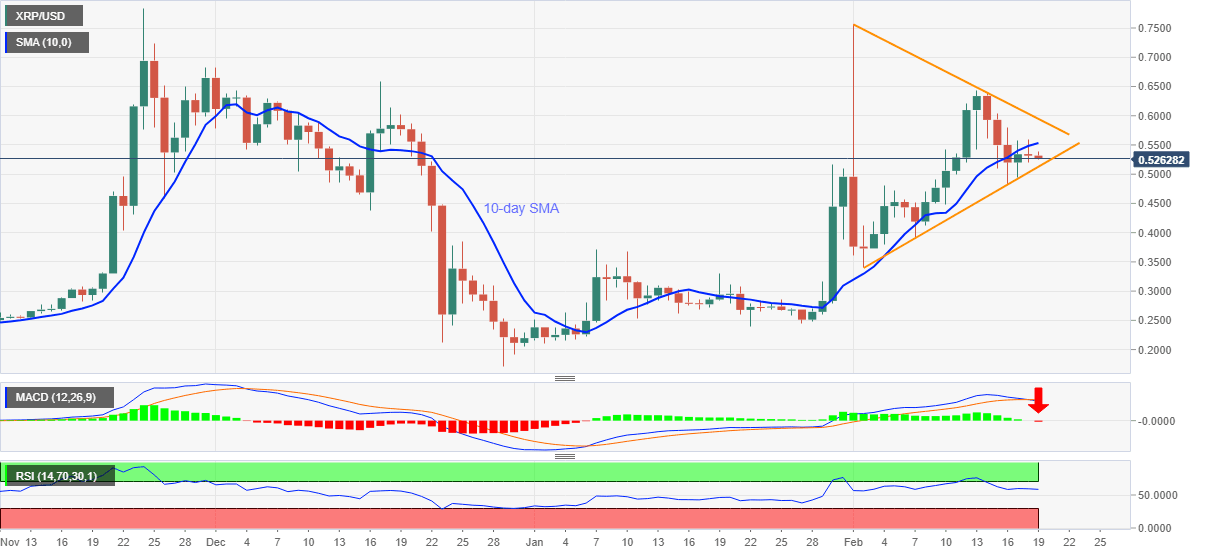

Ripple Price Analysis: XRP bears push for a downswing below $0.51

- XRP/USD keeps pullback from 10-day SMA, MACD turns bearish for the first time in six weeks.

- Ascending trend line from February 02 restricts immediate declines.

- Monthly resistance line adds to the upside filters.

XRP/USD drop to $0.5270 while extending the previous day’s pullback to early Friday. The altcoin’s latest weakness could be traced from its repeated failures to cross 10-day SMA as well as the first bearish MACD signal since the early January.

This keeps the ripple sellers hopeful. However, an upward sloping trend line from the initial February, close to $0.5100, restricts the quote’s immediate downside.

As a result, the XRP/USD bears should look for entry below $0.5100 for fresh downswing targeting the January 07 high near $0.3700. Though, the monthly low near $0.3400 can challenge the sellers afterward.

Meanwhile, an upside clearance of 10-day SMA, at $0.5530 now, will have to cross the downward sloping trend line from February 01, currently around $0.5950, to recall the XRP/USD buyers. Also acting as an upside filter is the $0.6000 round-figure.

To sum, Ripple’s failures to follow the crypto majors seems to give risk-taking sellers a fresh life.

XRP/USD daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.