MATIC price climbs ahead of Etrog upgrade mainnet release

- Polygon announced its Etrog mainnet upgrade for release on February 6.

- The upgrade will transform the chain to Type 2 zk-EVM, allowing developers to deploy code directly to the chain.

- MATIC supply on exchanges has declined in the past three weeks, paving way for Polygon’s native token’s price rally.

- MATIC price could rally nearly 16% towards its $0.9153 target.

MATIC, the native token of Ethereum’s largest scaling solution has plans to rollout the Etrog mainnet upgrade on Tuesday, February 6. This upgrade is key for MATIC holders as it will transform Polygon’s blockchain to a Type 2 zk-EVM that allows developers to deploy their code directly on the chain, just as they would, on Ethereum, with no further modifications.

Also read: XRP price consolidates leading up to crucial date in SEC vs. Ripple legal battle

Polygon gears up for Etrog mainnet release on February 6

Polygon has plans to transform its zero-knowledge Ethereum Virtual Machine (zk-EVM) network into a Type 2 zk-EVM. The difference is that the upgrade will simplify the process for developers to deploy their code on Polygon, attracting more protocols to the chain and boosting its utility.

Developers can just copy-paste their code exactly as it is on Ethereum, with no further modifications, for the Polygon blockchain. This is a key development and goes live on February 6.

As the release draws close, MATIC price slightly climbed, 1% on the day.

On-chain metrics signal bullish potential in MATIC

MATIC Supply on Exchanges has declined between January 19 and February 4, as seen on Santiment. A reduction in exchange supply typically reduces selling pressure on the asset and paves way for a recovery in its price.

MATIC Supply on Exchanges and price. Source: Santiment

Whale Transactions valued at $100,000 and higher have declined in MATIC, in the same timeframe. Whale Transaction spikes coincided with Network Realized Profits/Losses, signaling profit-taking by large wallet investors in MATIC. The drop in Whale Transaction Count combined with reduced profit-taking is supportive of MATIC price growth.

MATIC Whale Transaction Count and Network Realized Profit/ Loss. Source: Santiment

MATIC price likely to rally 16%

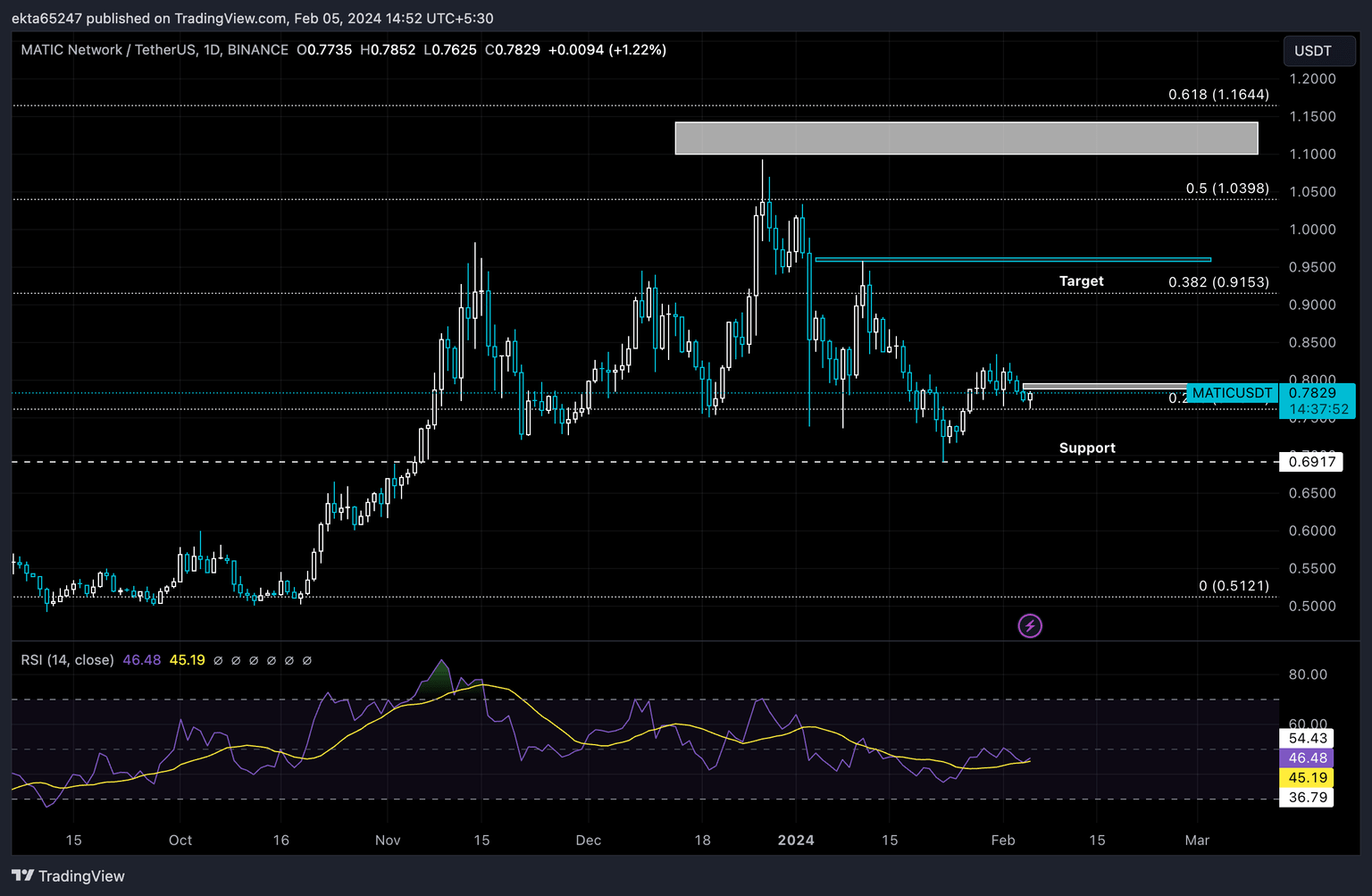

MATIC price climbed 122% between October 12 and December 27. The asset faced a rejection from the $1.0930 peak in December. Since then, MATIC price has been in a downward trend, forming lower highs and lower lows.

MATIC is currently trading below the bullish imbalance zone that stretches from $0.7884 to $0.7949. This zone currently holds as resistance and the altcoin is poised to see a trend reversal if a daily candlestick close occurs past the bullish imbalance zone.

The Relative Strength Index (RSI) climbed slightly from 45.08 to 46.35 in the past 24 hours. The uptick in RSI points to likely recovery on the daily timeframe.

MATIC/USDT 1-day chart

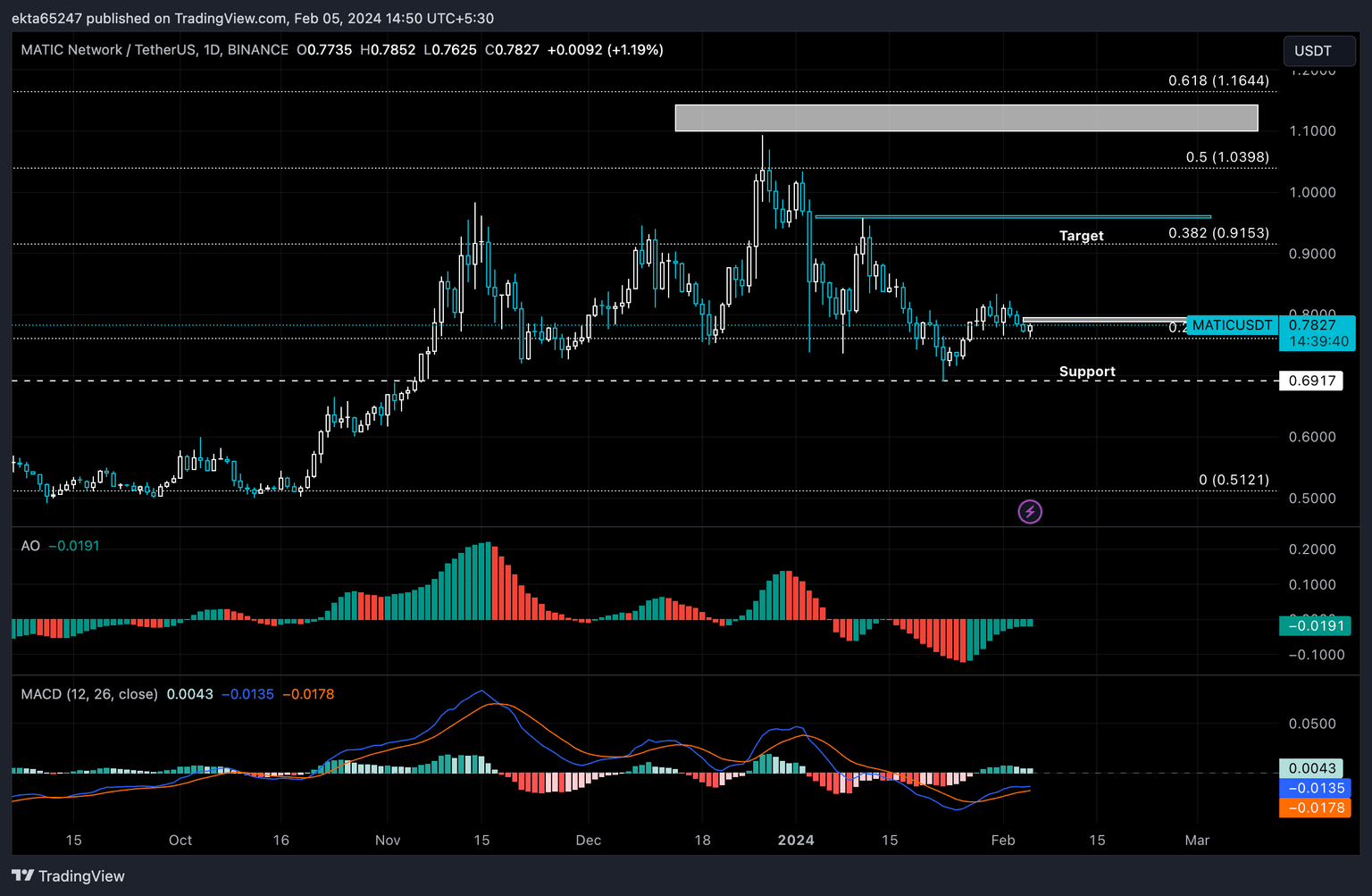

Similarly, the histogram bars of the Moving Average Convergence Divergence (MACD) are flashing green. Bulls are likely in control. The bars of the Awesome Oscillator (AO) signal a trend reversal is likely underway and the next target for MATIC price is the 38.2% Fibonacci Retracement of the token’s decline from February 18, 2023 top of $1.5675 to June 10, 2023 low of $0.5121, at $0.9153, a nearly 16% rally from the current price.

MATIC/USDT 1-day chart

If MATIC price sees a daily candlestick close below the 23.6% Fibonacci Retracement at $0.7612, the altcoin’s bearish trend is likely to remain intact. MATIC price could find support at its January 23 low of $0.6917.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B14.30.24%2C%252005%2520Feb%2C%25202024%5D-638427271780204275.png&w=1536&q=95)

%2520%5B15.18.57%2C%252005%2520Feb%2C%25202024%5D-638427272414421348.png&w=1536&q=95)