Ripple Price Prediction: XRP bulls are cooking 20% upswing

- XRP price shows a comeback after a brutal sell-off on Monday.

- A continuation of this uptrend could propel the remittance token to retest $0.371.

- Invalidation of the bullish thesis will occur if Ripple flips the $0.316 support level into a resistance level.

XRP price has been struggling compared to other altcoins, but the worst seems to be over for now. The recent sell-off has washed off the weak bullish hands, providing smart investors with a chance to accumulate. As a result, Ripple bulls are likely to enjoy a quick run-up soon.

XRP price shoots for the stars

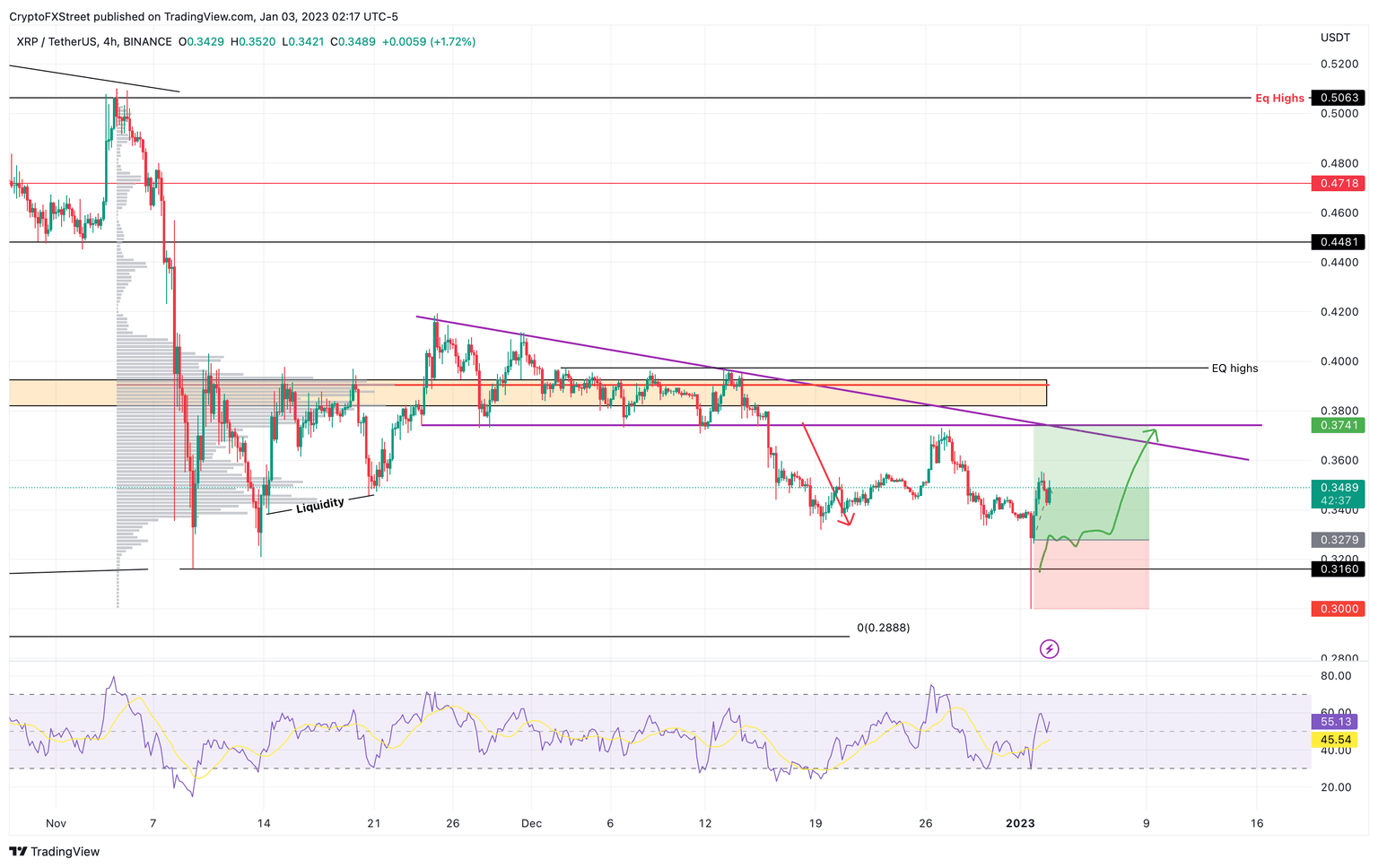

XRP price shed 11% in under an hour on January 2, which allowed market makers to collect the sell-stop liquidity below the $0.316 support level. Since this move was followed by a quick recovery above the said level, it signaled a manipulation move to quell the weak holders and provide long-term holders or smart money to accumulate.

As a result, XRP price has recovered 16% from the $0.30 bottom formed on January 2. As the remittance token hovers around $0.347, investors can expect this uptrend to continue with the backing of the Relative Strength Index (RSI), which has managed to shoot past the midpoint and hold above it.

This resurgence in buying pressure will likely inflate XRP price to revisit the immediate hurdle at $0.374. However, in some cases, Ripple bulls could blow past this barrier and revisit the equal highs formed at roughly $0.400.

XRP/USDT 4-hour chart

While the outlook for bulls looks plausible, investors need to pay attention to Bitcoin price. A sudden downtrend for the big crypto will be reflected by other altcoins, including Ripple. Additionally, a breakdown of the $0.316 support level that flips it into a resistance level will invalidate the bullish thesis by producing a lower low.

In such a case, XRP price could revisit the $0.288 support level, where buyers can regroup and attempt another recovery rally.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.