XRP eyes recovery despite low retail demand and risk-off sentiment

- XRP holds $2.22 as bulls push to reclaim key support areas amid heightened volatility.

- XRP remains choppy amid low retail demand and traders piling into short positions, hindering recovery.

- XRP could extend its correction by 15% as a Death Cross pattern beckons.

Ripple (XRP) holds above $2.22 as bulls pare losses on Wednesday, following two consecutive days of declines. Despite bullish attempts to regain control, XRP is facing low retail demand amid deleveraging, liquidations amid risk-off sentiment in the broader cryptocurrency market.

A weak technical structure has made it difficult to hold onto gains, triggering a cascade of losses since XRP reached its record high of $3.66 in mid-July.

XRP remains topside heavy in a weakening derivatives market

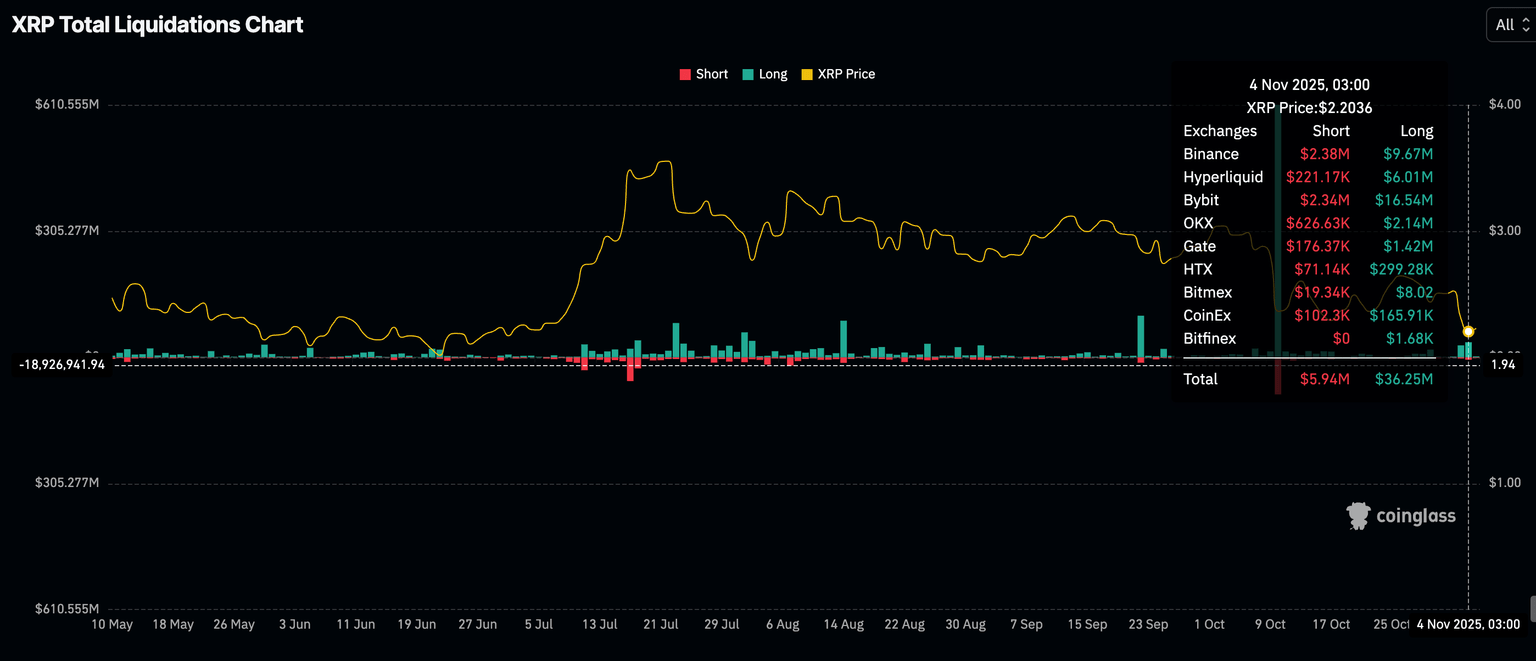

The sell-off on Monday and Tuesday has left many investors counting losses, as reflected by the amount of liquidations in the derivatives market. According to CoinGlass data, approximately $29 million in long positions was liquidated on Monday alongside $3 million in shorts.

The selling pressure continued on Tuesday, liquidating over $36 million in long positions and $6 million in shorts. CoinGlass shows liquidations totaling $2 million in long positions and $1.5 million in shorts on Wednesday.

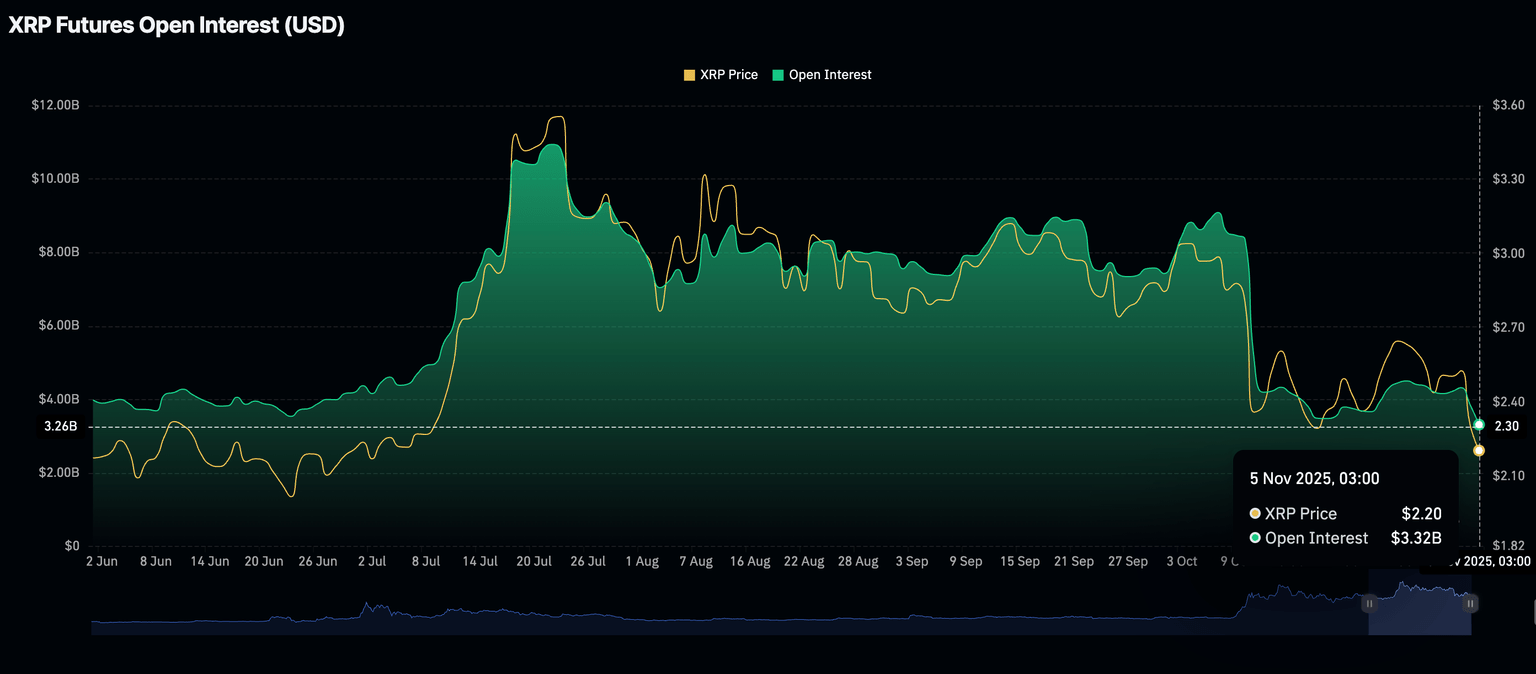

A sharp decline in futures Open Interest (OI) to $3.32 billion on Wednesday, from $4.33 billion on Monday and $9.09 billion on October 7, suggests that risk-off sentiment remains prevalent. Traders are likely staying on the sidelines due to a lack of conviction in XRP's ability to sustain recovery.

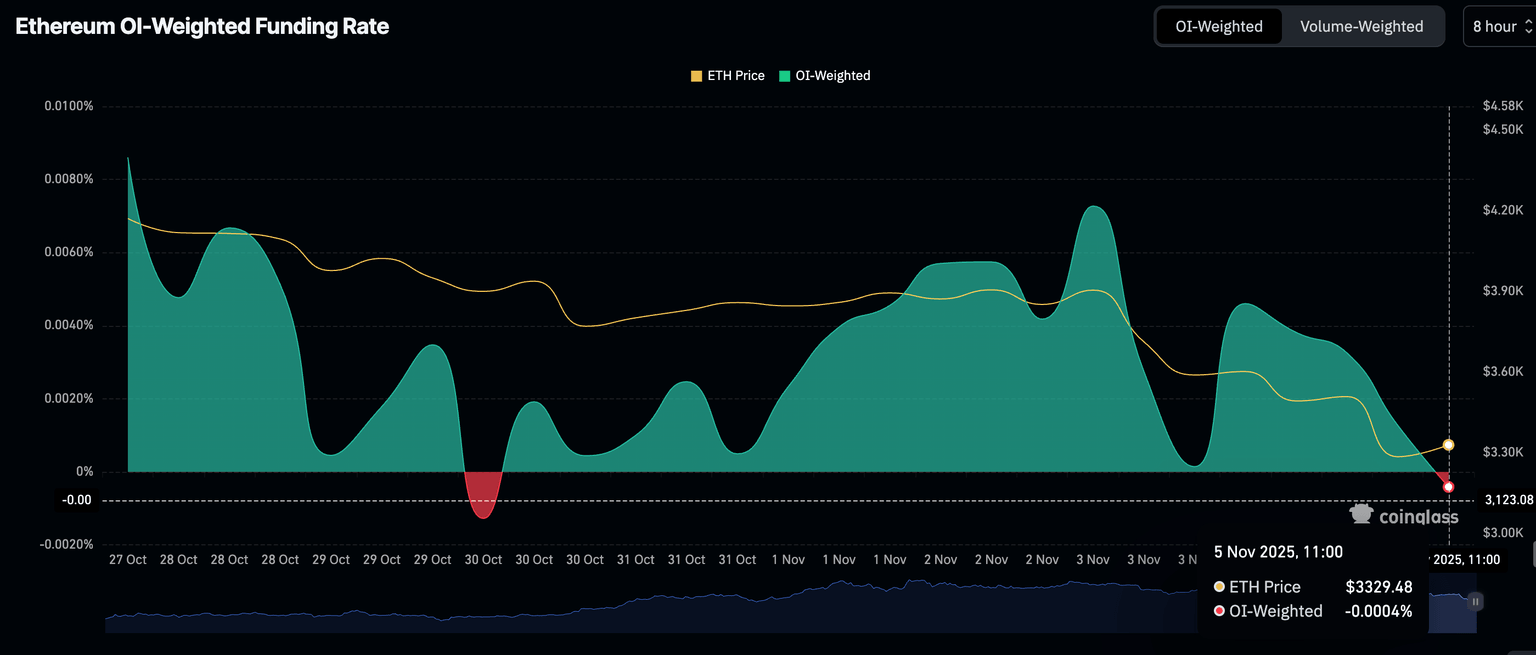

The OI-Weighted Funding Rate metric's erratic movements support the risk-off sentiment narrative. Currently, this metric averages 0.0001%, following a minor recovery from -0.0006 on Tuesday, indicating that traders are piling into short positions, leaving XRP vulnerable to selling pressure.

Technical outlook: XRP signals potential rebound

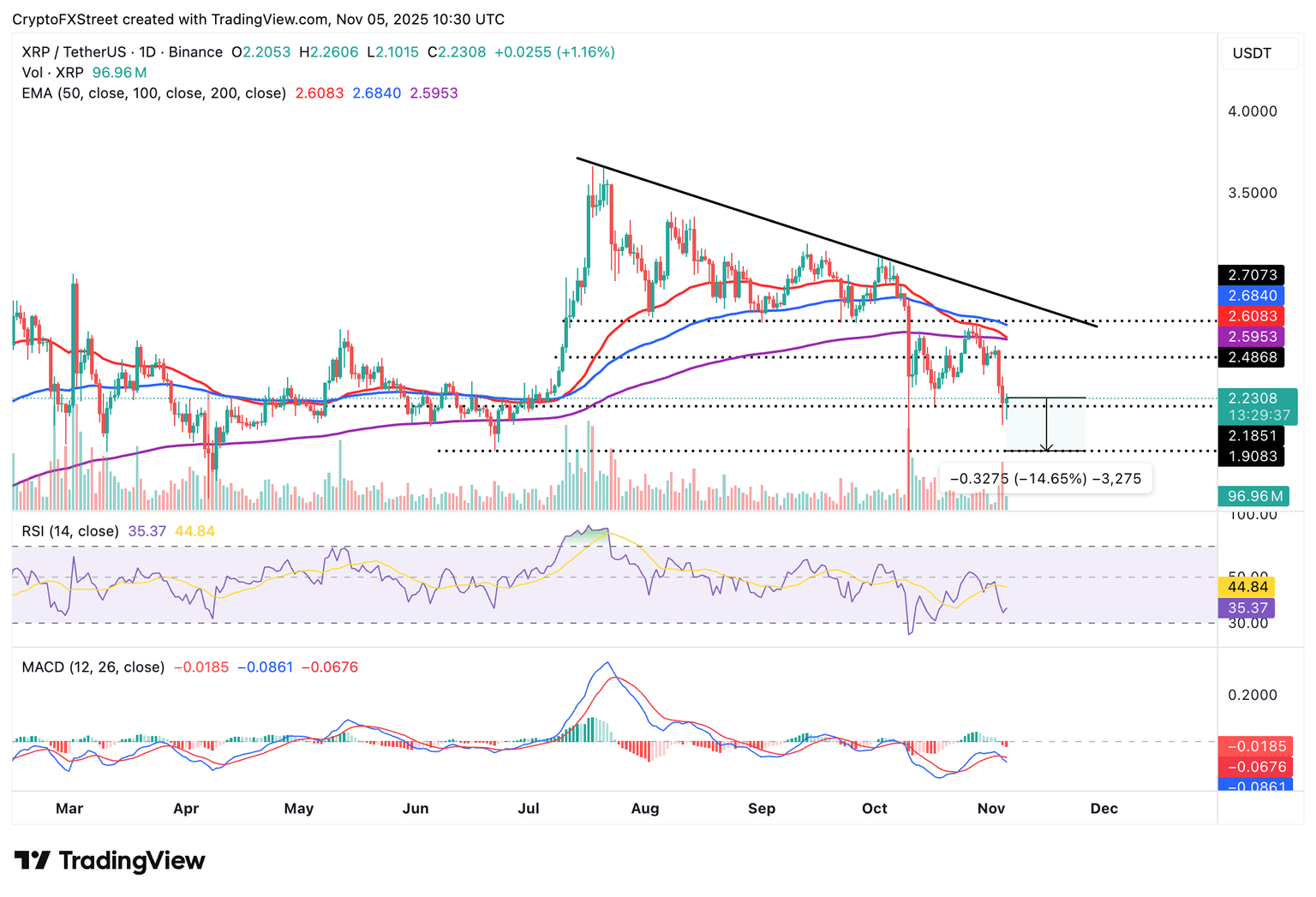

XRP is trading at around $2.22 at the time of writing on Wednesday, weighed down by headwinds in the broader cryptocurrency market. Traders are watching for a close above the short-term $2.22 support to usher in stability ahead of a potential recovery.

The Relative Strength Index (RSI) has recovered to 33 on the daily chart, signaling that bearish momentum is decreasing. Higher RSI readings indicate that sentiment is shifting from bearish to bullish, increasing the odds of a steady recovery toward the 200-day Exponential Moving Average (EMA) resistance at $2.59.

Still, traders should temper their bullish expectations due to an incoming Death Cross pattern in the same daily time frame. The 50-day EMA is moving toward a downward crossover with the 200-day EMA, which may further reinforce the bearish outlook.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart has maintained a sell signal since Tuesday, encouraging investors to reduce their exposure. Red histogram bars below the mean line suggest overhead pressure remains apparent, and the downtrend could resume, targeting lows below $2.00.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren