SafeMoon Price Prediction: SAFEMOON gives bull rally another try

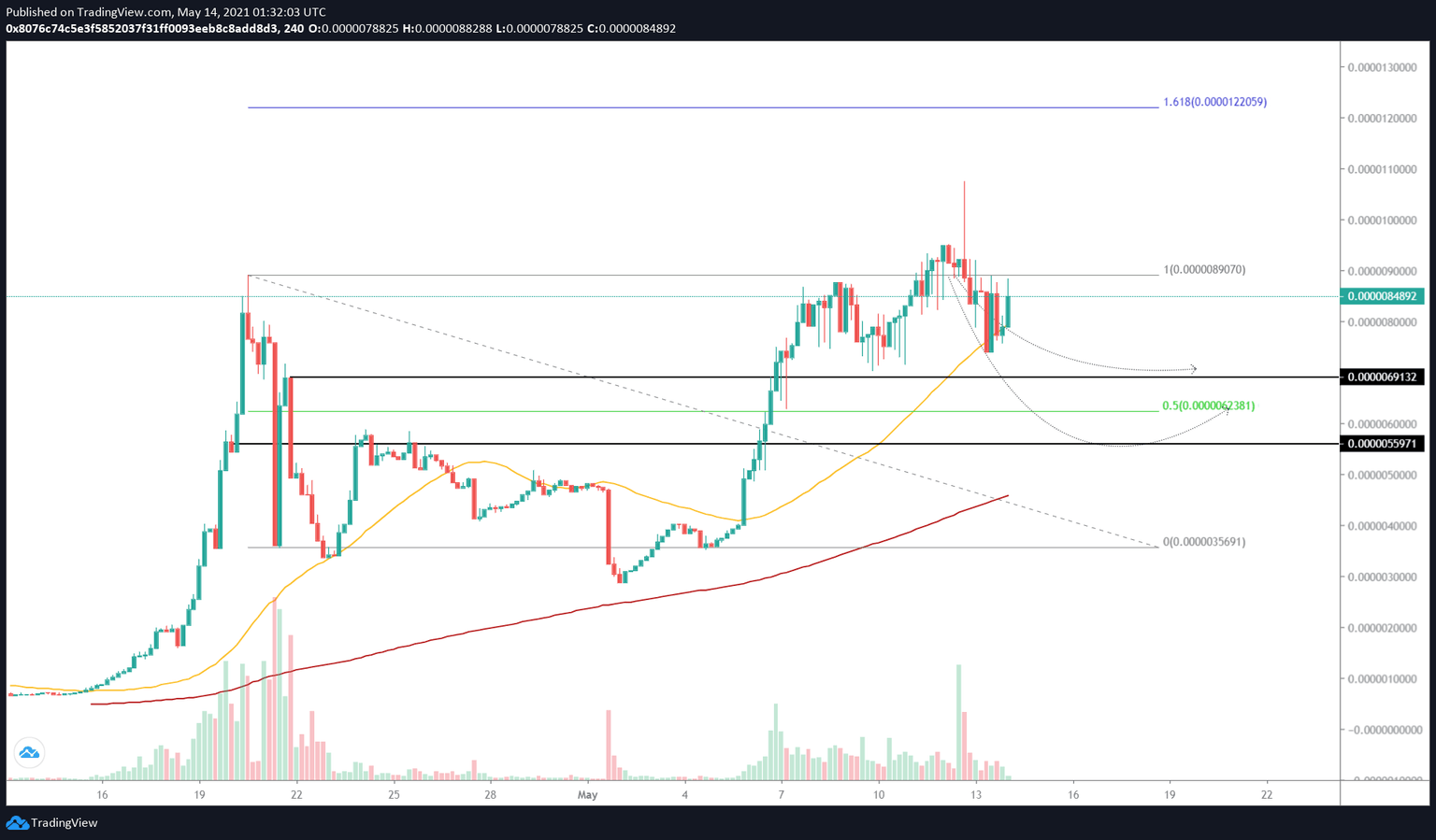

- SafeMoon price reentered its range that extends from $0.00000356 to $0.00000890 after creating a swing high.

- The 50 four-hour SMA at $0.00000792 supported SAFEMOON’s recent upswing.

- A breakdown of the 50% Fibonacci retracement level at $0.00000623 will invalidate the bullish thesis.

SafeMoon price remained unaffected during the Tesla-induced crash on Wednesday and continued to trade sideways. At the time of writing, SAFEMOON seems to have dipped back into its range and taken a jab at heading higher.

SafeMoon price needs a stable foothold to skyrocket

SafeMoon price is moving in lockstep but stuck between $0.00000356 to $0.00000890. However, on May 11, it explored out of this zone but failed to sustain this upswing. As a result, SAFEMOON quickly slid under $0.00000356 and is trading within this range.

The 50 four-hour Simple Moving Average (SMA) at $0.00000792 supported the falling prices. Over the last couple of hours, the altcoin has reacted nicely from the SMA mentioned above and surged nearly 11%, taking another jab at a bull rally.

As the majority of the cryptocurrency market rebounds, it is likely that SAFEMOON will also venture out from the upper range. A decisive 4-hour candlestick close above $0.00000890 will signal the start of an uptrend. In such a case, Safemoon price might rally 36% to tag the 161.8% Fibonacci retracement level at $0.0000122.

However, investors need to note that this bullish thesis holds if SAFEMOON slices through the critical level mentioned above.

SAFEMOON/USDT 4-hour chart

On the other hand, the inability of the buyers to quickly push Safemoon price above $0.00000890 will result in sellers taking over the altcoin. In such a case, SAFEMOOON could retrace 22% to the first support barrier at $0.00000691.

If the sellers overwhelm the buyers here, the 50% Fibonacci retracement level at $0.00000623 will likely dampen the bearish momentum.

However, if this support floor is shattered, it will invalidate the upswing narrative and kick-start a 10% downtrend to $0.00000559.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.