MATIC price to provide opportunity to accumulate before Polygon rallies 30%

- MATIC price is currently facing headwinds around $1.87, hinting at a formation of a swing high.

- If true, investors can expect Polygon to retrace 12% to $1.65 before kick-starting a 30% upswing to $2.13.

- A breakdown of the $1.52 support level will invalidate the bullish thesis.

MATIC price looks ready for a correction as a potential swing high seems to be forming. This development could lead to a correction that will allow sidelined buyers to purchase Polygon at a discount and kick-start a quick run-up.

MATIC price prepares for higher highs

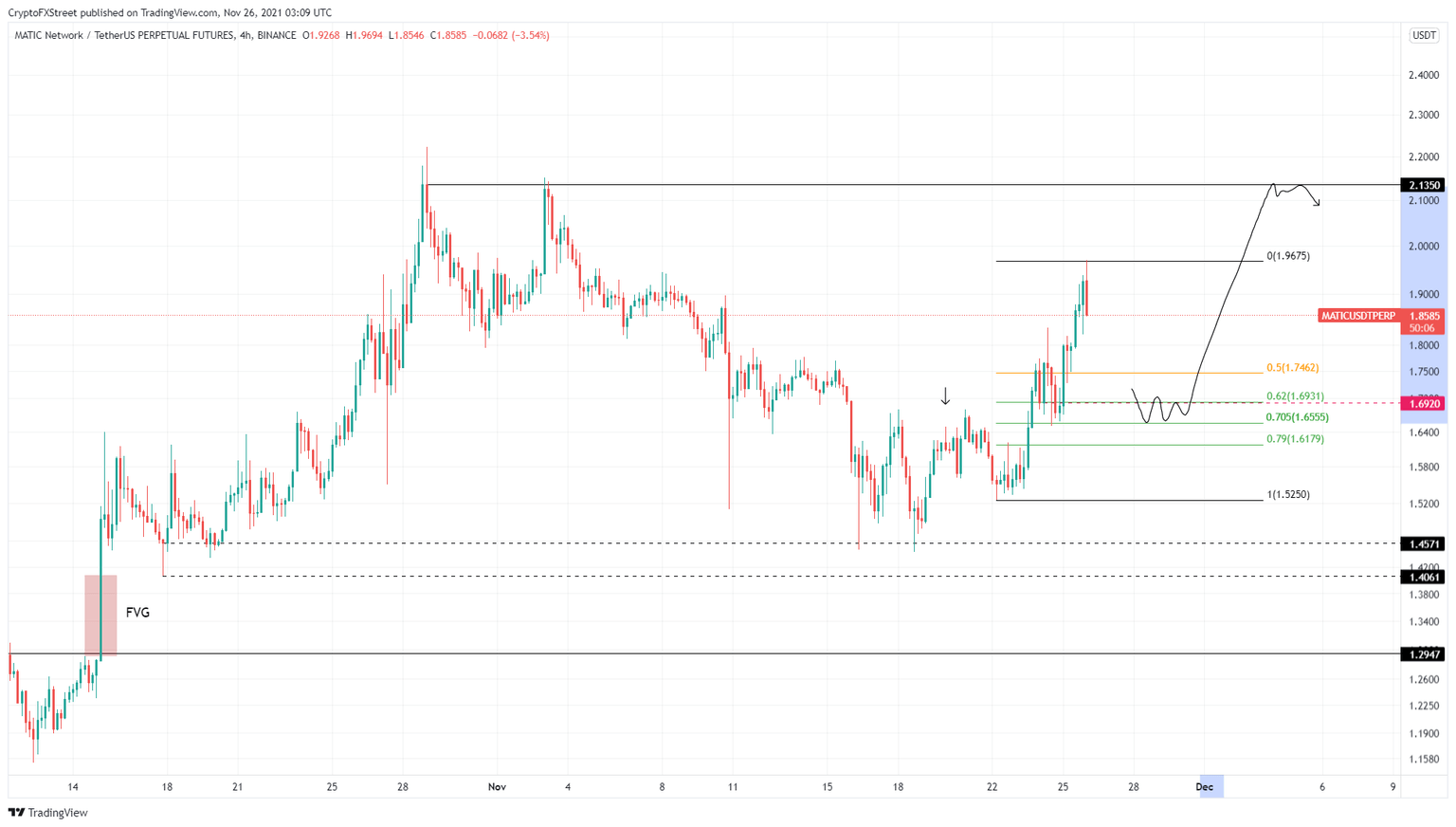

MATIC price rallied 30% over the past four days from $1.52 to $1.96. This upswing is currently facing a slowdown but will likely set up a swing high above $1.96. This formation will result in a temporary pullback to the 62% or 70.5% Fibonacci retracement levels at $1.69 and $1.65, respectively.

A retest of either of these two barriers will serve as a buy opportunity for sidelined investors who missed the initial leg-up. Therefore, market participants can expect MATIC price to see a bullish reaction around the levels mentioned above.

A quick run-up that slices through the swing high at $1.96 will confirm the start of a rally. The likely target for market markers would catapult MATIC price above the double top at $2.13, where buy-stop liquidity rests. This run-up would roughly constitute a 30% ascent from $1.65.

MATIC/USDT 4-hour chart

On the other hand, if MATIC price fails to hold above $1.65, it will retrace to the subsequent level at $1.62, where it could give the uptrend another go. However, a daily close below $1.52 will create a lower low and invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.