Ripple Price Prediction: Examining why XRP price is struggling to sustain the uptrend

- XRP price struggles to hold $2.10 support amid declining network activity.

- User engagement has yet to recover from a sharp decline from the first quarter peak of approximately 612,000 daily active addresses.

- Ripple whales are increasing their holdings, hinting at an improving sentiment and a potential breakout.

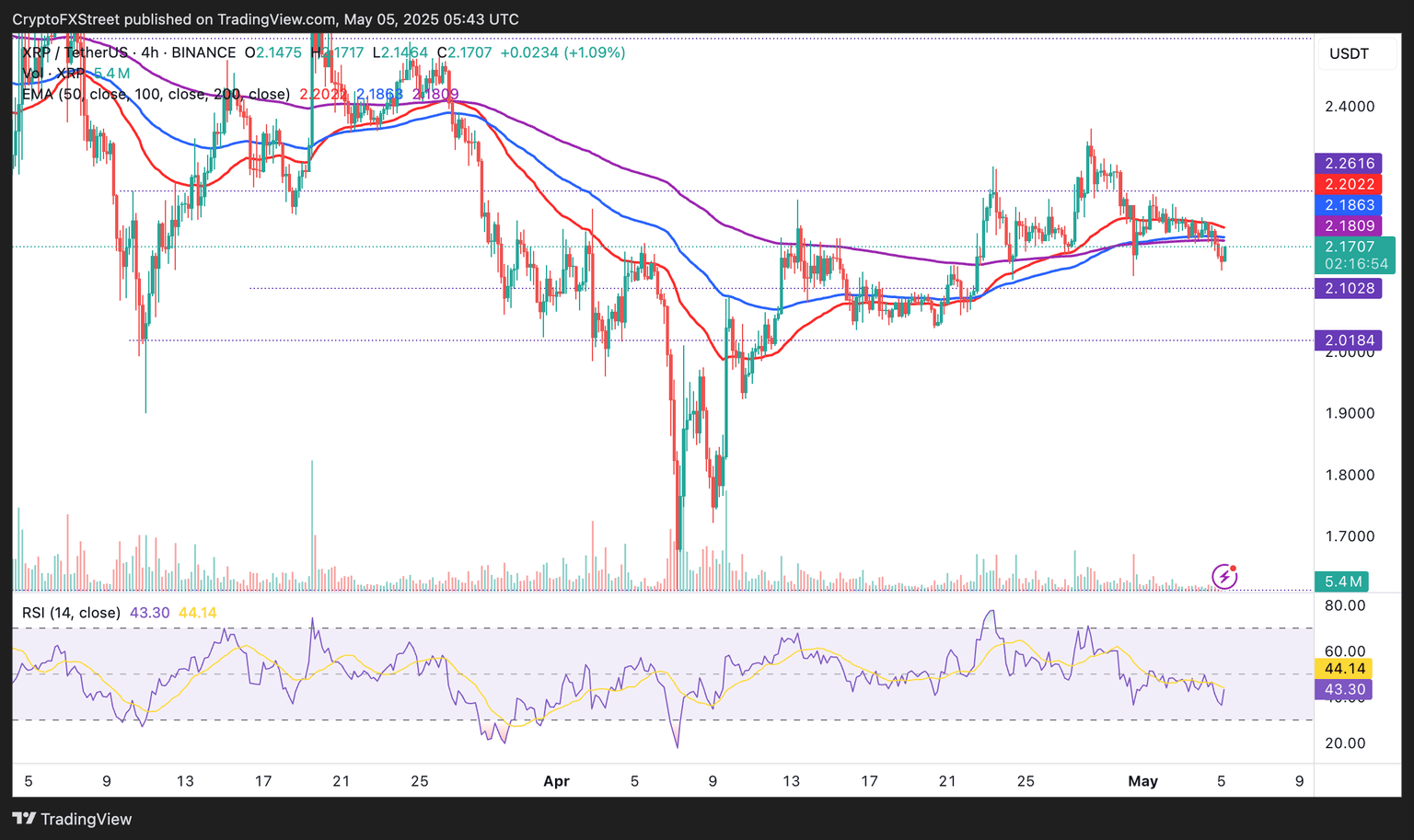

- XRP trades under key EMAs as the RSI indicator nears oversold in the 4-hour chart, signaling strong bearish momentum.

Ripple (XRP) price is yet to make headway in its broader recovery potential, targeting $3.00 in the medium term. The cross-border money remittance token hovers at $2.17 at the time of writing on Monday, up slightly on the day. The mundane broad sideways price action could delay the anticipated breakout, possibly culminating in declines below $2.00.

XRP price falters amid declining network activity

The XRP Ledger is experiencing a major slowdown in network activity compared to levels seen in the first quarter. On-chain data from Santiment reveals that daily active addresses on the protocol stand at a fraction of peak levels recorded in March.

At the height of the first quarter, the XRP Ledger posted a robust 612,000 daily active addresses, indicating strong user engagement and transaction activity. However, the chart below shows a dramatic slump through April and early May.

With only about 40,000 daily active addresses, fewer users transact on the XRP Ledger, which could point to waning interest or a lack of confidence in the asset's short-term prospects.

%20%5B07-1746427402215.26.29%2C%2005%20May%2C%202025%5D.png&w=1536&q=95)

XRP Daily Active Addresses | Source: Santiment

Historically, such drops in activity often precede periods of price stagnation or decline, as reduced transaction volume erodes liquidity and buying pressure. This makes the Daily Active Addresses metric an important indicator for traders as it could help ascertain the potential of the XRP price.

Despite the slump in daily active addresses, whale cohorts in the ecosystem are unrelenting in the quest to increase exposure to XRP. Large volume holders have consistently purchased XRP since early April, hinting at an improving risk-on sentiment. For instance, addresses with 10 million to 100 million coins currently account for 12.32% of XRP's total supply, representing a significant jump from 10.91% on April 1.

The green line on the chart below shows whales with between 100 million and 1 billion tokens currently hold 14.37% of XRP's total supply, up from 14.32% recorded on April 1.

%20%5B07-1746427425749.26.33%2C%2005%20May%2C%202025%5D.png&w=1536&q=95)

XRP supply distribution | Source: Santiment

The accumulation by large holders (1 million to 1 billion XRP) is generally a bullish indicator because whales often accumulate during periods of consolidation or before anticipated price increases. This suggests that large investor cohorts could anticipate positive developments such as a settlement between Ripple and the Securities and Exchange Commission (SEC) and a potential approval of spot XRP Exchange Traded Funds (ETFs).

XRP bulls attempt trend reversal

XRP's price holds above short-term support at $2.10, as bulls launch a new recovery attempt, targeting a rally to $3.00. However, XRP's position below the 50-, 100-, and 200 Exponential Moving Averages (EMA) could complicate matters for the bulls, challenging the anticipated breakout.

The Relative Strength Index (RSI) indicator, sitting below the midline at 43.30, signals increasing selling pressure. Yet, its upward trajectory suggests a potential rise above the midline, which could strengthen bullish momentum soon.

XRP/USDT 4-hour chart

Looking ahead, if XRP flips the 50-, 100-, and 200 EMAs into support, the technical structure would strengthen, favoring a bullish outcome. Beyond the moving averages, converging around $2.18-$2.20, resistance at the April's high of $2.36 must be broken to encourage more traders to buy XRP, anticipating an uptrend toward $3.00.

Meanwhile, decreasing network activity might hinder XRP's bullish momentum, limiting its ability to climb higher due to weak demand. Key support levels to watch include the nearby demand zone at $2.11, the critical $2.00 mark, and the April 7 low of $1.61.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren