Shiba Inu price nears support where bulls can realizeze 25% upswing in SHIB

- Shiba Inu price takes a step back as stock markets and risk assets tank.

- SHIB bounces off an important trend line that has been present since December.

- Expect support to swing in and push price action higher with a test at $0.00001600 due.

Shiba Inu (SHIB) price has tanked over 4% since Tuesday as traders are getting worried about a potential plateau and rising inflation worldwide. Next to that, markets are reacting to another round of layoffs from a few big US companies, and more earnings are hitting the wires. Though sentiment might look negative, the current developments will prove why SHIB could rally 25% in the coming days.

Shiba Inu price is selling the rumor now and buying the fact later

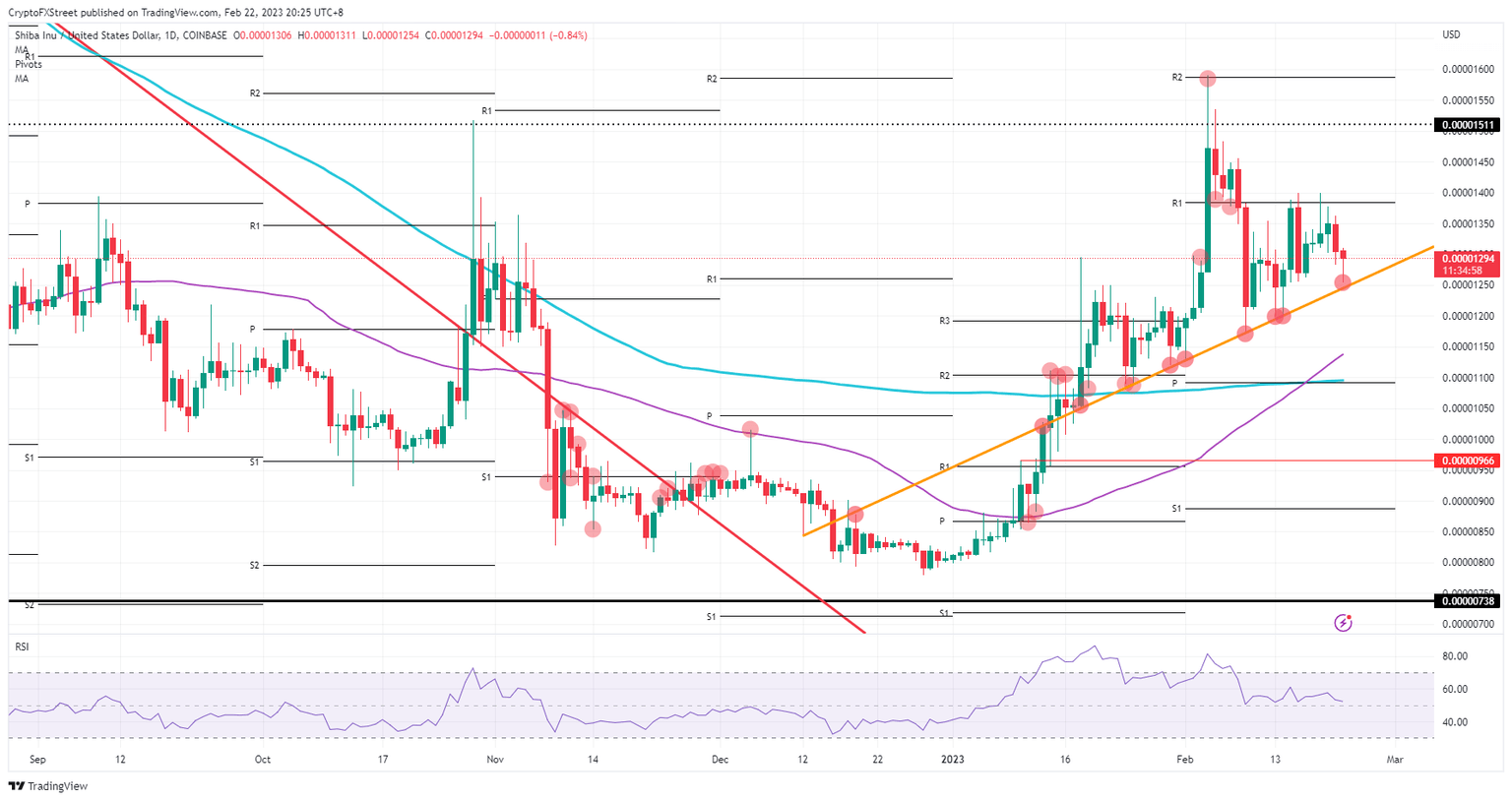

Shiba Inu price sees opportunistic traders heading for the exit and cashing in on their profits after another strong rally since the beginning of February. A big line in the sand for the rally since January is coming from the orange ascending trend line, which is holding strong relevance in this rally. SHIB dropped lower before bouncing higher off that trendline.

SHIB traders will see smarter money enter the orange ascending trend line with a longer-term projection of when to get out. That makes each bounce in SHIB more successful and could cause a massive upside explosion in the near future. Once the bounce tops $0.00001400, the road is paved for $0.00001600 with a 25% gain.

SHIB/USD daily chart

A firm break of the orange ascending trend line would indicate a clear and present danger that the full rally can be unwound. Any catalyst of the geopolitical, data or central bank sort could do the trick. Luckily, near $0.00001100 the 200-day Simple Moving Average aligns with the monthly pivot to preserve losses at about 13%.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.