Ripple Price Analysis: XRP/USD stuck in a range below $0.1900 as Ripple sue YouTube for scams

- XRP/USD has been moving in a tight range with a short-term bullish bias.

- Blockchain startup Ripple filed a lawsuit against the video-sharing platform.

Ripple's XRP settled above $0,1850. The third-largest digital asset has been range-bound since the beginning of the week. The coin has gained 1% since the beginning of the day and stayed unchanged on a day-to-day basis. Ripple's trading volume is registered at $8.2 billion, while an average daily trading volume settled at $1.7 billion.

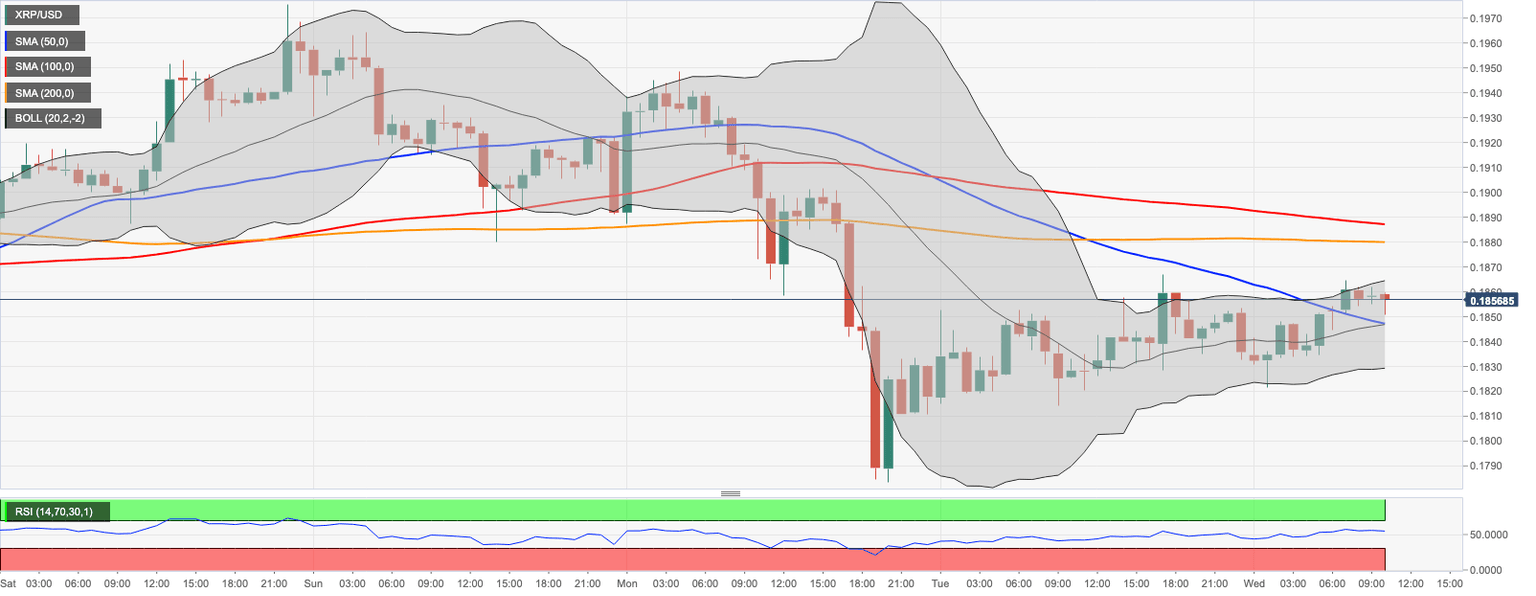

XRP/US: technical picture

On the intraday charts, the local support is created by 1-hour SMA50 and the middle line of the 1-hour Bollinger Band at $0.1845. The confluence of these technical levels has been limiting the sell-off since the beginning of the day. If it is broken, the downside momentum is likely to gain traction with the next focus on the intraday low $0.1830, followed by psychological $0.1800 with 4-hour SMA200 located just above this barrier. Considering the flat RSI, XRP/USD is likely to continue its range-bound pattern in the nearest future.

In the long run, the critical support is created by the lower line of the daily Bollinger Band at $0.1750 and 23.6% Fibo retracement for the downside move from February 2020 high at $0.1700.

On the upside, there is a strong resistance area on approach to $0.1900. It is reinforced by 1-hour SMA100 and SMA200, which means, the bulls will have a hard time pushing the price higher. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.1960-$0.1975 area. A sustainable move higher is needed for the upside to gain traction and bring $0.2000 into focus.

XRP/USD 1-hour chart

Ripple sues YouTube for frauds and false impersonations

The San-Francisco-based blockchain startup Ripple has taken legal action against YouTube for “dangerous online giveaway scams and false impersonations”. According to the statement, published on Tuesday, the company accused several social media platforms, including Facebook and Twitter, for turning a blind eye on fraudulent activities. However, the legal action is taken only against Google's YouTube.

This lawsuit calls on the video platform to do a number of things. First, to be more aggressive and proactive in identifying these scams, before they’re posted. Second, faster removal of these scams once they are identified and lastly, to not profit from these scams, the company said.

Author

Tanya Abrosimova

Independent Analyst