Polygon price surprises with another bullish move this Monday despite tailwinds

- Polygon price prints positive numbers, although harsh rhetoric rattles stock markets in Asia and Europe.

- MATIC price tries to test the upper bound of a pennant, flirting with a bullish breakout.

- Expect to see either a break or rejection, as current tailwinds are still unresolved and weigh on sentiment.

Polygon (MATIC) price action surprises by printing green numbers this Monday morning despite Asian and European markets hanging by a thread. With harsh rhetoric from Russia after the attacks on its vital bridge linking Crimea with Russia, geopolitics is back on high alert as Kyiv is being bombed at the time of writing. The nerves of every world leader involved in the situation between Ukraine and Russia are being tested as the threat of a nuclear escalation has never been so close. The ripple effect from these events could lead to a sell-off in every tradable risk asset in the market.

MATIC price technically has no room for a large and broad upside

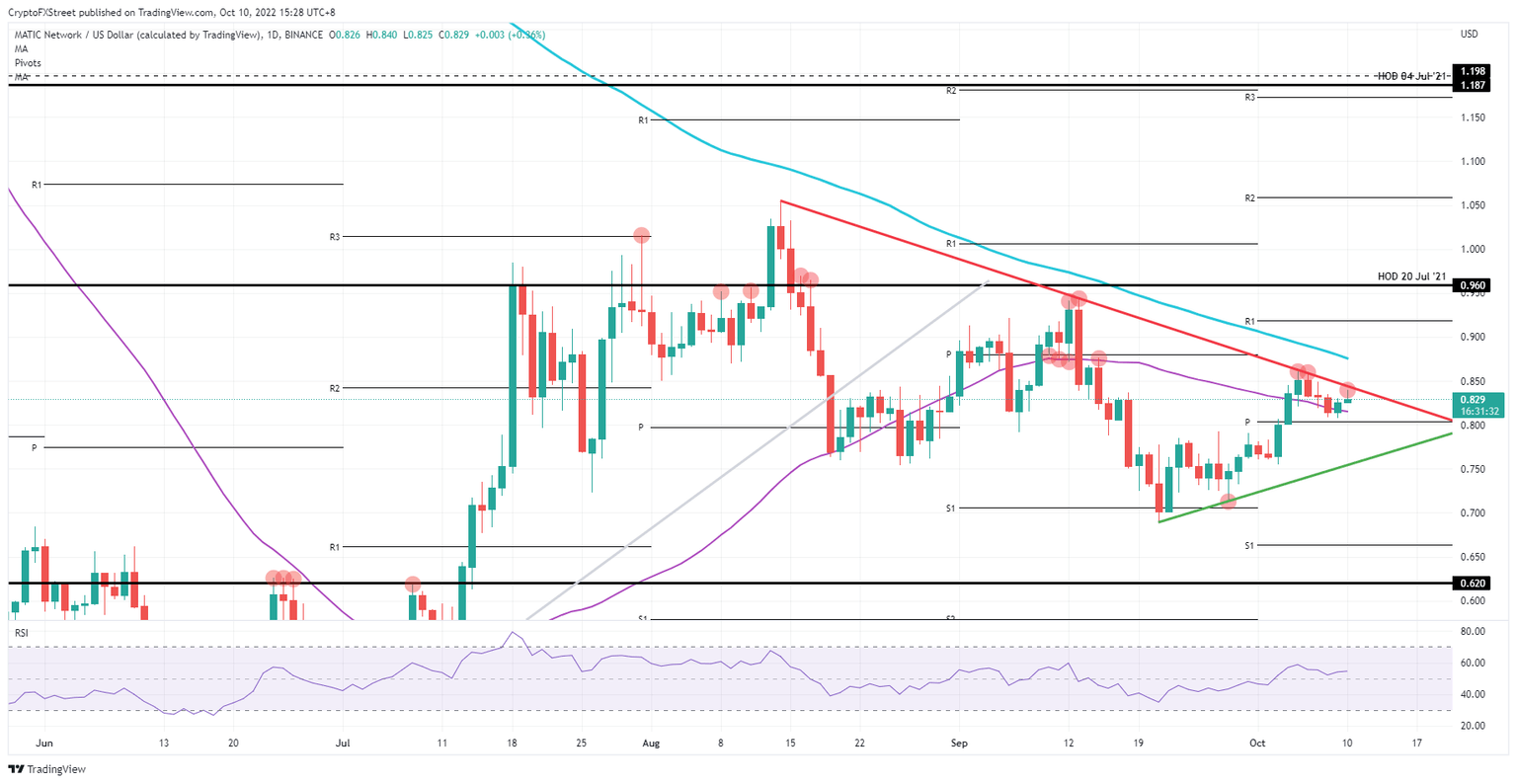

Polygon price action witnessed a turnaround on Sunday after closing with 1.5% gains on the board and breaking back above the 55-day Simple Moving Average (SMA). MATIC price action is currently flirting with a pennant breakout that has been dictating price action since September. bullish breakout looks granted if European markets can recover once Asia has closed.

MATIC price will probably breakout, but with limited upside to the 200-day SMA at $0.875, which has not been tested for over three months. Traders must be aware that roughly only 6% of gains are thus up for grabs. Huge tail risks from geopolitics that still have no resolution are a continual risk to the outlook and suggest any upside may be short-lived.

MATIC/USD Daily chart

As mentioned a few weeks ago, a small dislocation could be at hand where cryptocurrencies reacted independently from what is happening in the markets. Should MATIC price successfully break above the 200-day SMA followed by a daily close and open the following day, another leg higher could see $0.918 touched, at the monthly R1. That might be the ideal point to find some support before hitting $0.96, which is the high of July 20, 2021.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.