Market Wrap: Bitcoin back above $30 k in volatile trading session

Bitcoin’s near 50% decline from all-time highs surprised analysts as China’s crackdown fueled bearish sentiment.

Bitcoin had a volatile Tuesday, briefly dipping below $30,000 for the first time since January before settling around $33,000 at press time. The world’s largest cryptocurrency by market value is still up about 11% year to date, according to CoinDesk 20 data.

“The primary reason for the sell-off has been the crackdown in China on mining operations and banking services,” wrote Simon Peters, analyst at multi-investment platform eToro.

Latest prices

Cryptocurrencies:

- Bitcoin (BTC) $32542, -0.5%

- Ether (ETH) $1907.71, -2.16%

Traditional markets:

- S&P 500: 4248.67, +0.57%

- Gold: $1776.9, -0.34%

- 10-year Treasury yielded 1.475% versus 1.493% on Monday

Regulatory pressure from China has always been a headwind for cryptocurrencies, which is why the near-50% decline from all-time highs surprised some analysts.

“The news out of China regarding mining and trading crypto may seem dramatic to newer investors, while those with experience should be accustomed to the progression of this news over the past several years,” wrote Sean Rooney, head of research at crypto asset manager Valkyrie Investments.

Perhaps an intensified regulatory crackdown was not fully priced in given how the price of bitcoin nearly doubled over the past year.

“Today we polled our 950+ person community to gauge their opinion on where the bitcoin bottom may be, and we received split answers for $28,600 and $25,500,” wrote Nick Mancini, research analyst at crypto sentiment data provider Trade the Chain.

Others remain more optimistic about where bitcoin’s price is going. “Bitcoin is currently trading approximately one-third below its long-term exponential trend line,” a phenomenon it has only exhibited for 20% of the time in bitcoin’s history, according to Stephen Kelso, head of markets at ITI Capital. “Given the market forces and demand for scarcity assets to protect wealth, ITI believes this is an attractive buying opportunity for investors.”

For now, $30,000 remains a key support level, although technicals show limited upside towards $34,000-$36,000.

MicroStrategy bond stress

MicroStrategy’s latest bond to finance the company’s additional buying of bitcoin is now trading below its face value as the cryptocurrency continues to fall in value.

Prices on the $500 million bond, which closed on June 15, dropped almost three points after the company said on Monday it completed its purchase of 13,005 bitcoin at an average price of $37,617. Bitcoin was trading at around $32,542 as of press time.

At last count, MicroStrategy held 105,085 bitcoins. The company so far issued more than $1.5 billion in convertible notes and junk bonds to fund such purchases.

MicroStrategy's Bonds Dropped With BTC Price

Chart: Shuai Hao/CoinDesk Research Source: FINRA

Decline in active addresses

Blockchain data shows low demand for transactions over the past few months.

“Both Bitcoin and Ethereum have experienced dramatic slowdowns in on-chain activity, with active addresses and total transfer volume falling back to 2020 and early 2021 levels,” wrote Glassnode in a newsletter published on Monday.

Bitcoin’s active addresses have fallen 24% from the March peak, while Ethereum’s fall in active addresses has been more extreme, dropping 30% from peak levels.

Chart shows the recent decline in active addresses holding BTC and ETH. Source: Glassnode

Digital asset funds face outflows

Digital asset investment products saw a third consecutive week of outflows, totaling $79 million for the week ending June 18. This is now the longest bear run in outflows since February 2018 when there were seven consecutive weeks of outflows, according to a report by CoinShares on Monday.

“The focus of outflows continues to be bitcoin, which has endured its sixth consecutive week of outflows totaling $89 million,” wrote CoinShares.

Chart and tables show a breakdown of digital asset fund flows.

Source: CoinShares

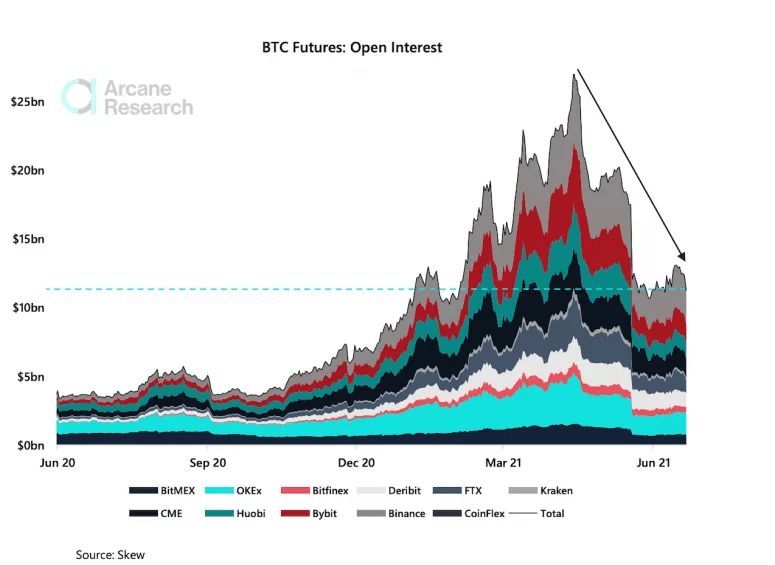

Open interest in bitcoin futures drops

The total open interest in the bitcoin futures market is sitting at $11.3 billion, down 59% from its April 13 peak of $27.3 billion, according to Arcane Research.

The downward trading indicates institutional investors are being “cautious” at the moment, Arcane said in a report. It also notes that three-month futures in bitcoin are in “backwardation,” meaning they are traded at a discount to current spot prices. That is generally perceived to be a bearish signal.

Arcane Research

Altcoin roundup

- CoinDesk’s columnist Lex Sokolin explained why ether’s price is built on firmer ground than bitcoin's. Bitcoin's thesis rests on a theory of money and power, while ether has a more durable footing: creative computation, according to Sokolin.

- Regulated crypto bank Anchorage Digital said it will provide custody and staking support for FLOW, the native token of the Flow blockchain.

- Crypto custody provider Fireblocks is being sued by a company that claims it lost access to more than $70 million worth of ether, according to a report by Calcalist. Fireblocks said it is investigating the issue.

Other Markets

Most of digital assets on the CoinDesk 20 were lower on Tuesday.

Notable losers as of 21:00 UTC (4:00 p.m. ET):

xrp (XRP) – 13.96%

polkadot (DOT) – 12.54%

tezos (XTZ) -11.06%

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.