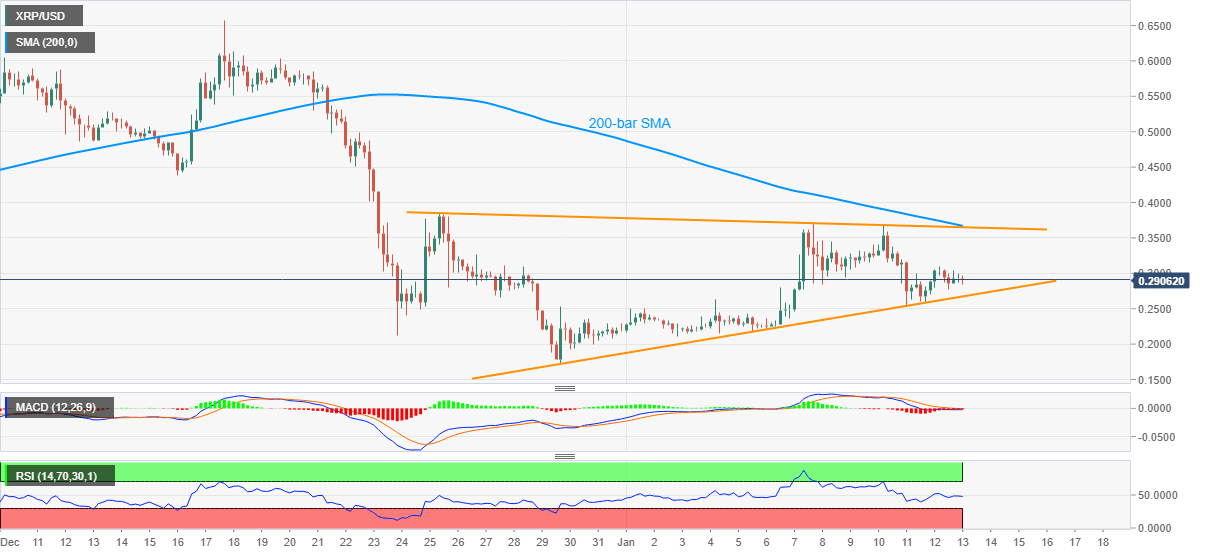

Ripple Price Analysis: XRP eases inside 13-day-old symmetrical triangle

- XRP/USD fails to extend Tuesday’s recovery moves, remains sideways inside short-term triangle.

- MACD eases bearish bias but 200-bar SMA joins triangle resistance to challenge bulls.

- Sellers may eye December lows on triangle breakdown.

XRP/USD drops to 0.2875 during early Wednesday. In doing so, the ripple pair defies recovery hopes, triggered the previous day, while funneling down a symmetrical triangle established since December 25.

Despite failures to regain upside momentum, MACD signals ease bearish bias while the RSI conditions are also normal, which in turn suggest a slow grind to the north.

However, 200-bar SMA adds strength to the triangle’s resistance, currently around 0.3670, to challenge XRP/USD bulls. Also acting as an immediate upside filter is the December 25 top near 0.3850.

It should be noted that the quote’s ability to jump past-0.3850 will enable it to challenge the mid-December low near 0.4380.

Alternatively, a downside break of the triangle’s support, at 0.2673 now, may direct XRP/USD sellers towards the 0.2100 threshold ahead of highlighting the 0.2000 round-figure.

In a case where the crypto pair remains depressed past-0.2000, December’s low around 0.1720 will be the key to watch.

XRP/USD four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.