SHIB Price Prediction: Shiba Inu holds its ground amid market crash, eyes 64% rally

- SHIB price dropped roughly 16% in Friday’s trading session due to Musk’s cryptic tweets.

- Regardless of the minor sell-off, the Adam and Eve pattern for Shiba Inu remains safe.

- A convincing close above $0.0000109 could trigger a 33% bull rally to $0.0000146.

SHIB price is in the process of setting up a bottom reversal pattern. Interestingly, the effects of Musk’s tweet were ephemeral, which allowed Shiba Inu and the rest of the crypto market to recover quickly.

SHIB price continues its journey

SHIB price saw an 83% sell-off from its peak at $0.0000394 to $0.00000654 in under ten days, starting from May 10. While this drawdown was brutal, to say the least, Shiba Inu has plans of making a comeback.

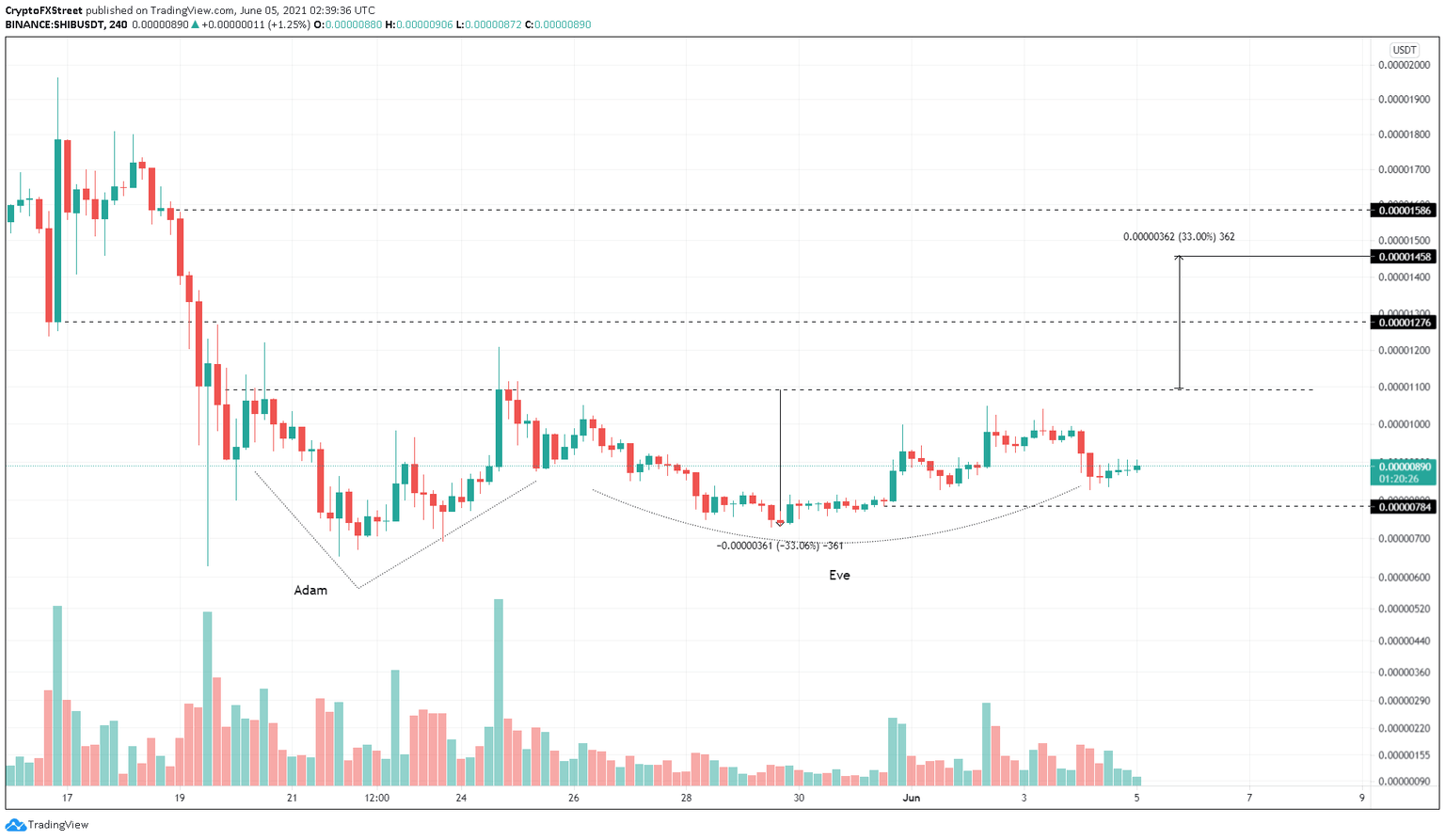

After this massive drop, SHIB price slipped into consolidation and has been doing it for more than two weeks. This range-bound movement has evolved into a bottom reversal pattern known as Adam and Eve.

This technical formation consists of two valleys, one with a V-shaped bottom and the other has a rounded base. The first swing low is referred to as Adam, while the second, Eve. A horizontal resistance level is formed when the peaks of the two swing lows are connected using trend lines.

The target for this technical formation is determined by adding the distance between the peak and the valley to the breakout point. Therefore, a decisive close above $0.0000109 will confirm a breakout from the reversal pattern and project a 30% upswing to $0.0000146.

SHIB/USDT 4-hour chart

However, if SHIB price fails to break through the resistance level at $0.0000109, it will signal weak buyers. If the resulting downswing produces a convincing close below the May 31 swing low at $0.00000784, it will invalidate the bullish thesis.

In that case, Shiba Inu might continue its downtrend to the second valley’s lowest point at $0.00000731.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.