Neo Market Update: NEO charts yearly highs, as it readies for DeFi

- The new Neo update increases the overall block size limit and improves overall network health.

- The 4-hour NEO chart has formed the head and shoulders pattern.

Neo issues new mainnet update

The Neo Global Development (NGD) has announced a new version of the core Neo2 node client, neo-cli v2.12.0. This update increases the overall block size limit and improves overall network health. The GAS limit has gone up from 10 to 50, while the max number of transactions per block has dropped from 500 to 200.

This increase in gas limit is for Neo’s upcoming DeFi – Flamingo. The new updates will ensure network stability by compensating for an expected increase in contract execution time.

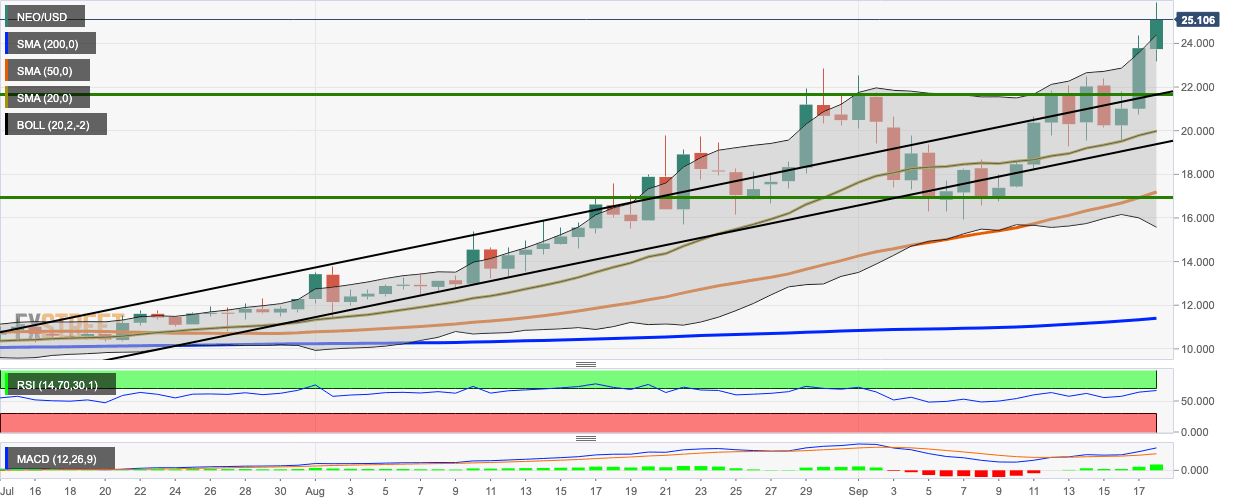

NEO/USD daily chart

NEO buyers have stayed in control for three straight days, charting the three green soldiers pattern as it went up from $20.35 to $25.15. The price reached intraday highs of $25.90, charting a 52-week high. In the process, the price has crossed the upper curve of the 20-day Bollinger Band and the relative strength index has crept into the overbought zone. Both these indicators show that the price is presently overvalued and will face bearish correction soon. The immediate target for correction will be $24.50, bringing the price back inside the 20-day Bollinger Band.

NEO/USD 4-hour chart

The 4-hour chart has formed the head and shoulders pattern and then broke above the upward trending line. The RSI is hovering along the very edge of the overbought zone, prompting a bearish correction, as the two latest candlesticks have formed a bearish engulfing pattern.

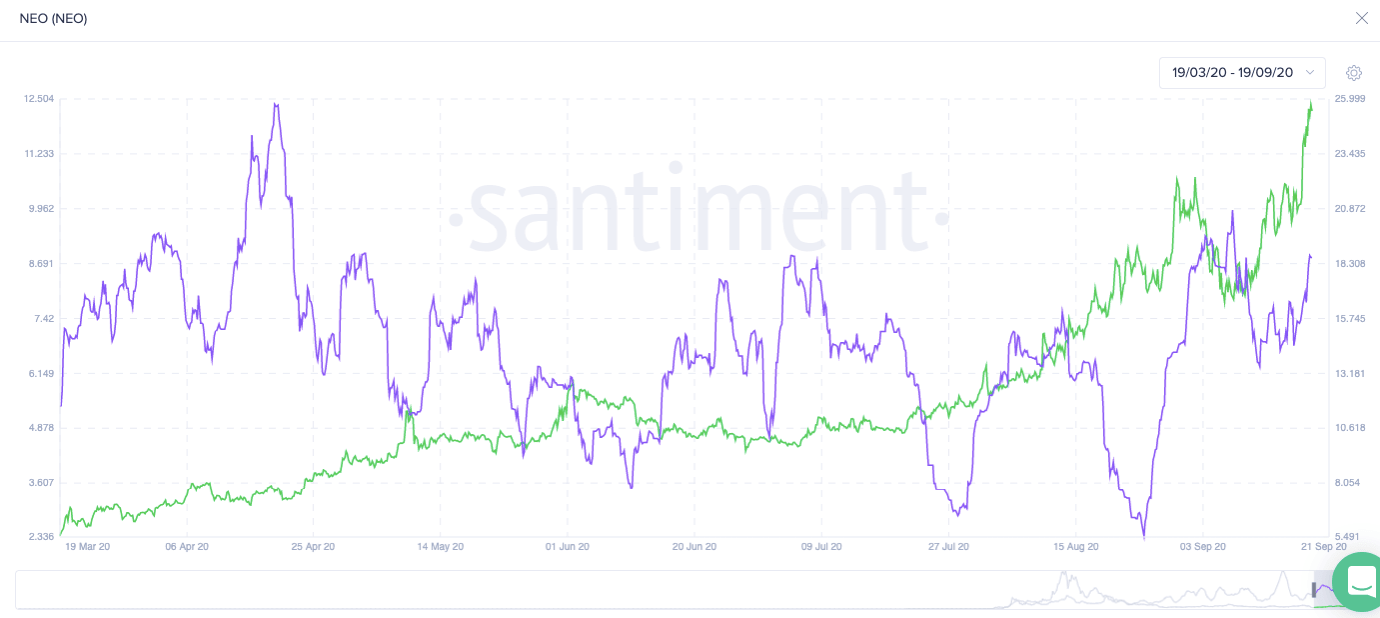

NEO on-chain dev activity

As per Santiment, the dev activity has recently increased due to the upcoming Flamingo. As expected, the price has reacted very positively to this increased dev activity.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637360678573406946.png&w=1536&q=95)