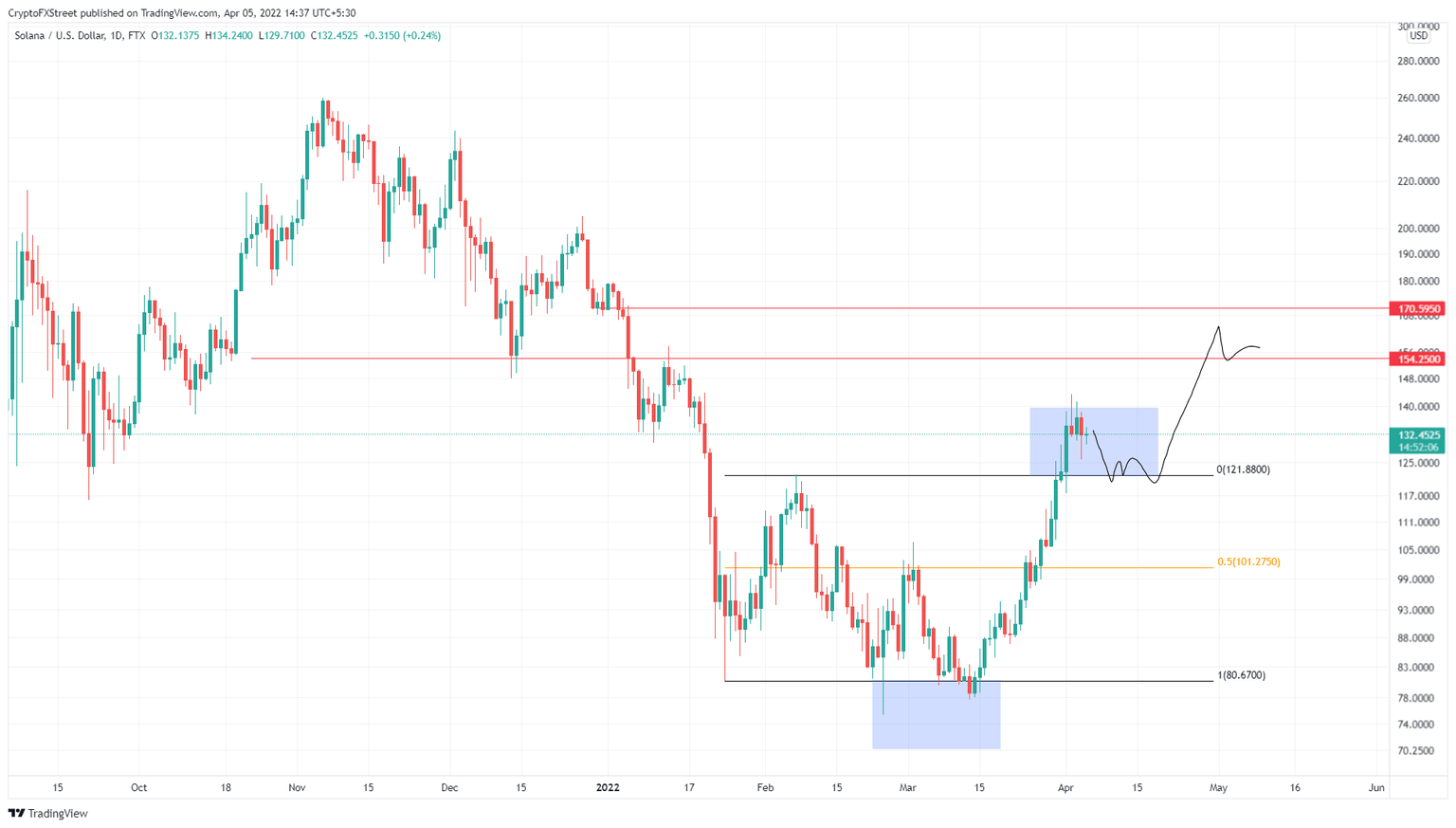

Solana Price Prediction: SOL prepares for a 40% move

- Solana price deviates above the range high at $121.88 to set the stage for further gains.

- A retest of the $121.88 support level will trigger a 27% ascent to $154.

- A daily candlestick close below $101.27 will invalidate the bullish thesis for SOL.

Solana price has revealed its bullish intentions as it moved above a crucial resistance barrier on April 1. This development is likely to be followed by an explosive move to hurdles after a minor pullback.

Solana price prepares to take off

Solana price rallied 83% in under three weeks and set a swing high at $143.53. This move deviated above the existing range that stretches from $80.67 to $121.88. While this development is bullish, SOL is likely to first retrace 8% before triggering another run-up.

A retest of the $121.88 barrier will provide sidelined buyers an opportunity to accumulate SOL at a discount, allowing them to ride the next leg higher. This rally, however, will propel Solana price to the $154.5 hurdle and constitute a 26% upswing. Due to the nature of this resistance barrier, it is likely that SOL will form a local top there.

Although unlikely, in some cases, Solana price could extend the run-up to retest the $170.59 ceiling, bringing the total move to 40%.

SOL/USDT 1-day chart

Regardless of the bullish outlook for Solana price, a sudden nosedive in Bitcoin price could turn the optimistic setup sour.

A daily candlestick close below $101.27 will invalidate the bullish thesis for Solana price. Such a move will also open the path for SOL to crash by 20% to the range low at $80.67

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.