Solana and Coinbase’s base connect together using Chainlink

Solana and Coinbase’s Ethereum layer-2 blockchain Base have been bridged together using Chainlink’s technology in a move to increase liquidity between the two networks.

Base said on Thursday that it launched a bridge connecting it to Solana secured by Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Coinbase, enabling seamless asset transfers.

The bridge is now live on mainnet for builders to integrate, and rolling out for anyone to use in apps, including Zora, Aerodrome, Virtuals, Flaunch, and Relay.

Users will also be able to trade Solana and many Solana-based assets on Base. Base developers can also integrate the bridge to support Solana assets, such as SPL tokens, natively in their apps.

Solana is the second-largest blockchain by value locked, with $9 billion in assets, while Base is the sixth-largest with $4.5 billion in assets, per DefiLlama. Both blockchains are known for their aim to facilitate trading and low fees.

A crosschain interoperability milestone

The bridge is a technical milestone, as it joins Ethereum Virtual Machine (EVM)-compatible chains with Solana’s non-EVM architecture.

Base is also positioning itself as a hub for multichain activity rather than competing solely within the EVM ecosystem, which could give it an advantage as users increasingly want access to assets across different chains without managing multiple wallets.

Both Base and Solana have been primarily used for memecoin minting and trading due to their high throughput and low transaction costs.

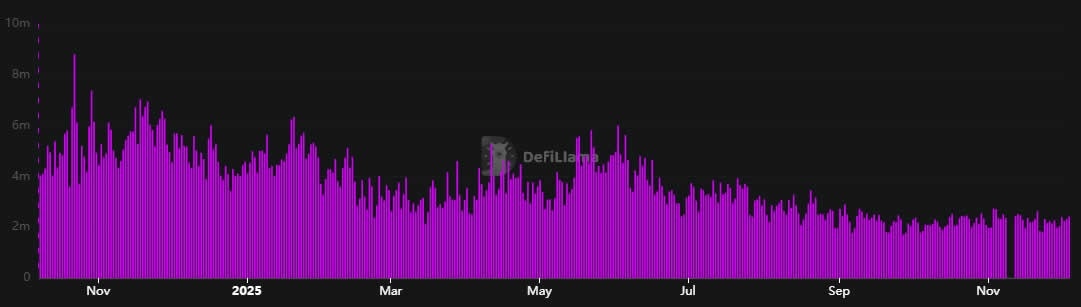

Activity on Solana has been in decline for a year, with active addresses peaking at over 6 million in November 2024 and subsequently falling to their current levels of 2.4 million, according to DefiLlama.

Base active addresses have also been in decline since peaking in June 2025; however, the blockchain’s transaction count has risen this year, hitting a monthly peak of nearly 407 million in November.

Solana active addresses have been falling this year. Source: DefiLlama

SOL and LINK trade down on the day

The price of the Solana token did not react to the news and dipped 3% on the day to below $140. SOL is now down more than 50% from its January 2025 all-time high of over $293.

Chainlink also dropped around 3% on the day to $14.30. LINK is now down 73% from its 2021 all-time high of nearly $53, despite the recent launch of the first US spot LINK exchange-traded fund, as altcoins have underperformed so far this market cycle.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.