SafeMoon Price Prediction: SAFEMOON prepares for 50% upswing

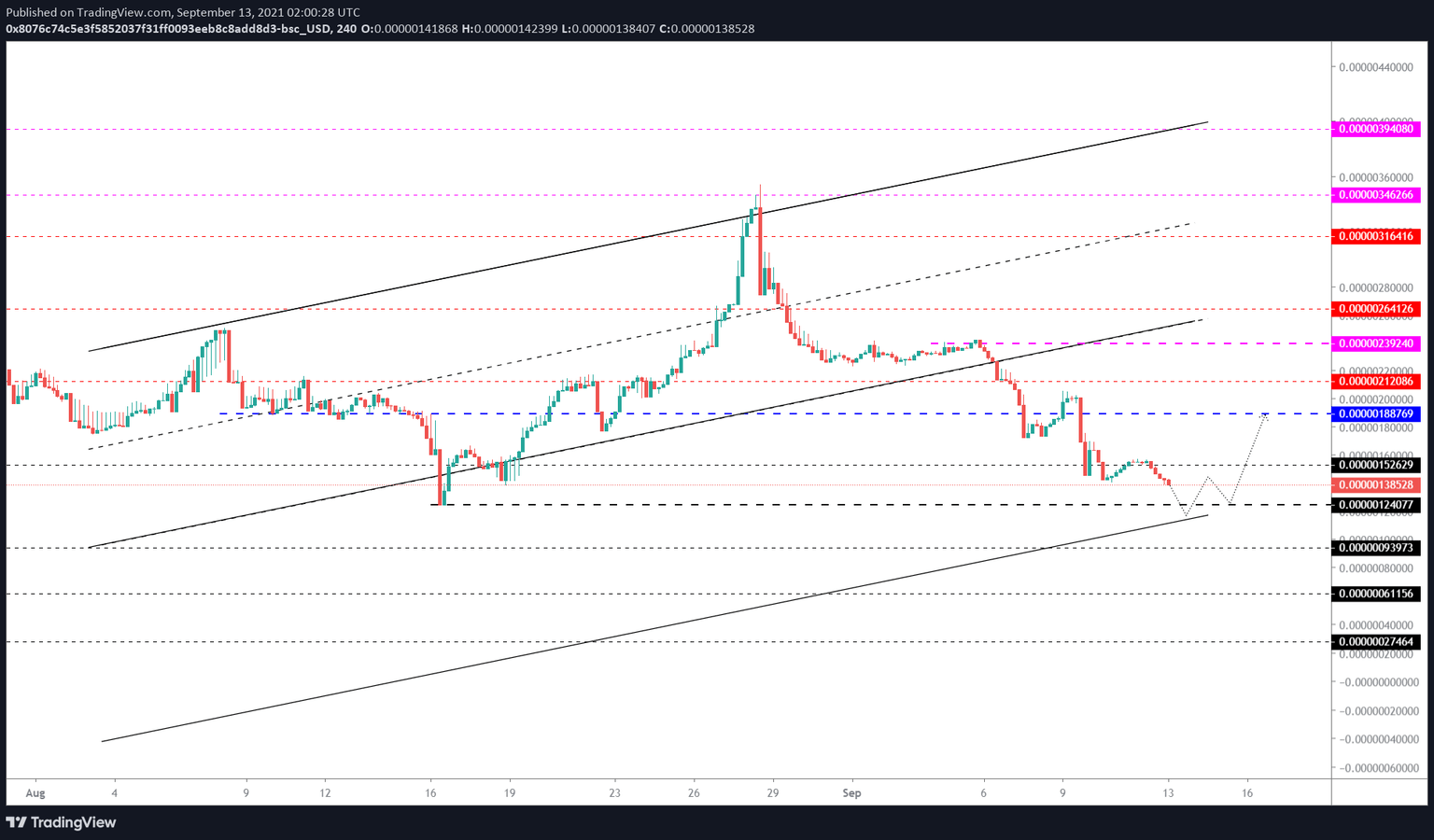

- SafeMoon price is currently approaching a stable support level at $0.00000124.

- A successful bounce off this barrier will create a double bottom and potentially propel SAFEMOON by 50%.

- A breakdown of the $0.00000124 barrier will invalidate the bullish thesis.

SafeMoon price has been on a downswing for roughly two weeks, but this downswing has pushed it close to a stable demand barrier. Assuming the bulls make a comeback, investors can expect a new uptrend to originate here.

SafeMoon price awaits resurgence of buyers

SafeMoon price has shed nearly 60% of its value over the past two weeks. Moreover, SAFEMOON does not seem to be having a good time since the May 19 crash. Regardless, there have been attempts to change this bearish outlook, but none of them have succeeded so far.

As SafeMoon price approaches the $0.00000124 support level, investors can be optimistic again as a new uptrend could originate here.

On August 16, SafeMoon price set up a swing low at $0.00000124, and the current downtrend is likely to do the same. A resurgence of buying pressure around this barrier is expected to trigger a new ascent.

Market participants can expect this new and potential rally to slice through the immediate resistance barrier at $0.00000152 and make a run at the next supply level at $0.00000189. This run-up from $0.00000124 to $0.00000189 would constitute a 50% ascent.

In a highly bullish case, SAFEMOON could tag $0.00000212, extending the gains to 70%.

SAFEMOON/USDT 4-hour chart

While the optimistic scenario depends on the assumption that the bulls make a comeback around $0.00000124, a failure to do so will exacerbate the downswing. A decisive close below this support barrier will create a lower low and invalidate the bullish thesis.

In this case, investors can expect SafeMoon price to tag the immediate support level at $0.00000094.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.