Solana price tosses in a triangle as SOL gets ready for an upswing

- Solana price looks optimistic despite the recent correction.

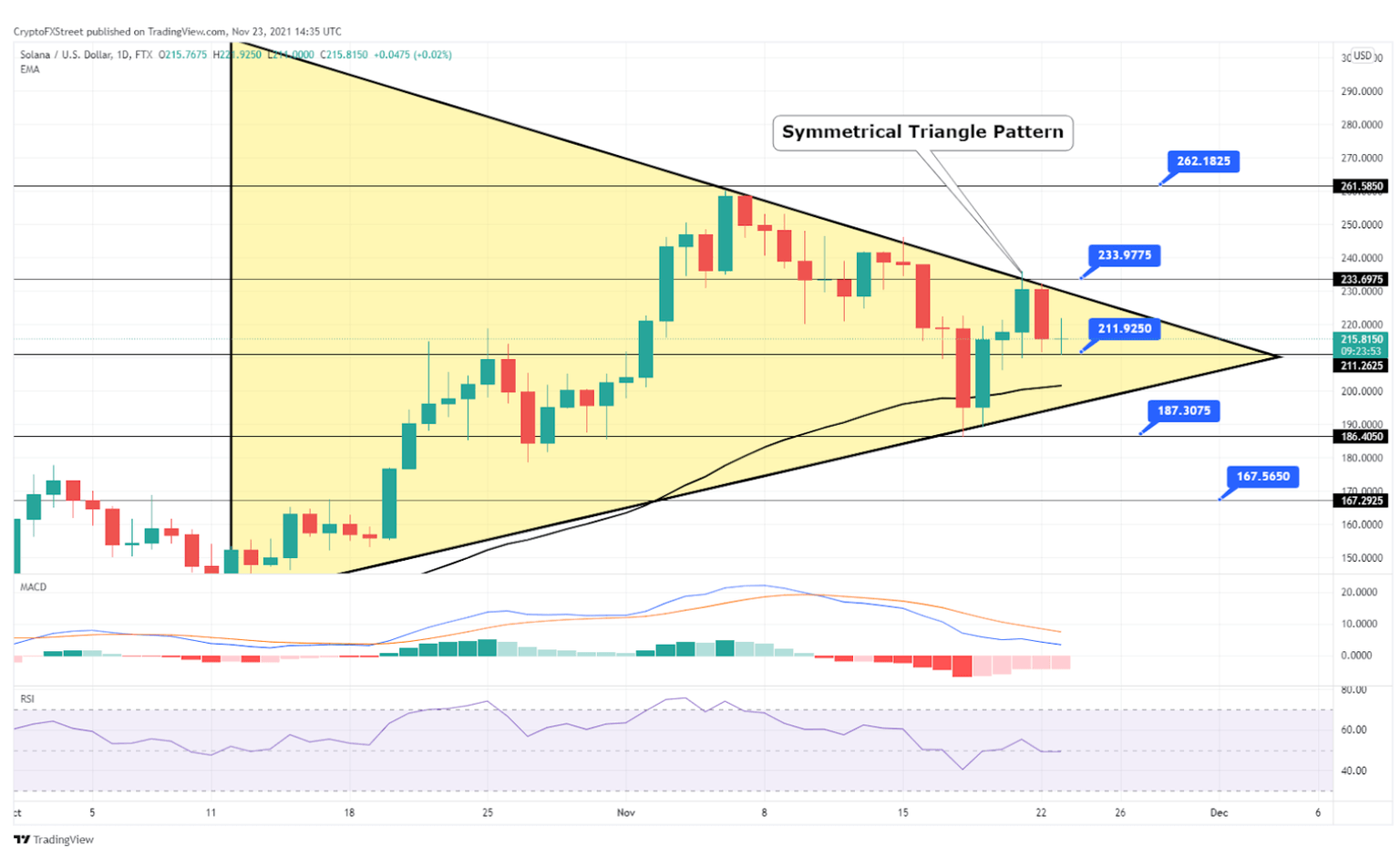

- SOL choppy session continues as a triangle pattern remains intact.

- Only by overcoming the $234 level can prices rise towards $260.

Solana price has been consolidating in a narrow range, forming a bullish continuation pattern on its 4-hour chart. A spike in demand could push SOL higher as it has already completed its correction.

Solana price attempts to rebound strongly

Solana price looks bullish in the long term. Still, there's been a slight downward correction in its price lately. SOL’s short-term technical outlook remains neutral as it's held in a choppy trading range between $234 and $210.

The fifth-largest cryptocurrency by market cap has formed a symmetrical triangle on the 4-hour chart. This type of technical pattern tends to break out in either direction, but for Solana other indicators support the bullish outlook.

For instance, the 50-day exponential moving average is acting as stable support at $200, and closing candles above this EMA is indicative of an uptrend. The upward trendline from Oct. 12 to Nov. 18 is still intact, serving as an additional layer of support. Meanwhile, the RSI crossed above 50, which is another positive sign.

A spike in buying pressure around the current price levels could validate the bullish thesis and create additional room for an upswing to $234 or $262.

Solana (SOL) daily timeframe

On the other hand, Solana has closed a bearish engulfing candle at $234 as the downward trendline represents a substantial hurdle ahead. This type of candlestick pattern is usually succeeded by a downswing. For this reason, traders must pay close attention to the $211 support level as any signs of weakness can result in a correction to $187 or $167.

Author

FXStreet Team

FXStreet