Solana price experiences temporary bounce as SOL contemplates retesting sub-$100 levels

- Solana price witnesses the first meaningful correction in its 876% bull run.

- A breakdown of the $119.26 demand barrier will knock SOL down to $95.94.

- A successful reclaim of the $147.55 resistance level as a support floor will invalidate the bullish thesis.

Solana price has been on an exponential rise since July 20 and has not witnessed any slowdowns until setting up a new all-time high on September 9. This roughly one and a half month speed run from SOL is currently experiencing a pullback that could extend lower if crucial barriers are breached.

Solana price at an inflection point

Solana price rose roughly 876% in 51 days starting July 20. What is most impressive about this run-up is that it did not experience any massive downswing along the way. However, after setting up a new all-time high at $216, SOL began cooling off.

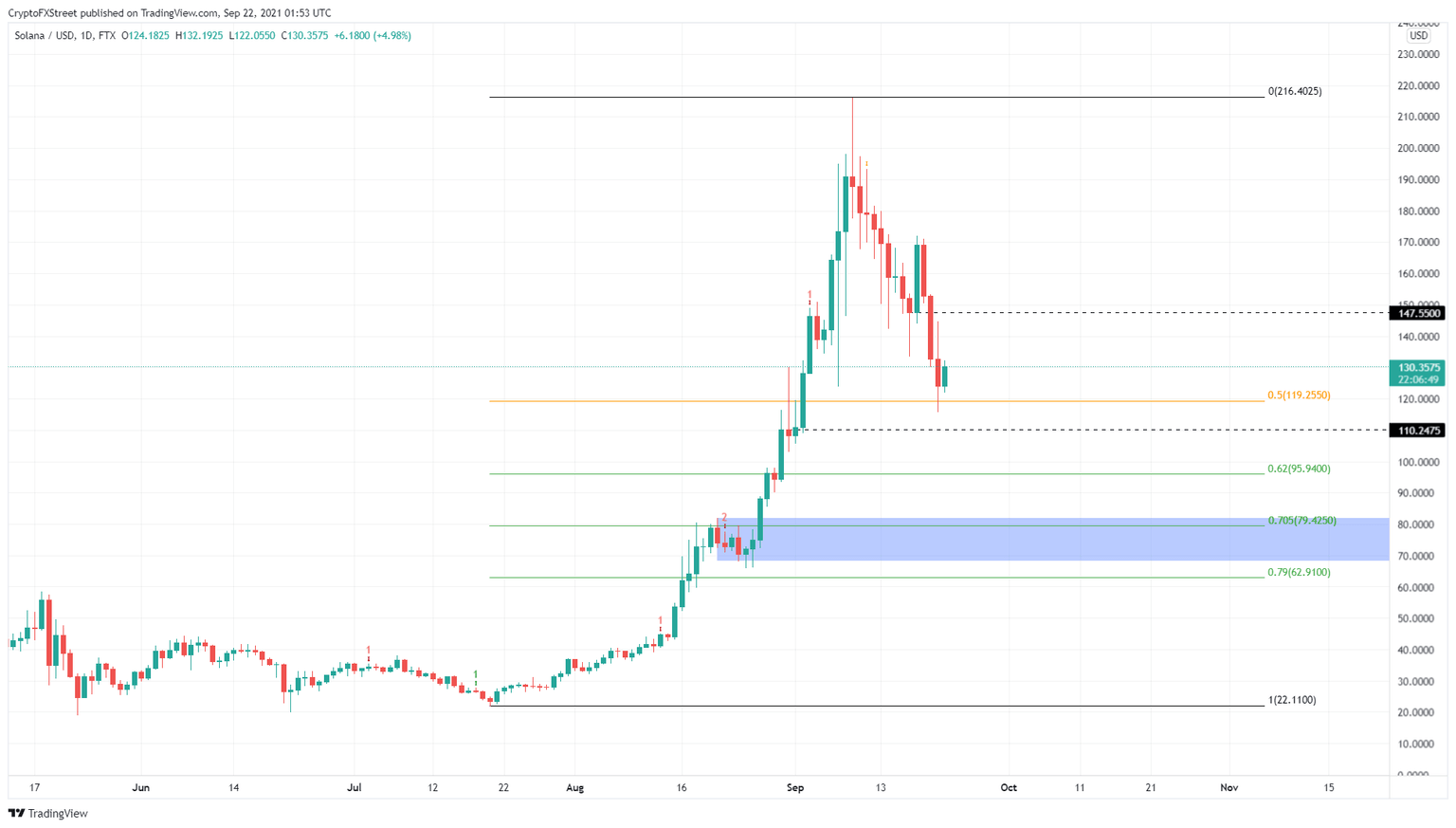

So far, the altcoin has dropped 44% and is currently bouncing off the 50% Fibonacci retracement level at $119.26. Still, this uptrend is unlikely to continue going higher, especially considering the state of the market.

A potential spike in selling pressure that slices through $119.26 will drag Solana price down to the immediate barrier at $110.25. This level is the only support floor that stands between a sub-$100 SOL and a steep correction.

Breaching this barrier will push Solana down to the 62% Fibonacci retracement level at $95.94, and if the selling pressure persists, the subsequent level at $79.43.

SOL/USD 1-day chart

On the other hand, this downswing could be ending after a successful bounce off the 50% Fibonacci retracement level at $119.26. In that case, Solana price needs to reclaim the $147.50 resistance level into a support floor.

This move will invalidate the bearish thesis and serve as a platform for a further ascent to $169.29.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.