Ripple Price Prediction: XRP/USD on verge of the breakout to $0.25 – Confluence Detector

- Ripple price stalls under $0.20 in preparation for the next rally targeting $0.30.

- The consolidation above $0.19 support has assisted in keeping the bulls in control even as focus shifts to levels above $0.20.

The cryptocurrency market is not only stable but also bullish during the Asian hours. On the other hand, Ripple price still lags behind critical resistance at $0.20. However, the consolidation above $0.19 (initial support) suggests that a breakout is around the corner.

At the time of writing, XRP/USD is trading at $0.1979 following a steady recovery from last week’s low and support at $0.1750. The main aim among the buyers is to pull the price above the resistance at $0.20. Further gains past the 38.2% Fibonacci retracement level of the previous drop from $0.3480 to a swing low of $0.11 could cement the bulls’ presence in the market and shift the focus to $0.30.

XRP/USD daily chart

%20(4)-637235542333877139.png&w=1536&q=95)

Meanwhile, the trend remains relatively bullish with Ripple trading above the 50-day SMA. The MACD is holding above the mean line while a positive divergence above the indicator signals possible movements upwards.

Ripple confluence resistance and support levels

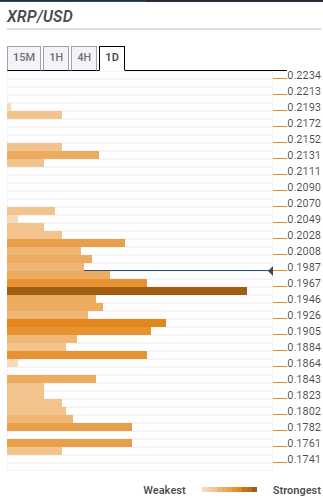

Resistance one: $0.1987 – This is the first resistance highlighted by the previous high one-day, SMA five 15-mins, SMA ten 15-mins, the Bollinger Band 1-hour upper curve, and the previous high 15-mins.

Resistance two: $0.2008 – This region is home to the previous week high, the pivot point one-day resistance one, the Bollinger Band 15-mins upper, and the previous high one-hour.

Resistance three: $0.2131 – Zone hosts the pivot point one-week resistance two and the Fibo 161.8% one-week.

Support one: $0.1967 – This region convergence the SMA 50 15-mins, the SMA 10-one-hour, and the 23.6% Fibo one-day among others.

Support two: $0.1905 – Highlighted by the SMA ten one-day and the BB one-day middle.

Support three: $0.1884 – Home to the Fibo 161.8% one-day, Fibo 38.2% one-week, and the pivot point one-day support three.

Also read: Ripple Weekly Forecast: XRP/USD journey to $0.30 in May begins

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren