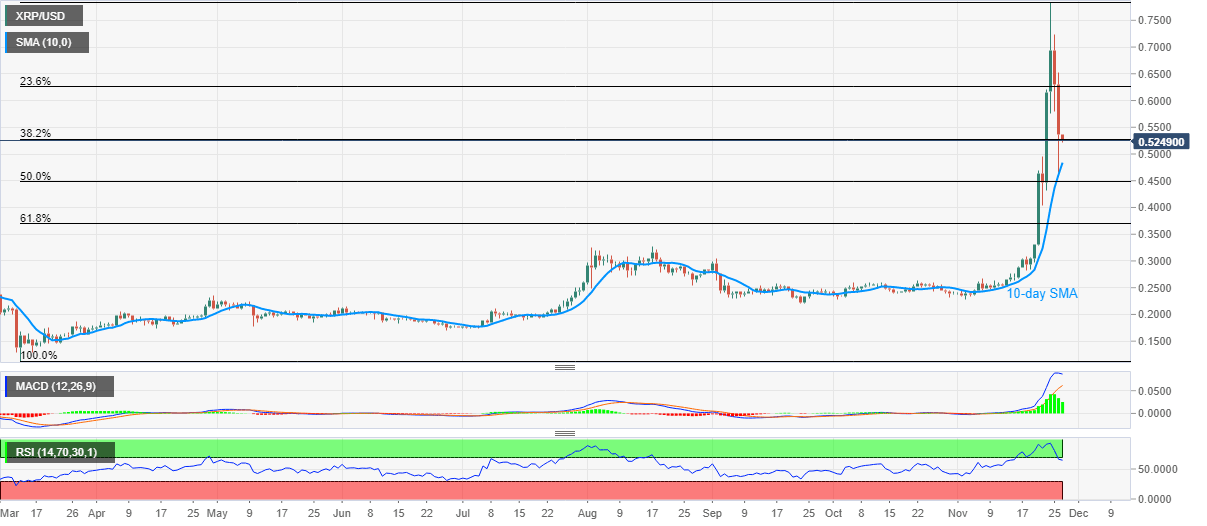

Ripple Price Analysis: XRP/USD fails to extend bounce off 10-day SMA

- Ripple stays depressed near the weekly low, eases below 0.5500 off-late.

- RSI’s pullback from overbought conditions keeps sellers hopeful.

- Key Fibonacci retracements hold the gate for further downside.

Ripple fades bounce off 0.4581 while declining to 0.5240, down over 2% during early Friday. The crypto major slumped the previous day, before bouncing off-late SMA.

However, failures to extend the corrective recovery join the RSI conditions that ease from the overbought region to keep the sellers hopeful.

Hence, XRP/USD sellers are currently eyeing a revisit to the 10-day SMA level of 0.4840 ahead of declining to 50% Fibonacci retracement of March-November upside, near 0.4485.

Also acting as a downside filter is the 61.8% Fibonacci retracement level of 0.3693 and August month’s top near 0.3280.

Meanwhile, an upside clearance of 0.5500 can trigger fresh recovery moves targeting the early-week lows below 0.5800. Though, any further rise will have multiple hurdles to cross beyond the 0.6000 threshold ahead of reaching the latest top close to 0.7845.

XRP/USD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.