SOL price surge faces reality check as on-chain activity falls

Solana (SOL) has recorded three consecutive months of green candles and continues to hold upward momentum into October. However, Solana’s on-chain data seems to tell a different story.

A growing negative divergence between price and network activity has raised investors' concerns about the sustainability of this rally.

Risk for SOL price from divergence between price and network activity

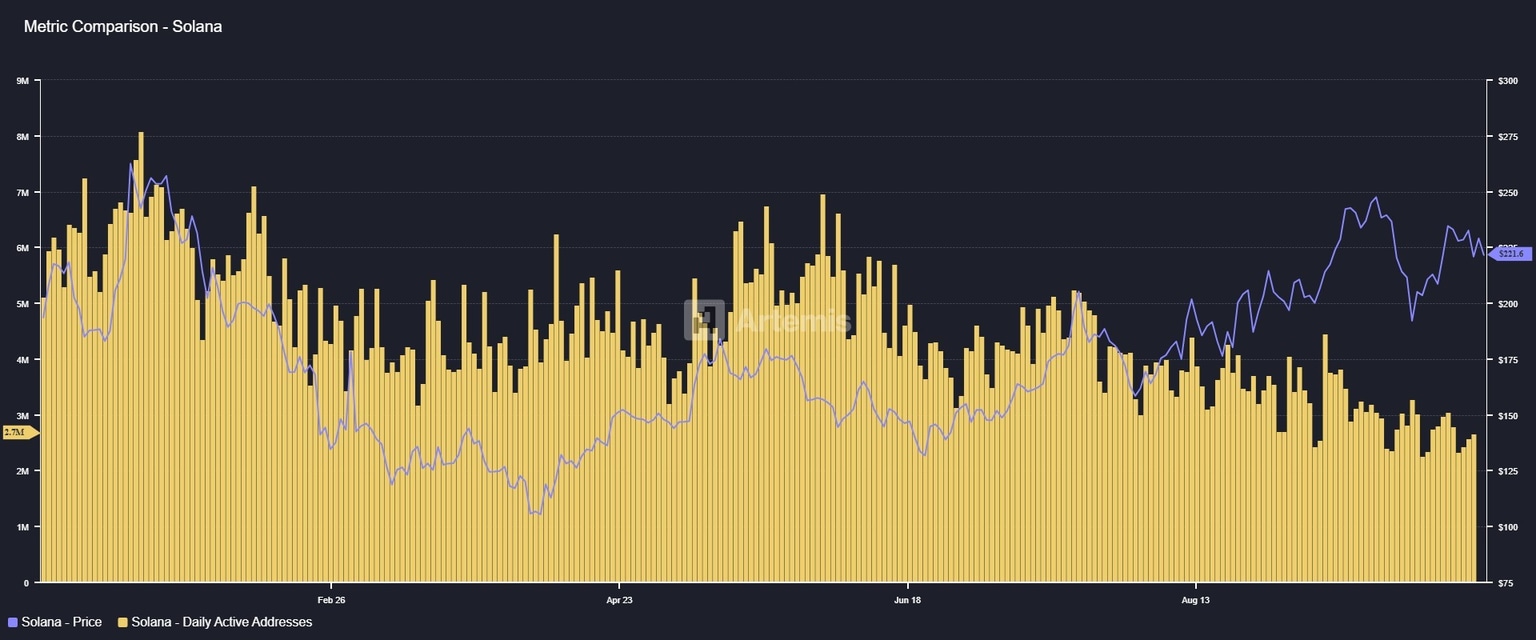

According to Artemis, the number of daily active addresses on Solana and the SOL price have historically correlated.

However, a divergence has emerged since mid-August. During this period, SOL’s price surged from $175 to over $220, while daily active addresses dropped from over 4 million to around 2.7 million.

SOL Price vs Solana Daily Active Addresses. Source: Artemis

This metric reflects network usage, including DeFi transactions, NFT trades, and decentralized application activity.

In a healthy market, rising prices are usually accompanied by stronger network activity, signaling genuine demand. In contrast, the current situation suggests that the price rally is driven primarily by speculation and market sentiment, not fundamental usage. This raises the risk of a sharp correction if sentiment suddenly turns negative.

Additionally, CryptoOnchain, an analyst from CryptoQuant, also observed a similar divergence between SOL’s price and its on-chain activity, measured by daily transaction count. While SOL’s price continues to climb, the number of transactions on the Solana network has fallen nearly 50%, dropping from around 125 million (July 24, 2025) to about 64 million per day.

Solana Price vs Network Activity. Source: CryptoQuant.

He further explained that 80–90% of transactions on Solana are “vote transactions” used to maintain network consensus. Therefore, it’s important to determine whether the decline stems from reduced user activity or changes in voting mechanisms.

“If it is determined that this decrease is directly related to user activity, the credibility of the current upward price trend is severely questioned, and it increases the risk of a significant price correction,” CryptoOnchain said.

Despite these warning signs, recent technical analysis shows a hidden bullish divergence on Solana’s daily chart, suggesting the uptrend might continue.

Additionally, investor optimism is growing over the potential approval of multiple SOL ETFs in October, which could further boost bullish sentiment.

Prominent analyst Lark Davis even predicted that this ETF momentum could push SOL’s price as high as $425.

Traders are chasing positive news and FOMO rather than focusing on network fundamentals. While this strategy may bring short-term profits, those gains could quickly vanish without a well-timed profit-taking plan once the positive headlines fade.

Author

BeInCrypto

BeInCrypto

Since 2018, BeInCrypto has grown into a leading global crypto news platform. Through our award-winning journalism and close ties with industry leaders, we deliver trusted insights into Web3, AI, and digital assets.