SafeMoon price action resilient in tough times, $0.00000216 target to upside

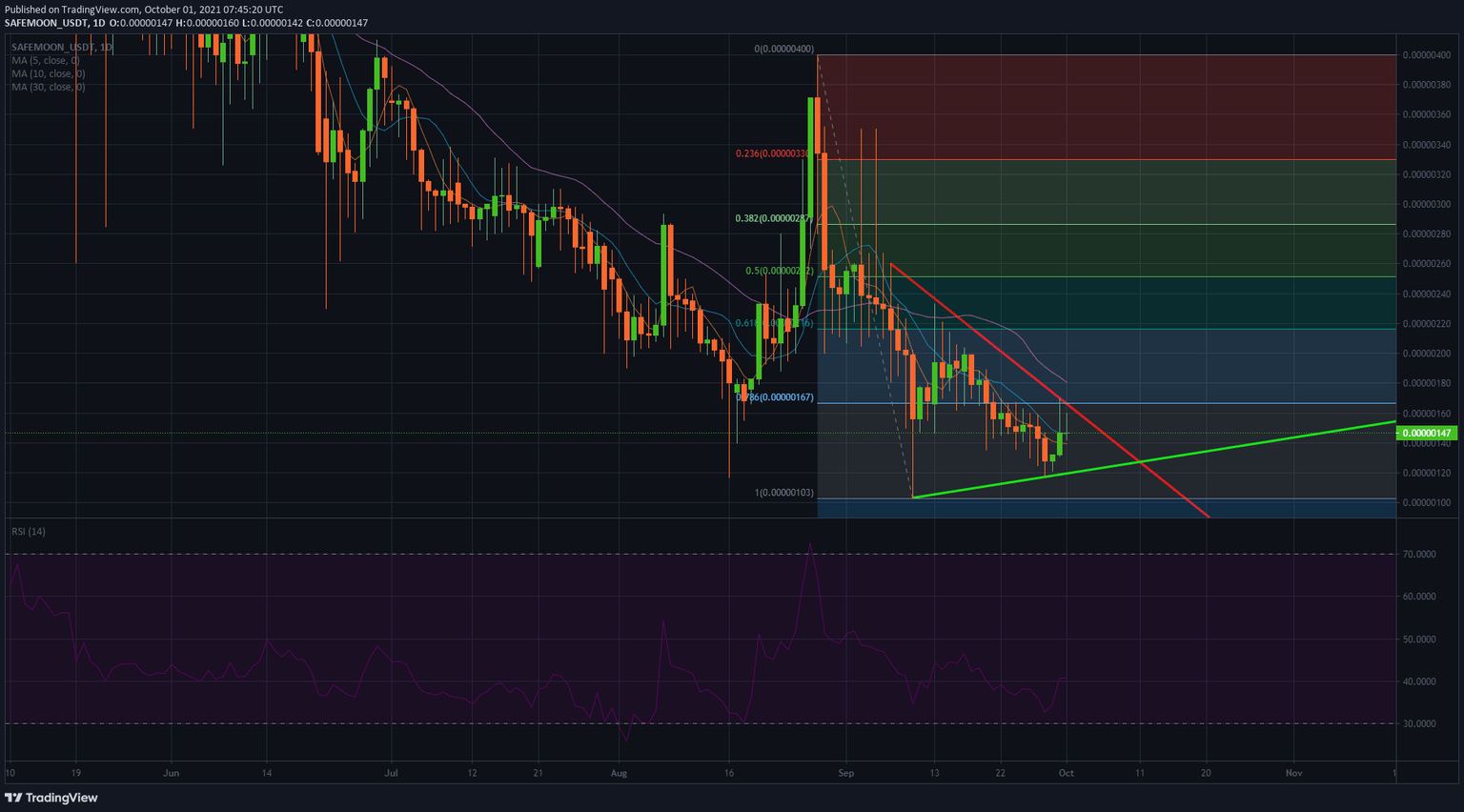

- SafeMoon price bulls faced strong headwinds, with solid gains toward $0.00000167, the 78.6% Fibonacci level.

- As bears in SafeMoon price action have been hurt, expect bulls to hold the upper hand if they can break out of the red descending trend line.

- SafeMoon bulls will look to complete the range toward the 61.8% Fibonacci level at $0.00000216.

SafeMoon (SAFEMOON) price action has been on a tear, although global market sentiment favors the bears. Bulls are pushing to test the 78.6% Fibonacci level and look to break above. From there, bulls will try to complete the Fibonacci range toward 61.8%, or $0.00000216. On the way, bulls will face some resistance from the current downtrend in global financial markets and the 30-day Simple Moving Average (SMA) at $0.00000180.

SAFEMOON price bears will try to contain bulls below the red descending trend line

SafeMoon price action is falling in favor of the bulls, although global market sentiment is nowhere near in favor of them. Bulls hammered out a rally that popped above the 78.6% Fibonacci level at $0.00000167. Price got rejected from the red descending trend line for now but looks to be broken to the upside anytime soon as both the 5-day and 10-day SMA provide support.

SAFEMOON price thus has a few elements in its corner and should support bulls in their attempt to break out of the 78.6% Fibonacci level. Once that happens, expect a leg up toward $0.00000216. That level falls in line with the 61.8% Fibonacci level.

SAFEMOON/USD daily chart

In that completion, expect SafeMoon bulls to face some headwinds around $0.00000180, where the 30-day SMA is coming in. Expect sellers to look for those levels to try and slow down the bull run breakout. Nonetheless, a test of $0.00000216 should be possible.

Bears will try to defend the red descending trend line in their favor. In case that happens, expect a squeeze back toward the green ascending trend line. A break lower would look for a retest toward $0.00000103.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.