Solana price can hit $40 if SOL bulls reclaim this level

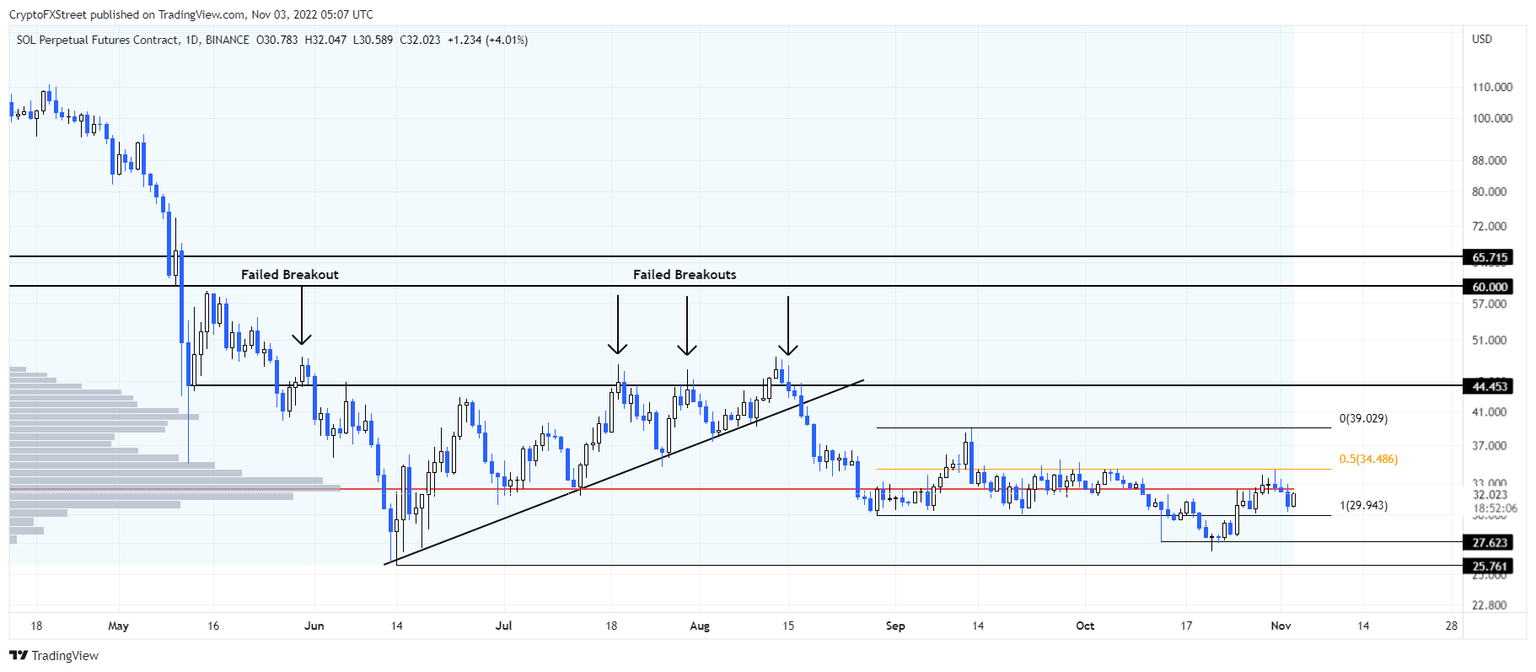

- Solana price is above a stable support level at $29.94 after a brief deviation below it.

- A resurgence of buying pressure at this foothold could result in a 22% upswing to $39.02.

- Invalidation of the bullish thesis will occur below $27.62 and could lead to a retest of $25.76.

Solana price has recovered above a crucial support level, indicating a higher chance of an upward move.Investors need to wait for a push above another significant hurdle, which will open the path for bulls to move higher.

Solana price at inflection point

Solana price deviated below the $29.94 to $39.02 range on October 19, but recovered above it after the FOMC meeting on November 2. This move hints at a bullish outlook for SOL as the recovery suggests that SOL is likely to head higher.

Sitting above is the point of control, aka higher volume traded level since April 2 at $32.48. A successful flip of this hurdle into a support floor will open the path for buyers to propel Solana price to the $34.48 and $39.09 hurdles.

In total, this move would constitute a 22% upswing for SOL and is likely where the upside is capped. Any move beyond this level is tough but a sufficient spike could extend this rally to $44.45.

Therefore, investors should wait for of Solana price to overcome the $32.48 barrier before making a move.

SOLUSDT 1-day chart

While things are looking up for Solana price, a breakdown of the range low at $29.94 will signal a lack of buying pressure. If this trend continues and SOL produces daily candlestick close below $27.62, it will create a lower low and invalidate the bullish thesis.

This development could see the so-called “Ethereum-killer” decline to the $25.76 barrier, where SOL bulls can regroup and give the optimistic outlook another go.

Here's how Bitcoin's moves could affect Elrond price

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.