Polkadot Price Prediction: DOT will hit $40 by October

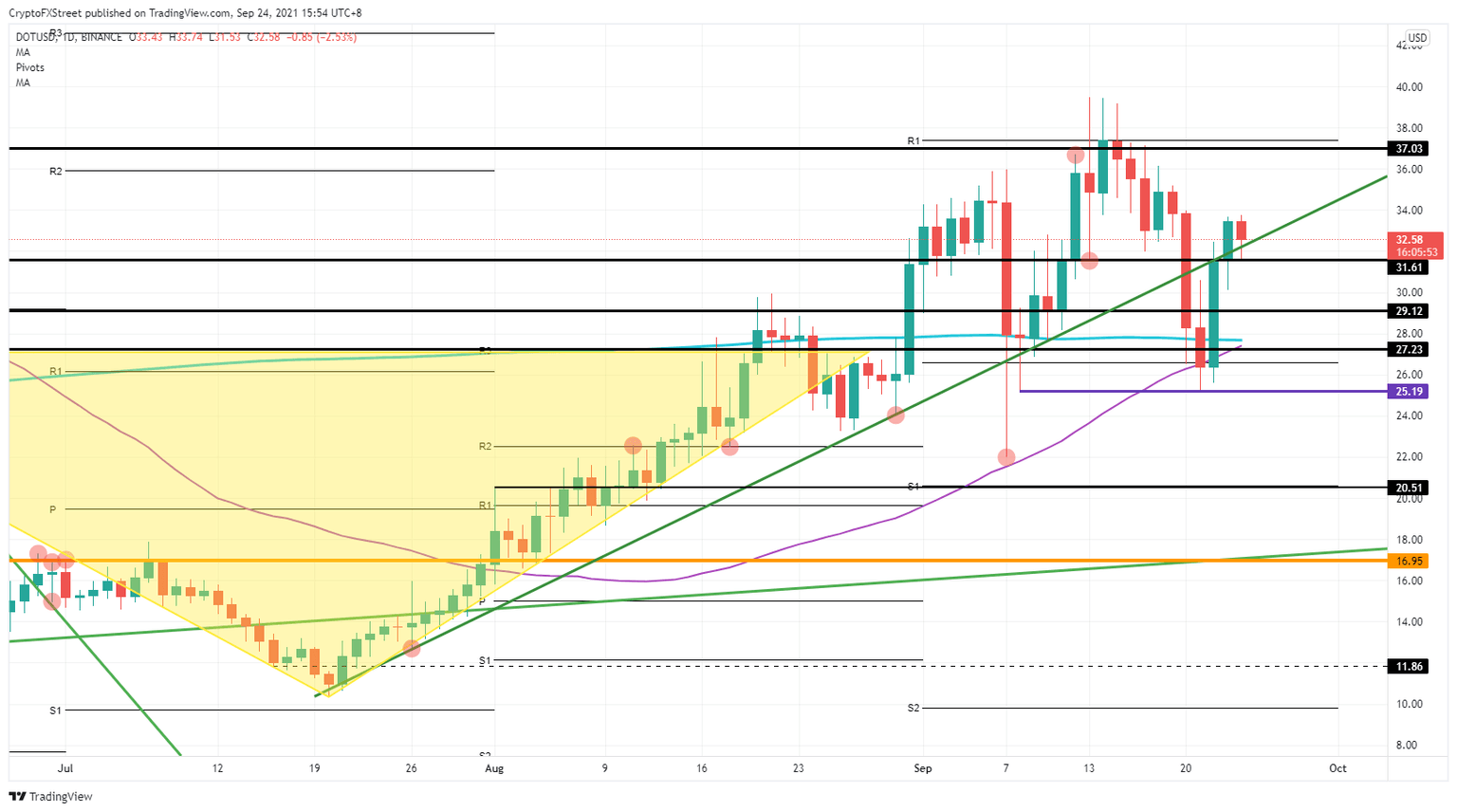

- Polkadot price supported by $31.61 historical level.

- Bulls look to complete the range to the upside, helped by the ascending trend line.

- A short squeeze could happen if bulls can push price action further upward.

Polkadot (DOT) bears are scrambling to cash in on their profits as price action for DOT reverses quite rapidly, with bulls overtaking control and pushing price action back toward levels achieved before the correction began. Some technical elements are helping bulls to lengthen further the uptrend, and momentum is building to hit $37.03 to the upside.

Polkadot bulls are squeezing bears, and DOT price action can only go north from here

Polkadot price is on a tear after the correction in the cryptocurrencies over the past few days. With markets now entirely focused on risk-on, Polkadot is being added to several portfolios and positions, and buyers are waiting for the proper entry levels to add even more to their positions, making DOT stick to the uptrend. The best entry point was $25.19, with the double bottom formation and the downtrend halted. In case buyers missed that opportunity, around $28 another good entry level offered itself. With both the 55-day and the 200-day Simple Moving Average (SMA) just below and the historical $27.23 level, bulls had plenty of reasons to go long and put their stops safely below these elements.

DOT price action looks to be taking a breather today, offering some excellent entry levels for a buyer who came in late and is still looking to join the uptrend in Polkadot. DOT price on Friday bounced off $31.61 and is trying to get back above the green ascending trend line that was the driving force in the summer rally. By the bulls reclaiming this element, new buyers will join in again, and others will want to add to their position.

DOT/USD daily chart

With momentum and volume building up further, expect bulls to try and hit $37.03 as the next profit target. That would be the point where the rally might come to a halt as sellers will undoubtedly try to get in here to push price action back and keep it from trying to go to $40.

Should price action in DOT start to fade, when Polkadot price would certainly close below the green ascending trend line, this would signal weakness and a shortage of buying volume. Sellers will jump on the occasion to run price action down again, back to $28, where sellers will face plenty of resistance.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.