Polkadot Price Prediction: A pullback followed by a stronger decline

- Polkadot price has been rejected from two moving averages,

- DOT shows an influx of volume transactions as the price descends.

- Invalidation of bearish outlook thesis is a breach above $8.00

Polkadot price seems on its way toward newfound lows. Key levels have been defined.

Polkadot price shows bearish stregnth

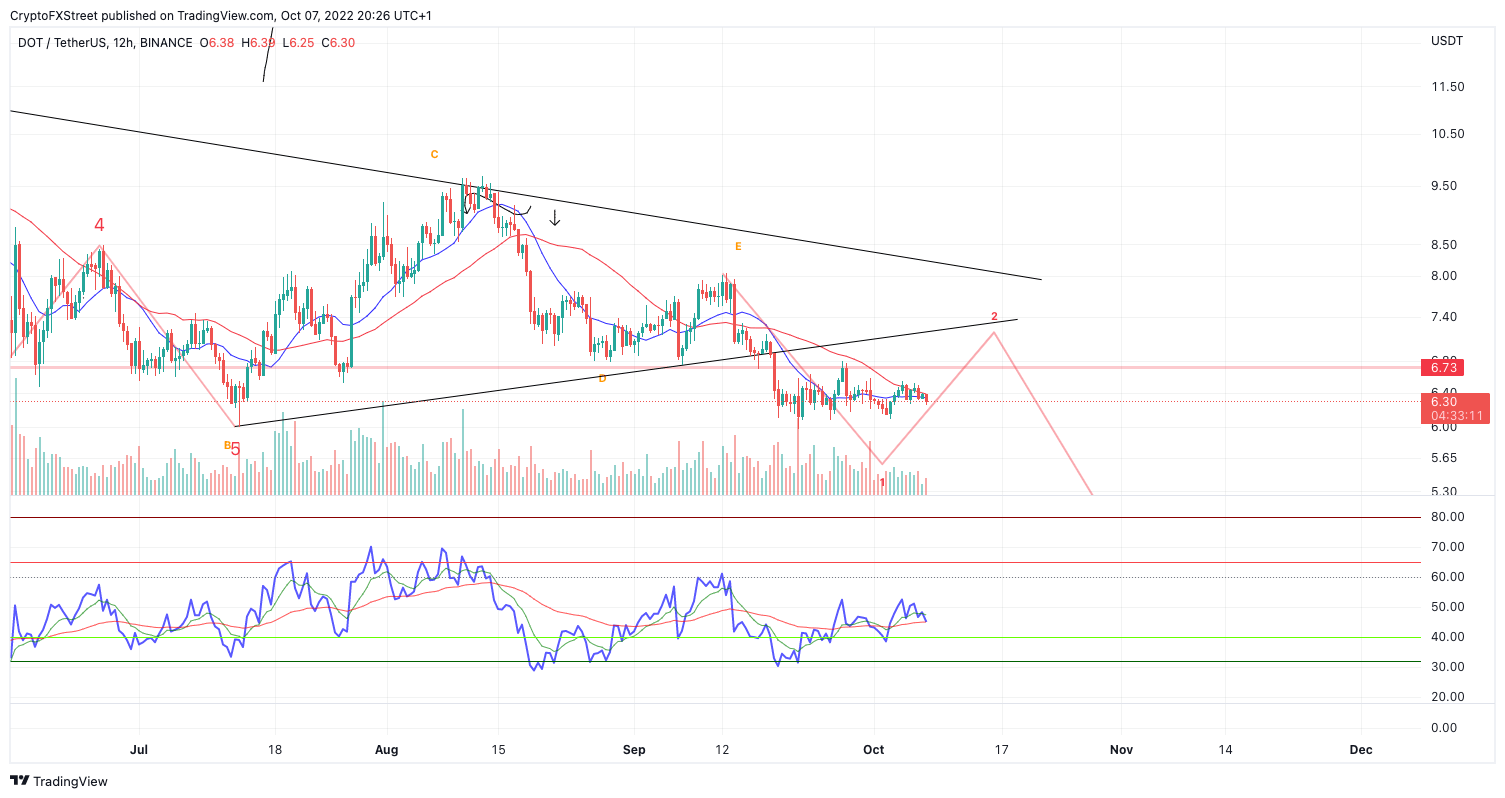

Polkadot price continues to show reasons to believe that a sweep-the-lows event is underway. DOT, The cutting-edge smart contract and gaming token, experienced a 24% decrease last month after breaching an ascending trend line. The trend line supported the summer as prices fluctuated back and forth in a triangular fashion. An influx of volume was spotted during the most recent sell-off, which looks like a continuation pattern compared to previous sell-offs.

Polkadot price currently auctions at $6.30 as the bulls have been rejected from both the 8-day exponential and 21-day simple moving averages. The Relative Strength Index is back above support on larger timeframes showing the current sell-off may be short-lived. A pullback near $7.00 is plausible in the days to come.

DOT USDT 12-Hour Chart

Invalidation of the bearish thesis is a breach of the September 12 $8,00 swing high. If the breach occurs, an additional uptrend rally targeting $10 could occur, resulting in an 85% increase from the current Polkadot price.

In the following video, our analysts deep dive into the price action of Polkadot, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.