Ondo Price Forecast: ONDO holds bullish structure as NASDAQ files to list tokenized securities

- Ondo edges closer to a Cup and Handle pattern breakout, projecting a 14% breakout.

- NASDAQ files with the US SEC, seeking listing of tokenized securities alongside traditional stocks.

- Ondo Finance's tokenized US securities could benefit if the SEC approves NASDAQ's request.

Ondo (ONDO) price displays bullish potential, trading above $0.93 on Monday. Risk-on sentiment is gradually returning to the broader cryptocurrency market, backed by favorable regulations in the United States (US) and optimism that the Federal Reserve (Fed) could cut interest rates next week.

NASDAQ seeks approval to list tokenized securities

NASDAQ has filed with the US Securities and Exchange Commission (SEC) to introduce trading of tokenized securities amid growing interest in the new asset class. If approved, the development would mark a new era for Wall Street, becoming the first stock exchange providing access to tokenized securities in the US.

The filing made on Monday seeks to modify NASDAQ's listing rules to pave the way for blockchain-based settlement amid easing US crypto regulations. According to Reuters, tokenized securities will be listed on the platform's main market in "either traditional digital or tokenized form."

The SEC has recently announced changes to its rule-making mandate, which includes amendments that allow for crypto to be listed on national exchanges and other alternative trading systems in the US.

NASDAQ believes it is a prime time for integrating tokenized assets, ensuring users benefit from the protection of the national market system.

"Wholesale exemptions from the national market system and related protections are neither necessary to achieve the goal of accommodating tokenization, nor are they in investors' best interests," Nasdaq said in a statement.

Meanwhile, Ondo Finance, one of the companies promoting the adoption of tokenized securities on Wall Street, announced the launch of over 100 tokenized stocks and ETFs on September 1, thereby ensuring access to global capital markets.

Ondo Finance also offers active tokenized US Treasuries. The offering, which targets institutional investors, provides qualified purchasers with exposure to short-term US Treasuries and money market funds (MMFs) with instant stablecoin mints and redemptions.

The likely adoption of tokenized stocks on NASDAQ could immensely benefit protocols like Ondo Finance, which are already building key verticals in the sector. Moreover, demand for ONDO could also rise, significantly increasing its value with time.

Technical outlook: ONDO rises ahead of Cup and Handle breakout

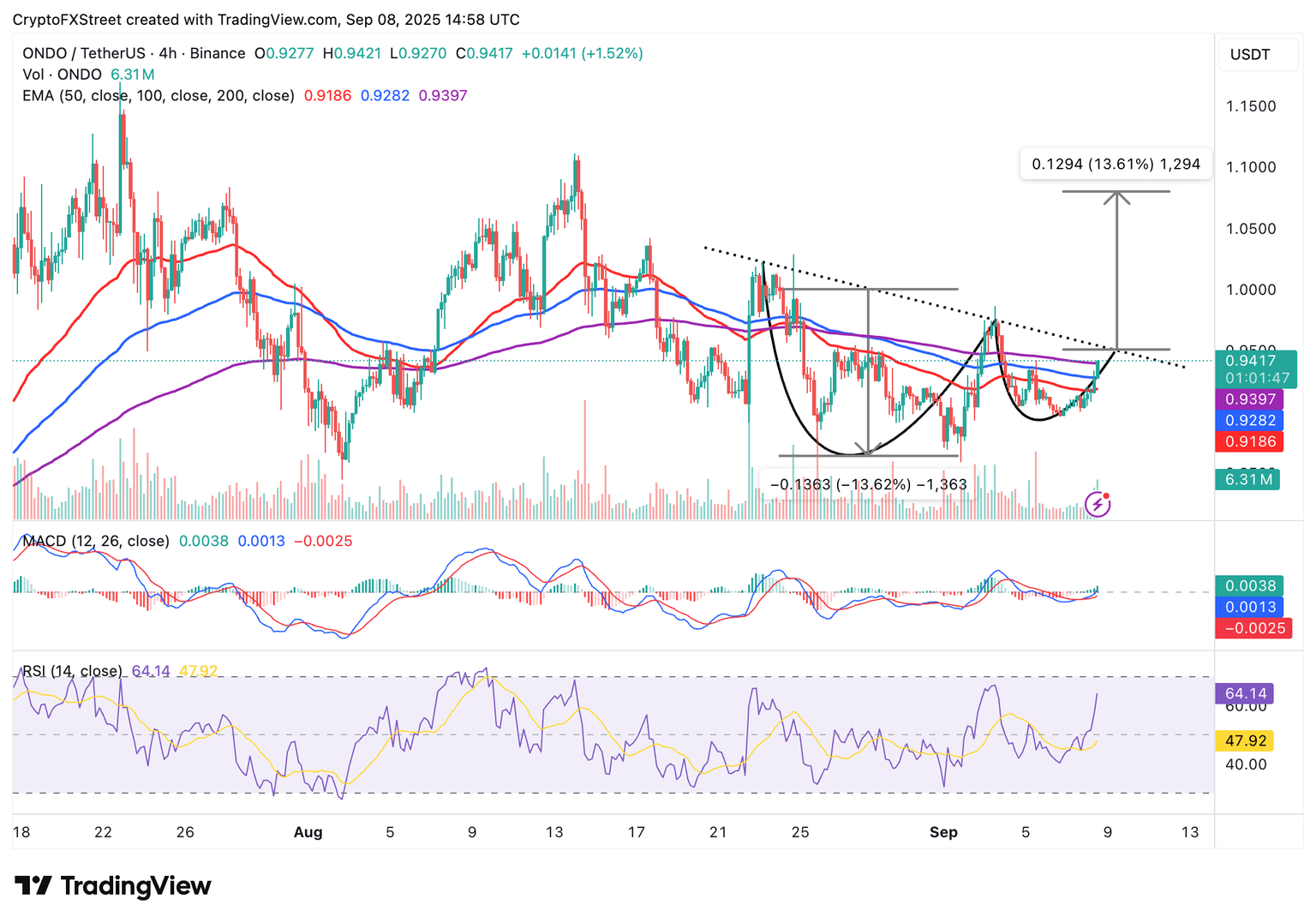

Ondo holds above the 100-period Exponential Moving Average (EMA) at $0.92 on the 4-hour chart. At the same time, bulls are pushing to break the 200-period EMA resistance at $0.93 to pave the way for a Cup and Handle pattern breakout.

ONDO's bullish structure is supported by a buy signal from the Moving Average Convergence Divergence (MACD) indicator within the same 4-hour timeframe. The position of the MACD line in blue above the red signal line, as the indicator rises, encourages traders to seek exposure.

A sharp rise in the Relative Strength Index (RSI) at 63 indicates buying pressure is increasing.

ONDO/USDT 4-hour chart

Traders will look out for a breakout at the dotted neckline resistance, which would validate a potential 14% increase to $1.08. This target is determined by measuring the height of the pattern from the neckline to the bottom and extrapolating it above the breakout point. If profit taking introduces volatility, tentative support levels include the 100-period EMA at $0.92 and the 50-period EMA at $0.91.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren