Pi Network Price Forecast: PI holds above key support amid recovery efforts

- Pi Network holds above a crucial support level, surviving the bearish start to the week.

- Validators on the Stellar network will vote on Protocol 23, named Whisk, which could boost the Pi ecosystem.

- Onramp Money urges users to use the Mainnet wallet address after officially announcing the integration of the PI token.

Pi Network (PI) trades above $0.3400 at press time on Wednesday, extending the 1.23% rise from the previous day. The upcoming vote on Stellar’s Protocol 23, called Whisk, could renew interest in Pi Network and boost the Pi ecosystem. Parallel to technical overhauls, Onramp Money officially announced PI token integration on Monday.

Pi Network’s technical upgrade amid Onramp integration

Pi Network, built on a modified Stellar protocol, prepares for the upcoming Stellar Protocol 23 upgrade, which will be voted on Wednesday at 17:00 GMT. The upgrade will drive blockchain development with key enhancements, including unified events and parallel transactions.

Pi Network announced that the custom Pi Protocol will pull upgrades from the new and improved Stellar rollout on the launch of Pi Node’s Linux version to boost the development process on the Pi ecosystem.

Pi Network will roll out two testnets before pushing the upgrade to the mainnet and has shared the possibility of planned outages, if required. Furthermore, the Know Your Customer (KYC) process required for Pi users, commonly referred to as Pioneers, to join the mainnet could achieve decentralization as the upgrade allows the Pi KYC solution authority transfer to other entities.

Parallel to the technical overhaul, Onramp Money announced PI token integration on Monday. The on-ramp protocol has urged users to ensure the Pi Network mainnet wallet address instead of the testnet address, making the service exclusive for the KYC-verified addresses.

Pi Network holds at crucial support

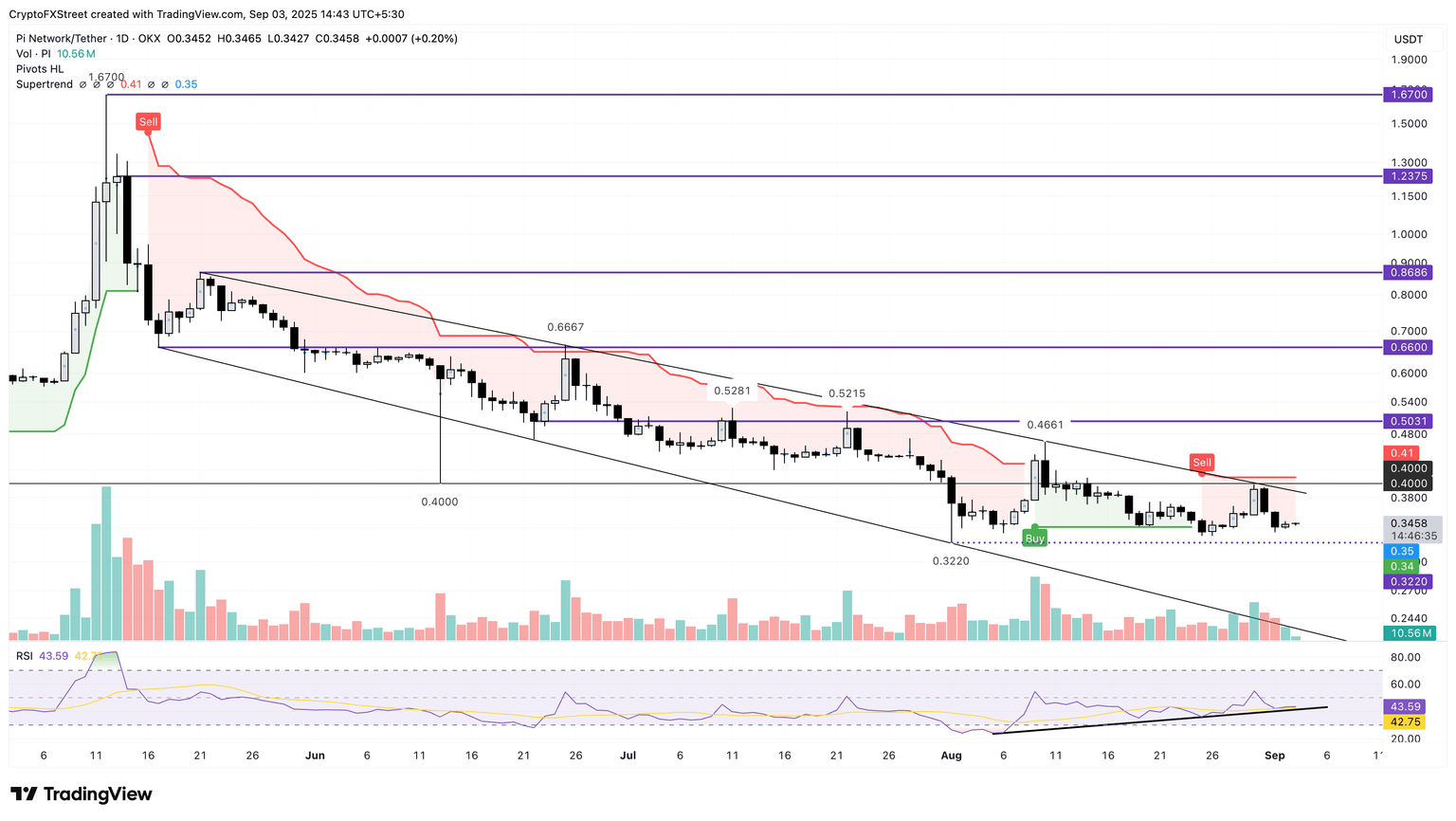

Pi Network holds above $0.3400, securing the gains from Tuesday. The largest KYC-based crypto project prevails a path of least resistance on the downside, risking the $0.3220 support, marked by the record low on August 1.

Still, the steady uptrend in the Relative Strength Index (RSI) reaching 43, indicates a bullish divergence with the price action taking multiple support from the area above $0.3220.

To reinforce an uptrend, the Supertrend indicator warrants a decisive close above its red line at $0.4100. This would mark a clear breakout from the falling channel pattern on the daily chart, which has remained intact from May.

PI/USDT daily price chart.

On the contrary, a drop below the $0.3220 level could extend the decline in PI towards the $0.3000 round figure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.