MATIC undergoes Bitcoin woes, uptrend still intact with new all-time highs by next week

- Polygon price has been caught in the spillover from the Bitcoin flash crash.

- MATIC price action remained very responsive on technical levels.

- The flash crash helped the RSI dip to neutral, offering bulls a chance to prep for new all-time highs at $3.0.

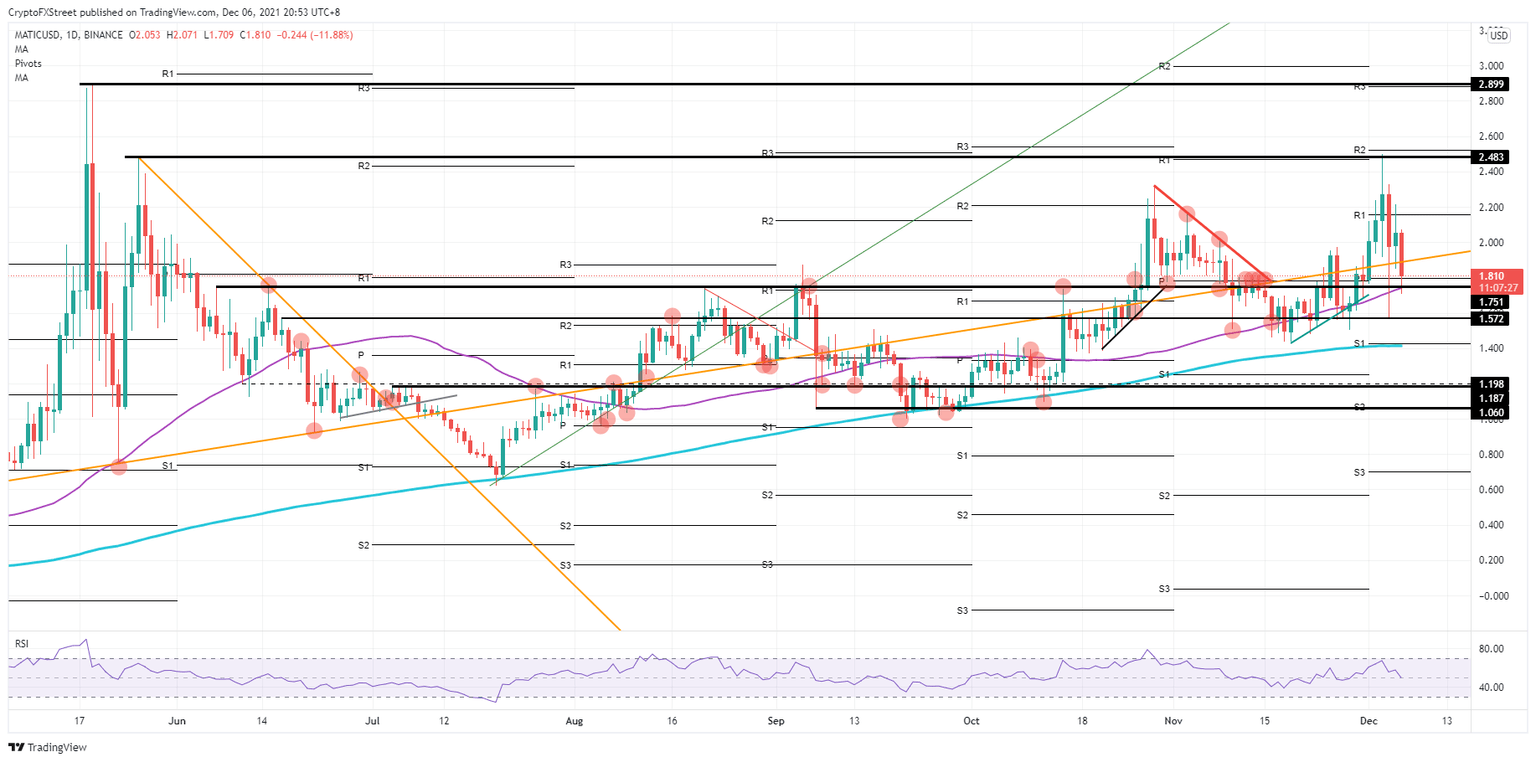

Polygon (MATIC) price hit a curb on Friday as bulls got rejected from further upside potential with a bounce off $2.48 and a knee-jerk reaction on Saturday with the falling knife move from Bitcoin spilling over into other cryptocurrencies. But bulls are on point and see their chance to buy into the price action and prepare for a new all-time high at $3.0. The technical levels will be critical to watch and respect to reach that level.

MATIC price offers fresh bulls a perfect entry to the rally

Polygon price had bulls concerned last week as the RSI (Relative Strength Index) already touched the overbought area and got investors worried about further upside potential as the buy-side activity was overheating. And with good reason, the price aggressively reversed with rejection at $2.48 and the monthly R2 resistance level. On Saturday, the pullback magnified as Bitcoin was the catalyst that triggered a global sell-off in the crypto asset class. But the technical level already marked up since June 17, halted the sell-off and acted as the entry for the bulls to catch the discount.

MATIC has been behaving a bit more logically since Sunday evening and Monday as price action is looking for a stable level to reboot its uptrend as the 55-day Simple Moving Average (SMA) at 1.75 is offering support. The actual backbone of the uptrend, the 200-day SMA at $1.40, was never at risk of breaking, not even during the turmoil on Saturday morning. Expect now a quick U-turn reversal as global markets are going back to risk-on, which might act as a tailwind in MATIC price action and push price back towards $2.48 by the end of this week.

MATIC/USD daily chart

Expect bulls to face some resistance at $2.48 with the current monthly R2 resistance, and technical level will trigger some profit-taking among bulls and investors. As long as global markets keep holding on to risk-on, expect a further leg up and possibly new all-time highs at $3.0 by the end of next week. Should that risk on element fade or turn to risk-off in global markets, expect more pressure to come on cryptocurrencies and push price action Polygon to the 200-day SMA at $1.40 for an attempt to break the uptrend.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.