Sandbox price plies back after 40% rally hits the snooze button

- Sandbox price starts to fade for a second day as investors cash in on their gains.

- SAND price looks to fall back towards the monthly pivot as dark clouds form in global markets.

- Expect Sandbox prices to look for support to reboot the rally with fresh buyers.

Sandbox (SAND) has been on the back foot for a second day now as global markets start to worry about the Omicron variant becoming the dominant strain, surpassing Delta in the number of contaminations. Investors are starting to pull out their money, which could leadSAND to pull back to $5.70.

Sandbox set to correct 10% intraday

Sandbox was in a sweet spot these past few days as investors enjoyed a 40% gain in price action, with the Christmas rally lifting sentiment. That same sentiment is taking a turn today as price action in SAND starts to fade a little too much with bulls looking for support. That first initial support is still 10% from the current price action.

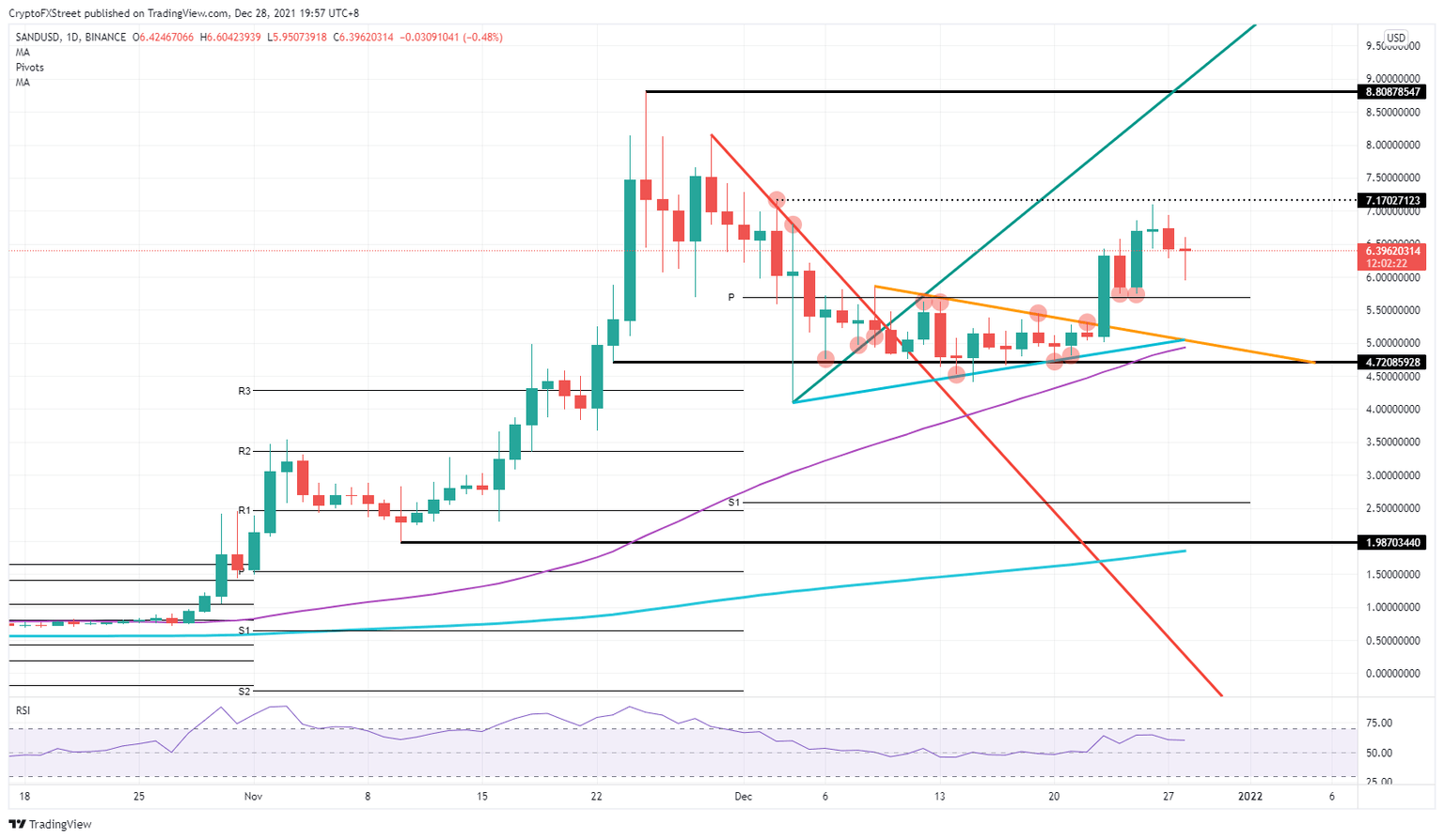

Expect SAND to dip further throughout the day toward the monthly pivot near $5.70, with the monthly pivot coming into play. If that level does not trick, investors will want to look for the intersection from the blue ascending trend line with the yellow descending trend line, making it a perfect entry-level to go long.

SAND/USD daily chart

As volumes these coming days are pretty thin, sentiment could shift quickly back into risk-on and see a retest of the $7.17 level, with a possible break above. Once there, investors will want to get in the price action again and jump on the bullish signals. That could easily see price action ranging from $7.17 to $8.80 and possibly to new all-time highs, but that would be in tandem with stock markets making new highs.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.