Ripple Price Analysis: XRP/USD lags behind Bitcoin in price performance and outperforms BTC on a macro level

- Ripple drab price action enters the second year but wins against Bitcoin as a better macro-asset.

- Ripple price is entering into consolidation above $0.19 even as the bulls remain relatively in charge.

Ripple price performance has lagged behind other major cryptoassets since the beginning of 2019. Although 2020 looked bullish for the token, at the moment the future of XRP in terms of price performance is still bleak especially after losing more than 40% of its value in the first quarter. Bitcoin, on the other hand, continues to prove to investors that it has the ability to recovery in spite of the crash in March. Bitcoin is currently trading above $7,000 just a few weeks before its third block reward halving.

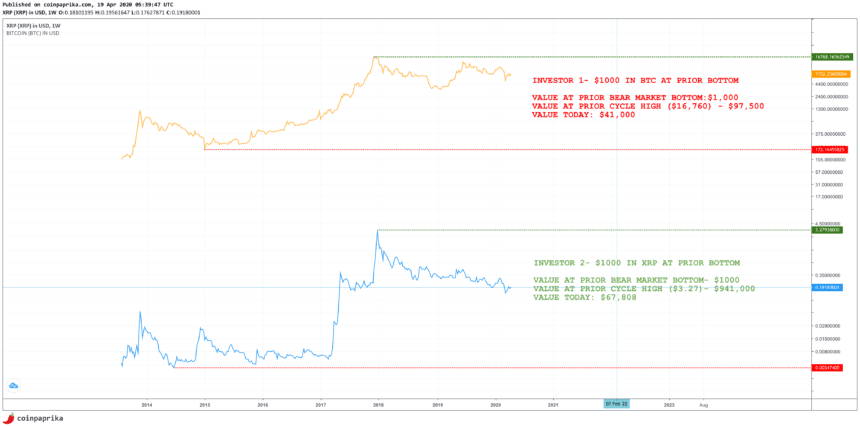

In spite of Ripple price weakness against BTC and USD, the token continues to outsmart Bitcoin on a macro level. According a popular trader, although pseudonymous, Ripple has over the years proved to be a better macro-asset compared to Bitcoin.

“If you invested in XRP over BTC prior to the last bull run, your inv. would currently be worth 1.5x the value of a BTC investor who chose BTC. If you sold at the top, you would’ve made 10x more. Yet you will continue to see CT mocking holders for their ‘terrible investment.’”

XRP/USD settles above the 50-day SMA

Ripple price closed the week above the 50-day SMA, which is a bullish indicator. In other words, XRP has a better chance of advancing higher this week in comparison to its performance last week. Meanwhile, the price is teetering at $0.1932 after the hurdle at $0.20 became impervious to the bullish breakout last Friday. A horizontally trending RSI hints that consolidation between $0.19 and $0.20 is the most formidable price action in the near term. Moreover, a bullish divergence above the MACD emphasizes that despite the drab price action, Ripple remains in the hands of the bulls.

XRP/USD daily chart

-637229502570552914.png&w=1536&q=95)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren