Meme Coins Price Prediction: DOGE, WIF, SPX aiming to extend recovery as risk-on sentiment prevails

- Dogecoin edges higher, aiming to extend its weekly recovery amid easing bearish momentum.

- Dogwifhat pulls lower, breathing after two consecutive bullish days, aiming to reclaim a key psychological level.

- SPX6900 bounces off with a V-shaped reversal from a crucial support level, potentially targeting a new all-time high.

The broader market recovery is witnessing a resurgence of risk-on sentiment following the Iran-Israel ceasefire. Amid easing bearish momentum, meme coins such as Dogecoin (DOGE), Dogwifhat (WIF) and SPX6900 (SPX) aim to extend the recovery seen earlier this week.

Dogecoin targets $0.20 as bearish pressure wanes

Dogecoin edges higher at press time on Wednesday, adding marginal gains to the 8% jump from Monday. Price action records a morning star pattern, known for igniting bullish reversals, completed on Monday with a bearish and Doji candle on the weekend.

The immediate resistance for DOGE is at $0.1710, marked by the June 5 closing price. A clean push in daily close above this level could extend the Dogecoin recovery to $0.20 round figure, close to the monthly high.

The Moving Average Convergence/Divergence (MACD) indicator approaches a buy signal as the MACD and signal lines inch closer towards a crossover. Investors could consider the rise of green histogram bars above the zero line as a sign of trend reversal.

The Relative Strength Index (RSI) reverses from the oversold zone to 40, signaling a sudden decline in bearish strength.

DOGE/USDT daily price chart.

However, if DOGE fails to trigger a trend reversal, it could retest the $0.1428 support level, close to the monthly low.

MACD indicator flashes a buy signal for WIF

Dogwifhat softens by 2.40% at press time as a breather phase kicks in following the 26% surge earlier this week. Similar to Dogecoin, WIF completes a morning star with a 20% rise on Monday.

The recovery targets towards the $1.00 round figure, acting as the psychological resistance level, near the highest monthly closing. A closing above $1.00 could propel WIF towards $1.20 level, the highest closing in May.

The momentum indicator mimics Dogecoin, suggesting a easing in bearish strength. The MACD indicator triggers a buy signal with a crossover while the RSI hits the halfway level at 50, bouncing off the oversold boundary.

WIF/USDT daily price chart.

On the flip side, a closing below Tuesday’s opening at $0.83 could extend a steeper correction to $0.65, last tested on Sunday.

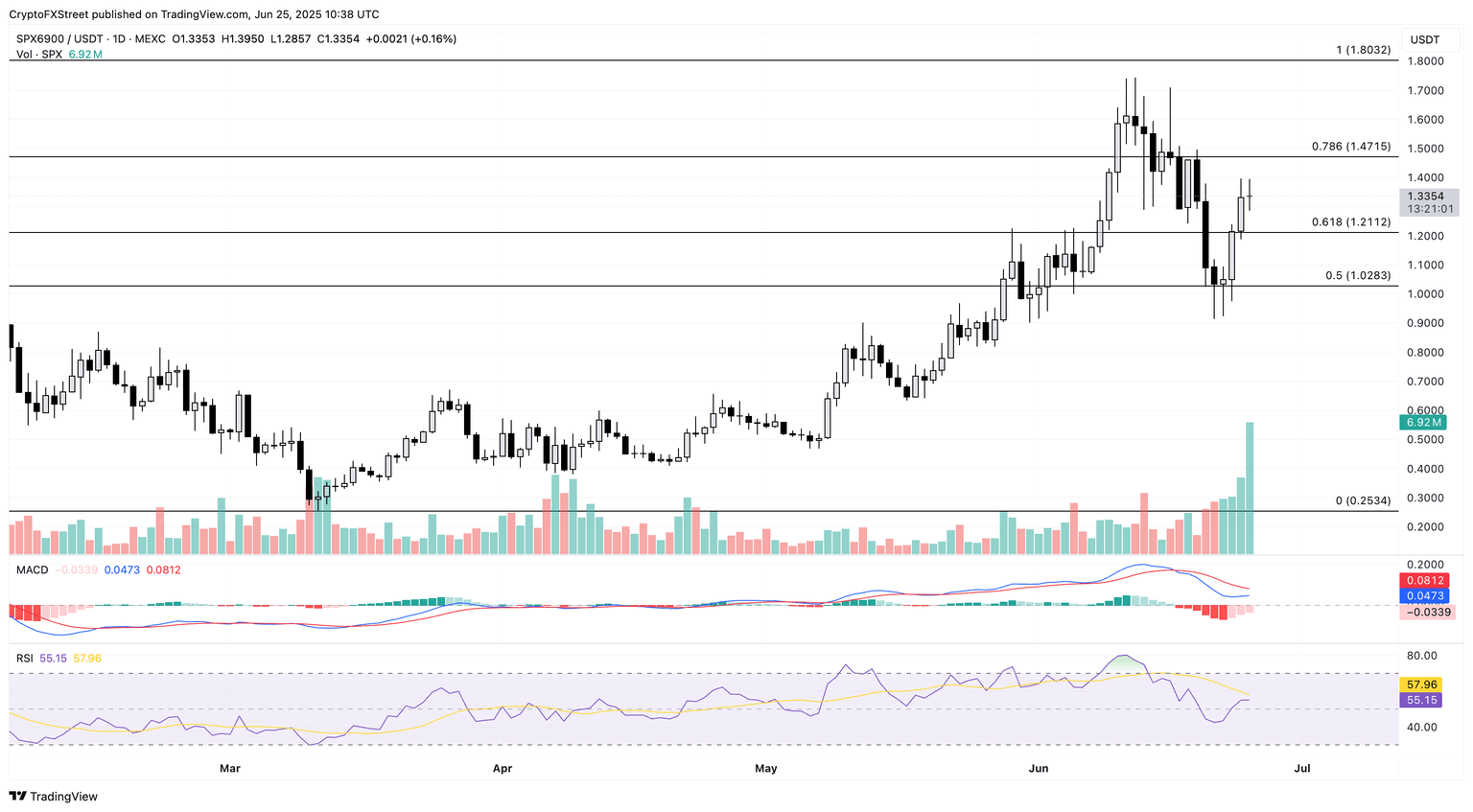

SPX recovery targets new all-time high

SPX6900 records around a 27% surge so far this week as the meme coin holds dominion over the $1.00 psychological support level. At the time of writing, SPX extends gains for the fourth consecutive day after completing a morning star pattern above $1.00 on Monday.

The 50% Fibonacci retracement level, drawn from the all-time high of $1.80 to the year-to-date low of $0.25, at $1.02, aligns closely with the $1.00 psychological level, making it an important support zone. Price action reflects the morning star formed at the 50% retracement level, targeting the 78.6% level at $1.47.

A close above this level could result in a new all-time high in SPX, potentially targeting the $2.00 round figure.

Momentum indicators on the daily chart point to subsiding bearish momentum. The MACD indicator displays declining red histogram bars concurrent with the rising MACD line, indicating a weakening in selling pressure. Further up, the RSI crosses above the halfway line with a U-shaped reversal to 55.

SPX/USDT daily price chart.

However, if SPX closes below the 61.8% level at $1.21, the meme coin could retest the $1.00 round figure.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.