NXT – ID ($NXTD) close to moving higher

With Bitcoin recently breaking out to new all time highs the Crypto and Blockchain market has reached fever pitch. NXT -ID isn’t your typical crypto stock, but it is in the related field of blockchain. Lets take a look at what the company does:

“NXT-ID is a manufacturer and distributor of non-monitored and monitored personal emergency response systems. NXT -ID has extensive experience in access control, biometric and behavior-metric identity verification, security and privacy, encryption and data protection, payments, miniaturization and sensor technologies.

Fit Pay, Inc., a wholly owned subsidiary of NXT-ID, Inc. (NASDAQ: NXTD) and Cascade Financial Technology Corp (Cascade FinTech) are in joint development of a platform that gives cryptocurrency holders the ability to use the value of their currency to make purchases at millions of retail locations worldwide. The new platform will enable devices with stored value exchanged from cryptocurrency to be used for traditional payment transactions.”

Lets dig into the charts!

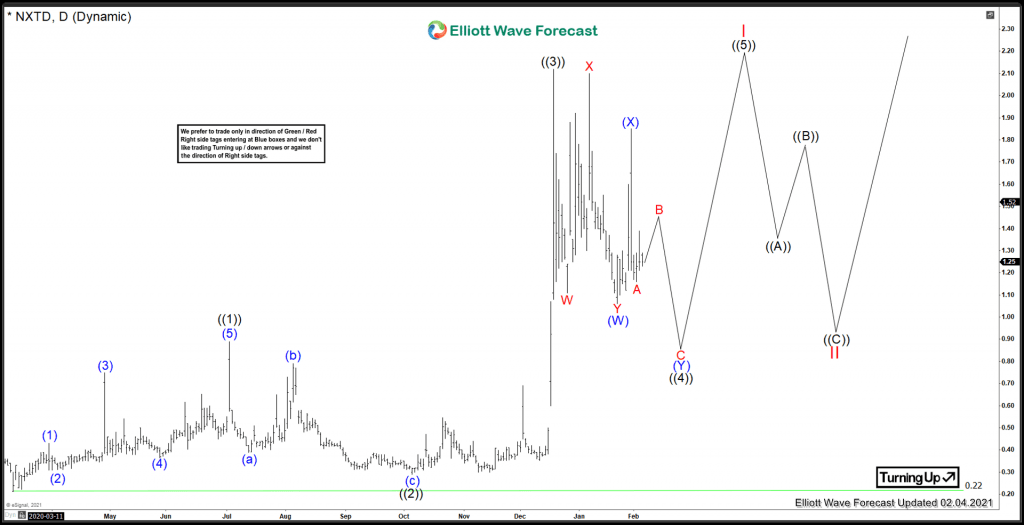

NXT -ID Elliottwave Daily View

Medium term term view from the all time low in March 2020 set @ 0.22. NXT -ID went sideways to up for an extended amount of time in a wave ((1)). After that, corrected for 3 months into ((2)). From there, a very sharp wave ((3)) took place which peaked at 2.12 on December 17 2020. After that, it has been sideways to down in a choppy double zig zag corrective pattern. It is common for instruments to go sideways for extended time after sharp wave 3 advances. It is possible that ((4)) has found a low where (W) is set and wave ((5)) has already begun. Moreover, there is no divergence in momentum in daily RSI. One more high with divergence is favoured to set Red I before correcting in Red II.

In Conclusion, ((4)) may still be in progress, but depending on Bitcoin, further weakness may take place before moving higher. Regardless we do not like to trade the sideways zones but like to trade extreme areas.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com