Solana price could reach $175 after SOL's recent rebound

- Solana price bounced off a significant Fibonacci level.

- Bulls ramped up price action with 18% of profits.

- Another leg higher will hold 20% of additional profits for bulls if they can clear $150 in Solana price action.

Solana (SOL) price was on the downturn on Monday, but bulls have seized on two technical entry points as a reason to pair back losses. With losses almost recovered in total, more upside could offer itself to bulls if buyers can clear the hurdle at $150. The price of Solana could jump to $174.32.

Solana bulls hold the cards at $145 and need to push the price beyond $150 for more upside

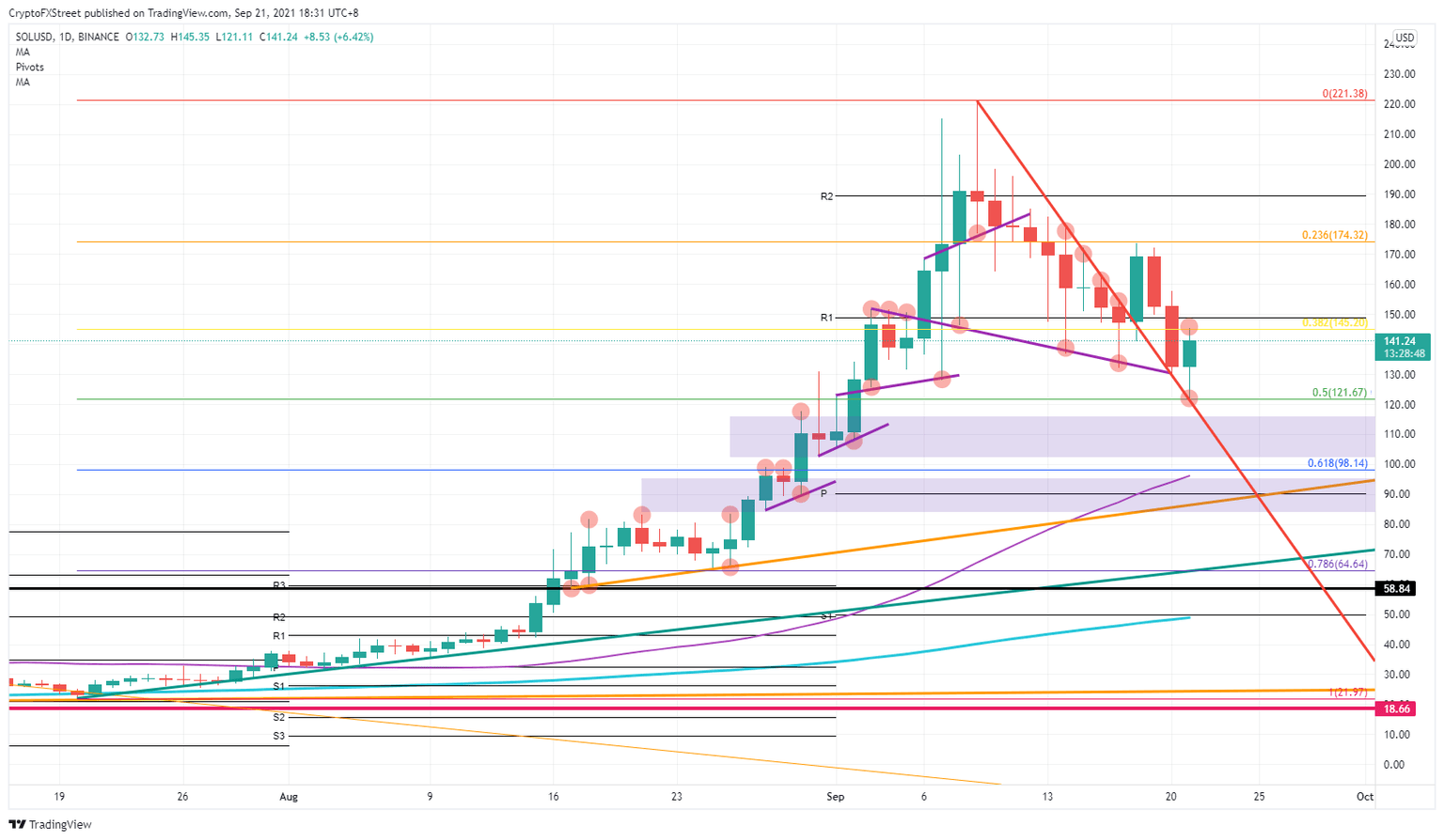

Solana price was in a correction phase on Sunday, but price action behaved better than other alt-currencies. Buyers were patient and picked up Solana at an exciting level, proving that technical analysis works and has its fruit to bear. Bulls picked up SOL at $121.67, which is the 50% Fibonacci retracement from the high of September to the low of July. With that, the red descending trend line falls in place as well. This trend line had four tests to the upside before bulls broke above it, and now it is acting as support for the bulls to enter long positions.

SOL price is intraday hitting the 38.2% Fibonacci level at 145.20. Just above the R1 monthly resistance level at $150, bulls will have their work cut out to squeeze sellers out of their attempts to have another run to the downside. This is why SOL must see buyers push the price and preferably keep it above $150. That would attract more buyers and open up the possibility of hitting $174 by the end of this week.

SOL/USD daily chart

Expect Solana price action to try and push beyond $150. Once bulls have gained control, they should stay above that $150 by the end of the trading day. Hesitant buyers will add volume to the rally and probably another 16% to the price action.

With some significant economic agenda events, sentiment could quickly turn 180 degrees and spell more downside pressure for Solana prices. With Evergrande in a possible default on Thursday and the FED FOMC meeting on Wednesday, two significant catalysts could cause some hiccups on the path to more upside. Except, in that case, the Solana price enters below the red descending trend line again and looks to test $98.14, which is the 61.8% Fibonacci level.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.