Polkadot needs a breather to give late investors a chance to get in

- Polkadot price dips back below a critical level in a short profit-taking phase.

- As global markets reassess the situation, the slightest tailwind will trigger massive investor inflows.

- Expect price action’s current fade to be contained – with the next target set at $30.

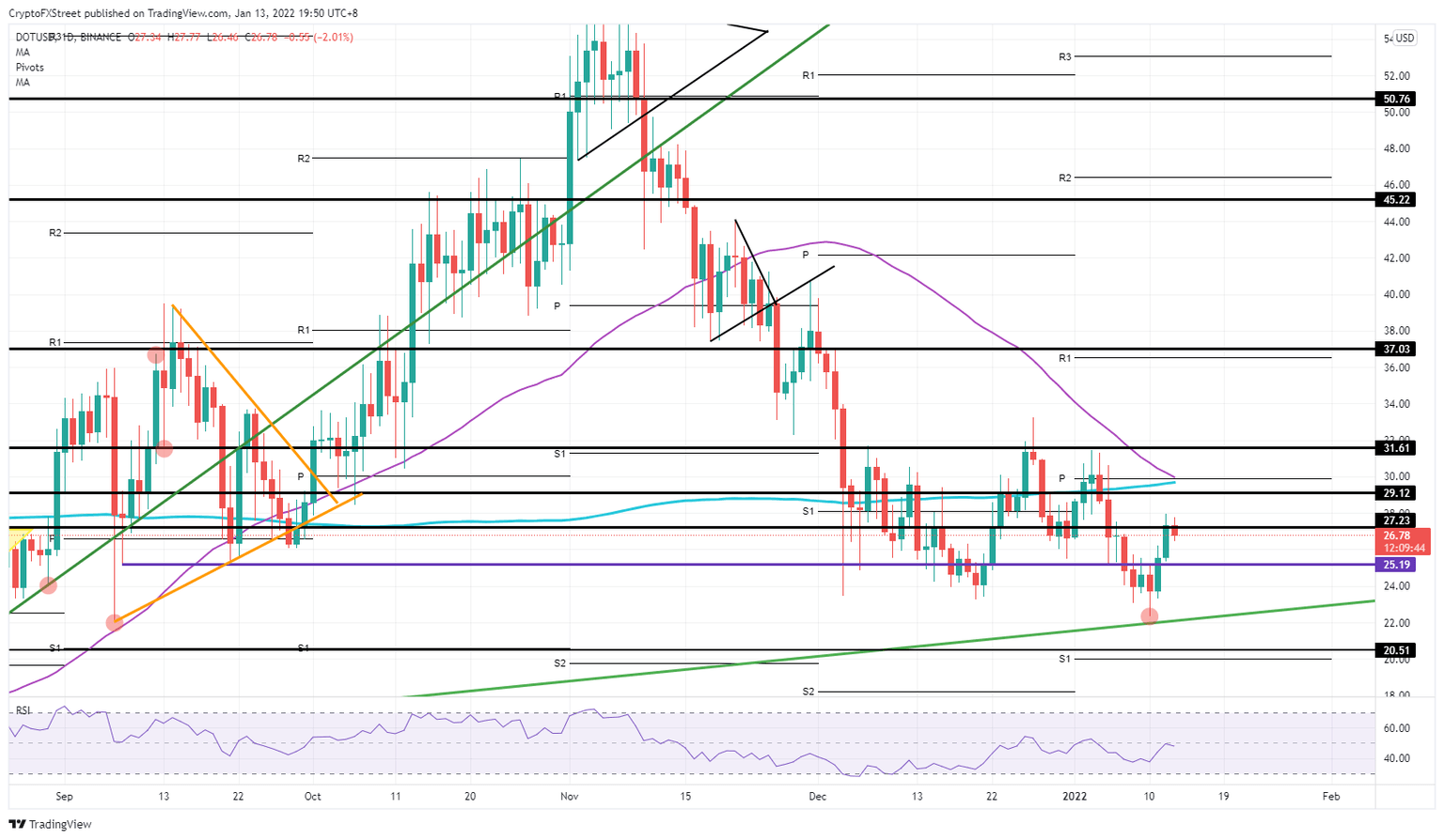

Polkadot (DOT) is clawing its way back after an extended decline, renewing interest from bullish investors. Agile traders were able to pick up DOT coins at the longer-term green ascending trend line, creating a bounce-off move back towards $27, in just two trading days. As the price action takes a slight breather today, investors and traders who missed out on the initial rally have been offered a new window of opportunity. Expect to see further inflows from funds to ramp up price action towards $30.

Polkadot price action set for $30, a crucial longer term objective

Polkadot price action is at a turning point in the trend where cool-headed investors are expected to sit on their hands and refrain from taking large chunks of profit, as they wait for prices to cruise higher. The entry on Monday at the green ascending trend line was a perfect technical play that many experienced market participants will have used to join DOT price action. The initial rally pushed higher towards $27.23 but is seeing a pullback now as short-term participants book profits and global markets remain muted.

Expect the pullback in DOT price action to be contained as major fundamental changes are unlikely. nvestors that missed the first entry point can also now join the trend as it pops higher, with the Polkadot price reaching $30 potentially by Friday. That level will be crucial for an extension of the uptrend as it is where the monthly pivot and both the 200-day and the 55-day Simple Moving Averages (SMAs) are located. If bulls can refrain from taking large profits too soon , a death cross (crossing 55-day below 200-day SMA) can be avoided, and a return to $50 could be in the cards longer term.

DOT/USD daily chart

The risk to the downside comes from geopolitical conflicts fading into the background. There is a chance, however, that these could quickly flare up again and spark a broad based sell-off in the markets, which would cause significant headwinds for Polkadot. Bulls could be pushed against the green ascending trend line as pressure mounts – with a break towards $20.50 and the monthly S1 trying to take the pressure and provide a floor. At such a level investors would likely see Polkadot price as offering a seductive discount opportunity, rather than part of a broader sell-off.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.