MATIC Price Prediction: Polygon bulls contemplate a comeback

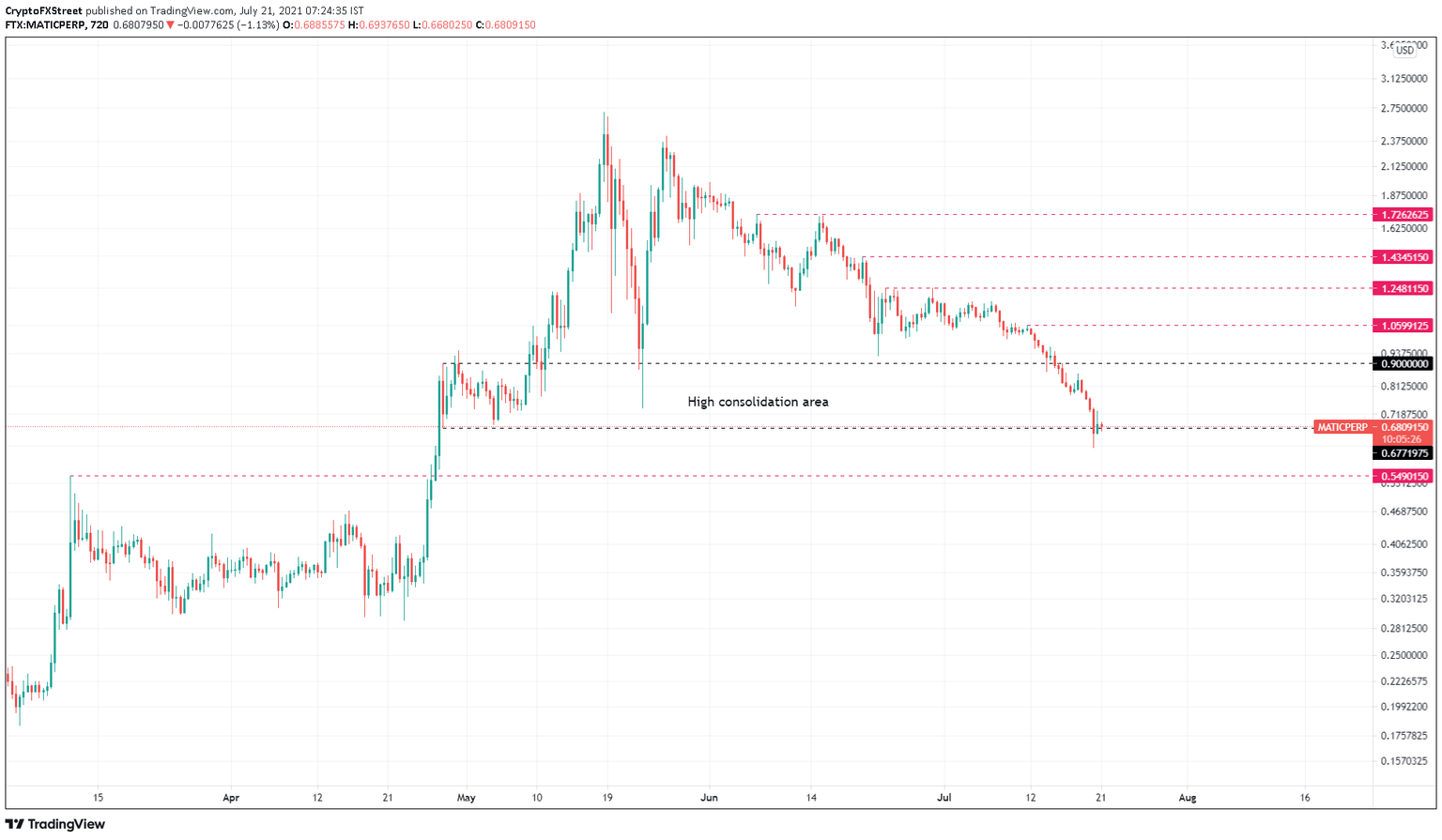

- MATIC price is hovering above a crucial support level at $0.677.

- Confirmation of an upswing will arrive after Polygon climbs above $0.90.

- If the bullish momentum persists, $1 seems attainable in the short term.

MATIC price is currently hovering above a vital level, a breakdown of which could spell disaster. However, the bulls appear to have come to the rescue. A continuation of the uptrend will face blockage and probably lead to consolidation in a tight range.

MATIC price awaits a trigger

MATIC price crashed roughly 27% over the past four days, briefly slicing through the support level at $0.677. The recent retest of this level was the third time over the past three months.

Interestingly, the last two times Polygon tagged this barrier, MATIC price saw a quick yet bullish reaction. Therefore, if something similar were to happen, investors can expect the altcoin to rally 32% to tag the $0.90 resistance level.

Since MATIC price saw significant consolidation between $0.677 and $0.90 in late April and early May, a similar sideways movement might likely occur this time around.

However, a decisive 12-hour candlestick close above $0.90 will confirm the bulls’ intentions, pushing MATIC price to the next supply barrier at $1.06.

If the bullish momentum persists, Polygon could go beyond $1.06 and tag crucial ceilings at $1.248, $1.435 and $1.726.

MATIC/USDT 12-hour chart

While things look good for MATIC price, a reversal pushing the altcoin below $0.677 will dent the bulls’ plans.

If the resulting downswing continues to head lower, it will encounter a stable support level at $0.549, a breakdown of which will invalidate the bullish thesis and result in a potential sell-off to $0.471.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.