OKEX withdrawals to trigger a massive volatility spike on the cryptocurrency market

- OKEx started testing its withdrawal functionality before reopening.

- The market volatility may increase once users get access to their funds.

OKEx, one of the world's largest cryptocurrency exchanges, is ready to unlock a cryptocurrency withdrawal functionality on November 27. The trading platform users had to wait over a month until the company settled its legal issues and the Chinese police released one of its co-founders and a private key holder.

Read the full story of what happened with OKEx here

While the news is welcome for many OKEx customers whose coins got stuck on the troubled trading platform, the cryptocurrency community is anxious that the market volatility will skyrocket once OKEx traders get access to their funds.

OKEx starts testing withdrawals, volatility ahead

According to the CEO of blockchain analytical company CryptoQuant, Ki-Young Ju, someone has just moved 0.00 BTC from an OKEx wallet. The transaction may be attributed to system tests before the full reopening.

He also added that the event might result in a spike in market volatility as people will start sending withdrawal requests en masse. While he did not elaborate on the direction of the potential price movements, some crypto Twitter users believe that it may trigger the massive correction of the cryptocurrency market as traders will be eager to cash out on their assets that increased in value during the past month.

The cryptocurrency market is overbought

In the past 30 days, the total capitalization of all digital assets in circulation increased from $394 billion to $545 billion, which corresponds to nearly 30% growth. Meanwhile, an average daily trading volume more than doubled during the same period.

Bitcoin and all major altcoins experienced double-digit growth, while Greed and Fear Index, calculated by the service Alternative.me, shows that the market reached the level of extreme greed. As FXstreet previously reported, it is a precursor of a massive downside correction. If history is any guide, even a minor trigger may set the market unwinding bullish bets.

Traders are ready to lock profits

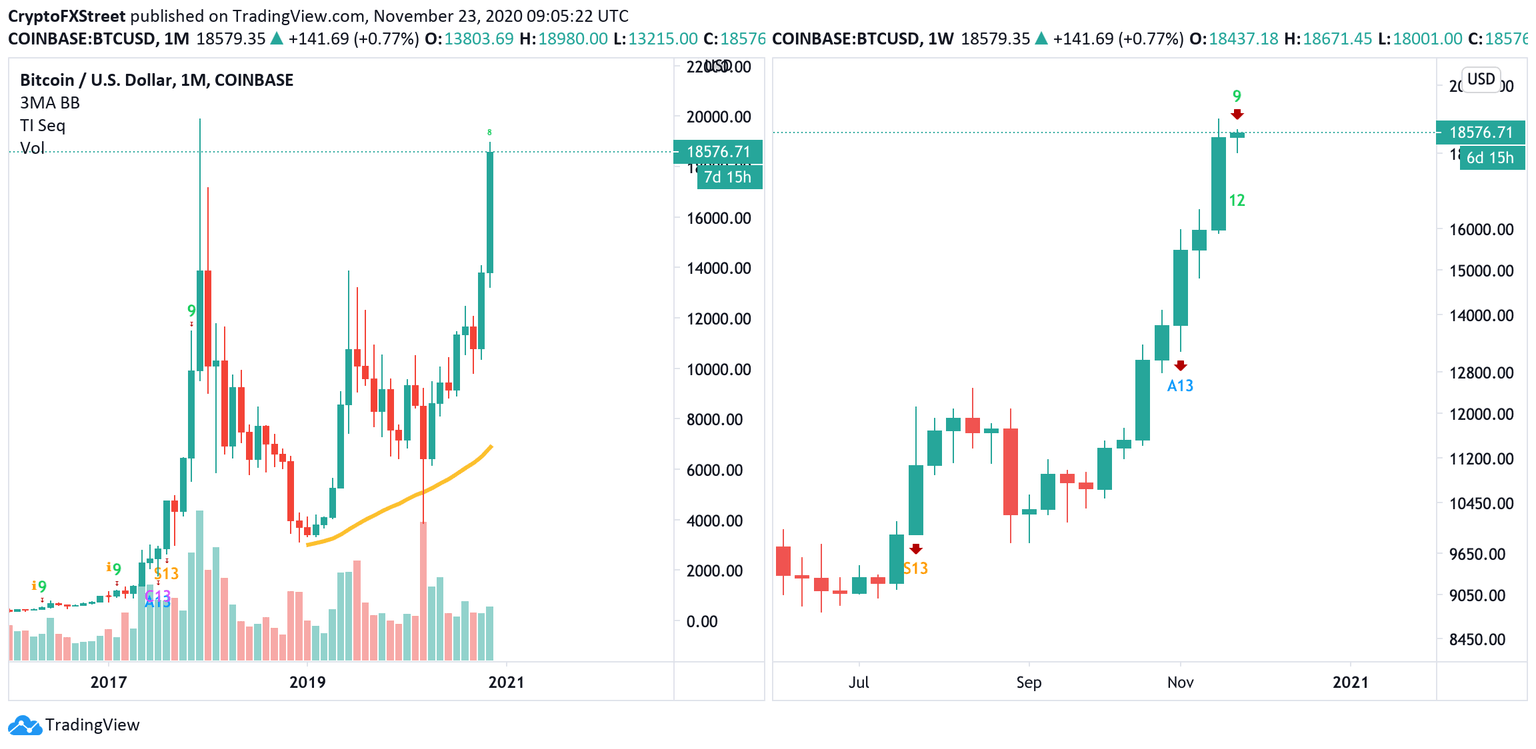

BTC/USD weekly and daily charts

If OKEx users choose to take some profit on their released cryptocurrency holding, Bitcoin may dive below $18,000 and extend the decline with the initial focus on the former strong resistance of $16,500, followed by $14,000 (daily EMA50). Meanwhile, the TD Sequential indicator has created a sell signal on both daily and weekly charts, giving additional credence to the bearish scenario.

Meanwhile, considering the strong altcoin correlation with the pioneer digital asset, the Bitcoin sell-off will drag the whole market down. The bullish bets will start collapsing like a house of cards as traders will rush to block profits on their long positions. In this case, the downside correction may continue until the end of the year.

Author

Tanya Abrosimova

Independent Analyst