Shiba Inu price eyes 30% ascent after recent resuscitation

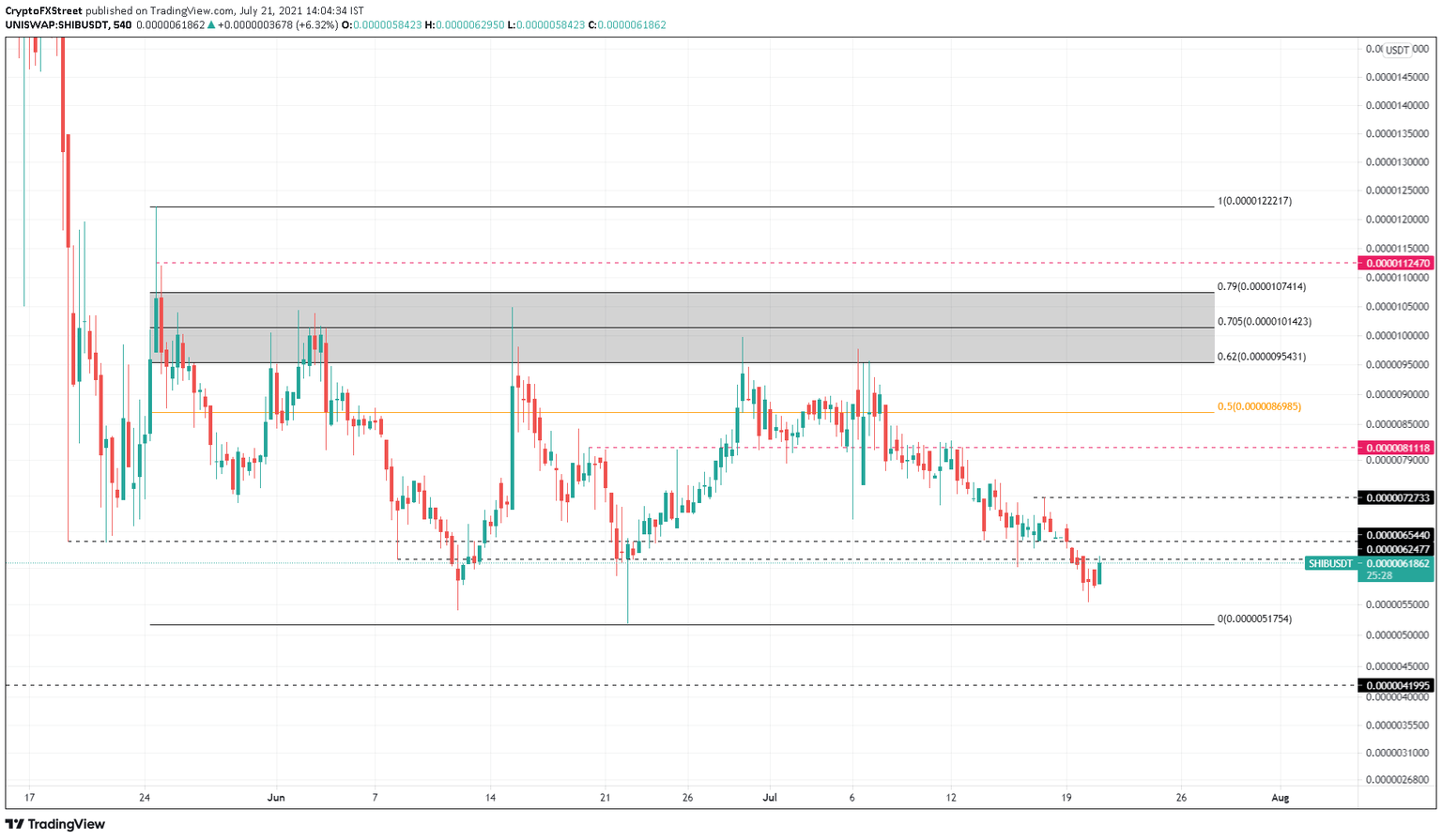

- Shiba Inu price cashed 23% in under three days as it slid below the $0.00000625 support level.

- A quick reclaim of the $0.00000727 resistance barrier will add credence to the uptrend narrative.

- A breakdown of the range low will invalidate the bullish thesis for SHIB.

Shiba Inu price is showing signs of life after a massive downtrend. This development is seen across the board, with almost all altcoins resulting from an uptick in Bitcoin price.

If the current trend continues, SHIB is likely to continue heading higher.

Shiba Inu price to kick-start an uptrend

Shiba Inu price is currently indicating what seems like the start of a reversal. This move comes after SHIB crashed 43% over the past two weeks and dipped below the $0.00000625 support level.

This sweep of the said demand barrier allowed market makers to collect liquidity. Therefore, the current setup shows a high chance that the reversal will be successful.

While it is apparent that Shiba Inu price might rally 18% to tag the resistance level at $0.00000727, it is unsure if the bulls can push past it. If the buyers manage to produce a decisive 9-hour candlestick close above $0.00000727, it will serve as a confirmation of the uptrend.

In such a case, SHIB might even tag the 50% Fibonacci retracement level at $0.00000870, roughly a 40% upswing from the current position – $0.00000619.

SHIB/USDT 9-hour chart

While the optimism around the recent uptick in Shiba Inu price is good, it is overly dependent on the pioneer cryptocurrency. Therefore, a potential yet sudden spike in selling pressure that pushes BTC lower could ripple out into a crash for SHIB.

If such a move were to occur, leading to a breakdown of the range low at $0.000000518, it would invalidate the bullish thesis.

In some cases, the selling pressure might even push Shiba Inu price to $0.00000420.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.