinger bands middle boundary to avert possible losses to $0.067.

Stellar recently found stability at $0.067 after a 43% slump from August's peak around $0.12. Recovery has been limited under the upper boundary of an ascending parallel channel. At the moment, XLM is facing conflicting situations where one move could see it rally 26% to $0.12 while another could see it retest the recent support at $0.067.

Stellar bulls prepare for a massive upswing

At the time of writing, XLM is trading at $0.083 and holding slightly above the 50 Simple Moving Average on the 4-hour chart. On the upside, the cross-border token is facing a challenge at $0.085. Closing above the moving average would allow buyers ample time to plan for the uphill battle at the channel's upper boundary.

XLM/USD 4-hour chart

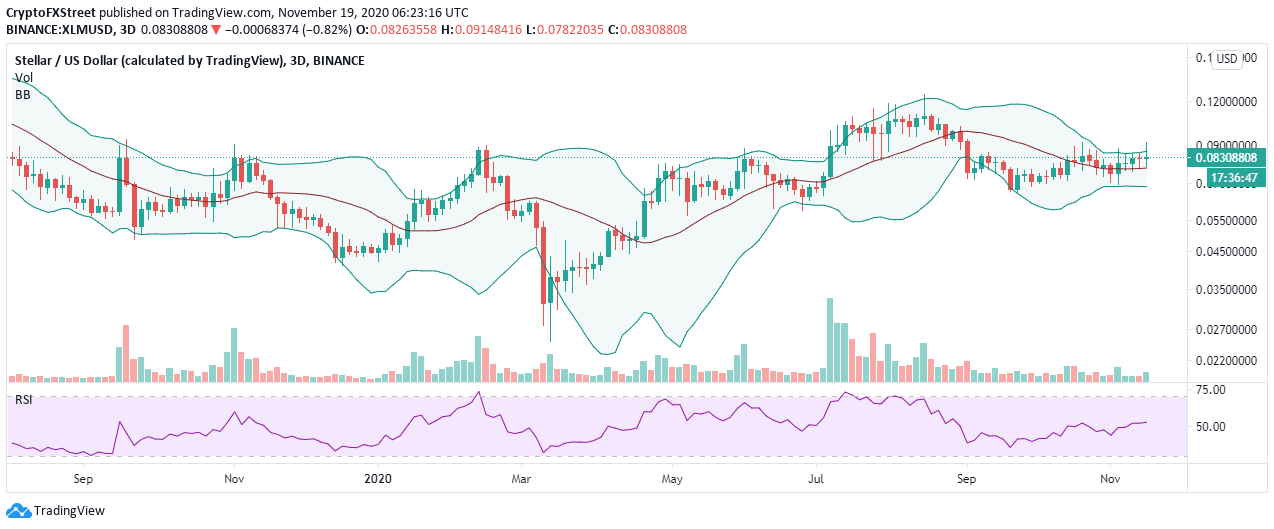

The 3-day XLM/USD chart shows the price dancing in a no-trade zone. Nonetheless, buyers have recently channeled their effort to overcome the overhead resistance as highlighted by the Bollinger bands.

On the downside, Stellar is likely to continue holding above the Bollinger bands' middle boundary. If the cryptoasset closes the day above $0.085, the price will likely enter a trajectory for an impressive 26% rally to $0.12. The Relative Strength Index appears to be validating the bullish outlook after crossing above the midline.

XLM/USD 3-day chart

On the flip side, things might turn the other way if Stellar closed the day under $0.085, which might call for a surge in sell orders as the bullish camp gets worn out due to exhaustion. On the other hand, trading below the Bollinger bands' middle boundary could open the Pandora box, pulling XLM back to the drawing board at $0.067.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(8)-637413647955056964.png&w=1536&q=95)