Polkadot Price Prediction: DOT can hit $125 if it can close above this price level

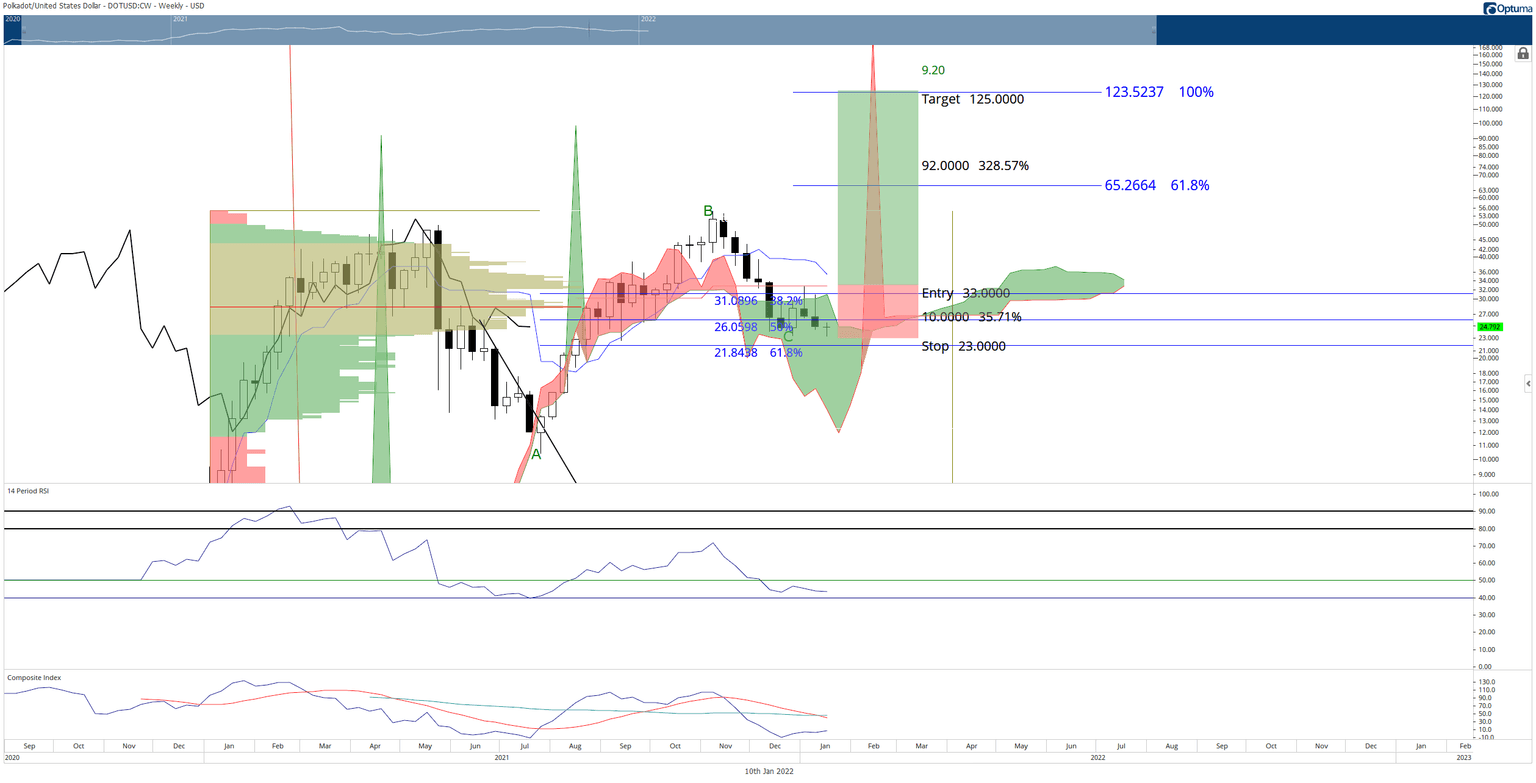

- Polkadot price remains inside the volatile and indecisive Ichimoku Cloud.

- A successful breakout and close above key resistance levels on the weekly chart could trigger new all-time highs.

- Risks to the downside remain.

Polkadot price has been in the unfortunate position of being stuck inside the Ichimoku Cloud. The Cloud represents indecision, volatility, misery, whipsaws, and pain. It is the place where trading accounts blow up. However, a successful move out and above the Cloud would generate extremely bullish trading conditions.

Polkadot price needs a weekly close at or above $33

Polkadot price faces a collection of significant resistance zones ahead:

- 50% Fibonacci retracement at $26.

- Volume Point Of Control at $28.75.

- Top of the Cloud (Senkou Span A) at $38.

- 38.2% Fibonacci retracement at $38.

- Kijun-Sen at $33.

In a nutshell, Polkadot price needs to close above the Cloud and the weekly Kijun-Sen. The Tenkan-Sen, however, would remain above the close, but the slope of its line suggests it may not hold as resistance. Additionally, a close at $33 would position the Chikou Span into open space – a necessary condition for a clear breakout higher.

A hypothetical long entry would be a buy stop order at $33, a stop loss at $23, and a profit target at $125. The profit target is slightly above the 100% Fibonacci expansion at $123.50. The trade setup represents a 9.2:1 reward/risk with an implied profit target of over 325% from the entry.

DOT/USDT Weekly Ichimoku Chart

However, until the entry is confirmed, Polkadot price may continue to face some significant whipsaws in price action, especially given the present construction of the Cloud. In addition, downside risks are pretty substantial, with near-term Ichimoku support now at the bottom of the Cloud (Senkou Span B) at $15.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.